A hoax statement claims Galp is abandoning its involvement in northern Mozambique in order to pursue a “100% renewable future”.

The statement appears legitimate, with Galp boilerplate blurb and press details, while spoofing the Galp press email address.

The purported Galp declaration says the gas project in Mozambique is “too high a risk due to terrorist conflict and corruption of the Mozambican government”.

It went on to say that Portugal would work to withdraw its workers safely and pay 4,500 euros ($5,280) to local communities. Galp will commit to “100% renewable production in the next three years” to create “thousands of new decent jobs around the Galp world”.

The hoax said the decision had been prompted by the hidden debt scandal. Credit Suisse and VTB Bank were involved in this, which saw the provide loans of around $2 billion to Mozambique.

It went on to create a purported quote from Galp CEO Andy Brown.

“Galp, as a responsible investor, always ensures that its transparent financial activities serve as an example for a corruption-free Africa and does not tolerate the disappearances, detentions and torture of journalists reporting on the gas industry in Cabo Delgado,” the statement reported Brown as saying.

The hoax is available here:

Galp abandons gas in Cabo Delgado towards a 100% renewable future

The company has rejected the hoax. It pointed to the fact that the statement was released on April 1.

The hoax has fooled some, including Portugal’s TVI24. The hoax continues a campaign of guerrilla marketing in Portugal.

A Galp está a ser alvo de marketing de guerrilha por causa da exploração de gás em Cabo Delgado, a região de Moçambique onde está a haver ataques reivindicados pelo Daesh. pic.twitter.com/7aS4LhmyLd

— Guilherme Trindade (@SexoGratweeto) April 1, 2021

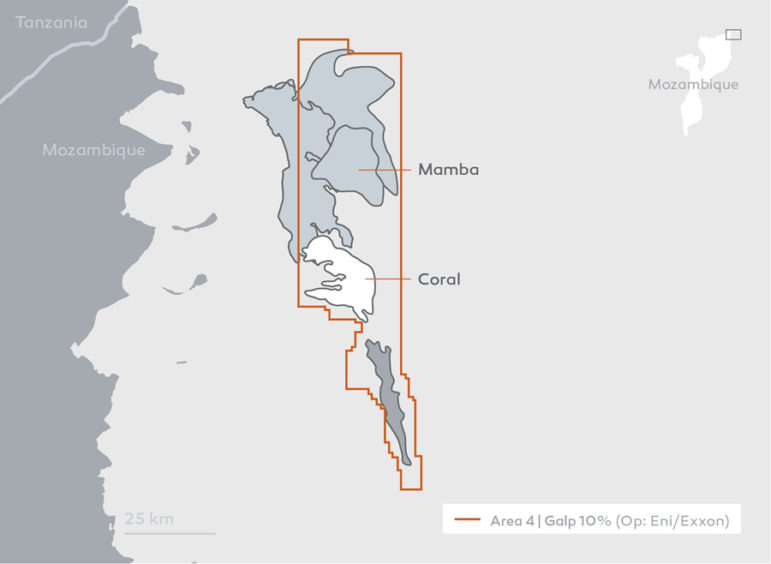

Galp has a 10% stake in Area 4, in the offshore Rovuma Basin. Eni is in the process of building the Coral Sul floating LNG (FLNG) project, due to begin producing in 2022.

ExxonMobil, another member of Area 4, has plans to build Rovuma LNG. However, the company has pushed back the final investment decision (FID). The recent attack on Palma on March 24 will have done little to encourage Exxon.