© Supplied by Gabon presidency

© Supplied by Gabon presidency Gabon Oil Co. (GOC) has sealed the acquisition of Assala Energy, with Maurel et Prom acknowledging defeat.

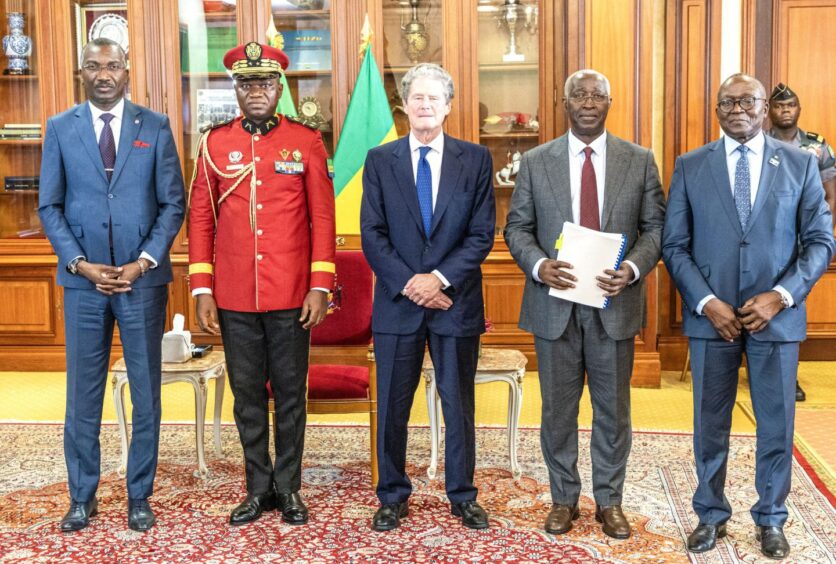

Gabon President Brice Oligui Nguema held a ceremony on February 15 to witness the signing of the sale and purchase agreement (SPA). The president set out his plans to acquire Assala for Gabon in his new year speech.

GOC is acquiring a 75% stake in Assala. The statement did not reveal when the transaction would close.

Determination

The president said that the decision to pre-empt the sale had come on November 25, 2023. At that point, he said, “many thought that we had neither the determination, nor the resources to follow through on our claims”.

“Through this operation, Gabon has only exercised its sovereign right over its natural resources like other countries,” the president said. “This historic act taken today is a starting act reflecting the intention to reconquer our sovereignty and ensure that in the eyes of friendly Nations, immortal Gabon remains worthy of envy.”

The president explained the transaction would see Gabon retaining more value from its resources, increasing its revenues and demonstrating its sovereignty. He also mentioned the importance of creating employment in the sector and of increasing control over the sales price of oil.

Signing the agreements were the managing director of GOC and Bob Maguire, co-head of Carlyle International Energy Partners (CIEP), which owned Assala. Minister of Petroleum Marcel Abeke attended the ceremony.

Maguire, in comments circulated by Gabon, said GOC would be a “very good manager” of Assala and Gabon’s resources.

Carlyle confirmed the deal had been signed to sell Assala. The terms are “materially the same” as those agreed with Maurel in August 2023.

“Carlyle believes that under GOC’s ownership, Assala Energy is well positioned to continue to contribute to the future of Gabon’s energy industry and economy. The transaction is subject to customary closing conditions.”

Deal backing

Financing for the transaction has not yet been confirmed.

Gunvor may have played a role in backing the transaction for Gabon. Guillaume Letessier, head of origination and structured trade in the EMEA for the trader, was shown expressing Gunvor’s support for Gabon.

Vitol has also been mentioned as a possible funder of the GOC deal. At the time of publishing, neither Gunvor nor Vitol had responded to a request for comment on the transaction.

Assala is the second largest producer in Gabon, the presidency said in its statement. It has eight fields, in five permits, with another five non-operated fields. It also has an onshore pipeline network and an export terminal at Gamba.

Abeke, in comments at the ceremony, noted how expatriates had dominated Gabon’s oil sector for many years. The government established GOC to tackle this problem, he said.

Previously, GOC was confined to working on marginal fields. As such, it had little impact on Gabonese production. “Realising [GOC’s] ambitions are only possible by an increase in its assets through processes such as the one we are starting today”, Abeke said.

Maurel’s move

Maurel noted the signing of the GOC deal with Carlyle. The French company noted the agreement took precedence over its own deal, signed in August 2023. Oligui Nguema took power the same month.

Maurel had agreed to buy Assala for $730 million.

Maurel said it wanted to remain a “trusted partner” of Gabon and had been working in the country for nearly 20 years. The company is likely to be a buyer of assets, although it has a number of options geographically. For now, it said, the company is working on restarting activities in Venezuela.

Updated at 12:26 to include Carlyle’s statement on the signing.