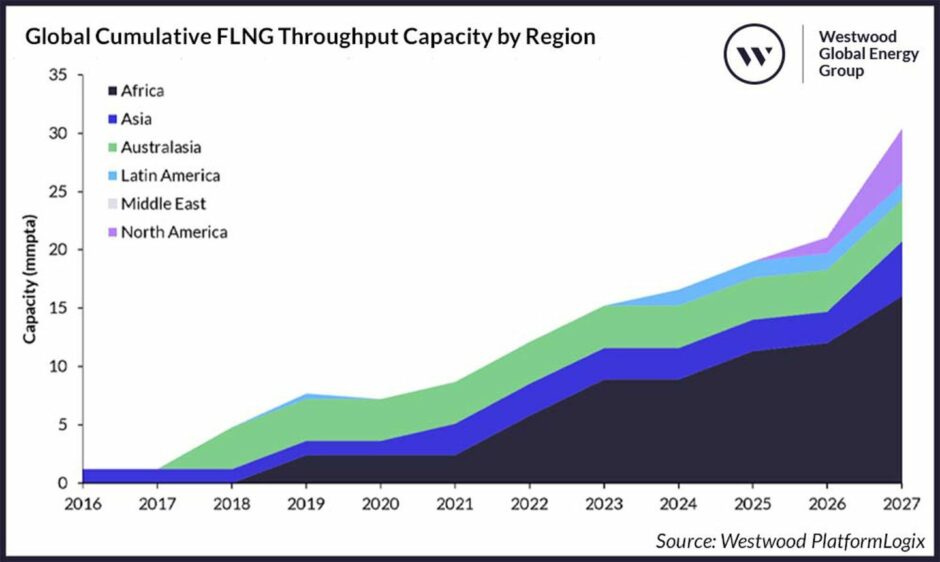

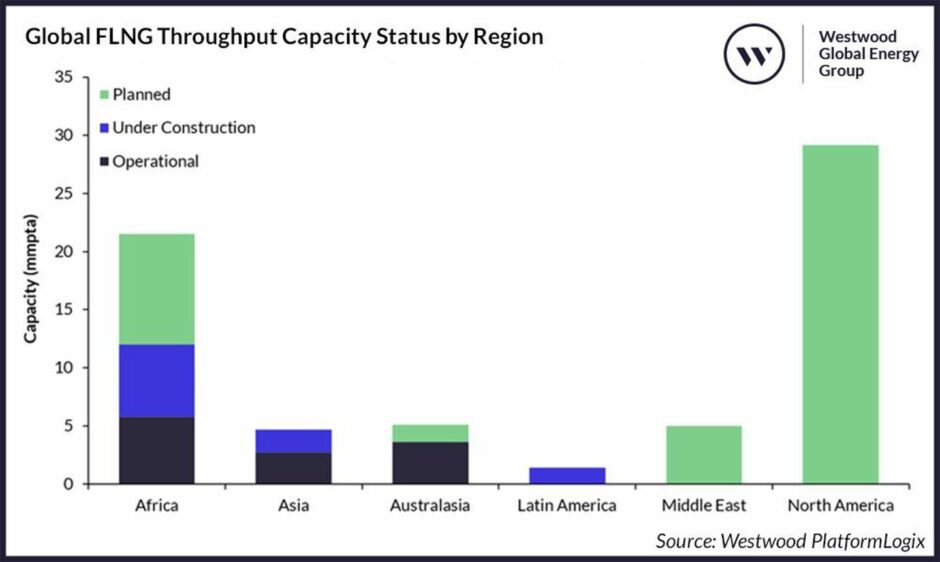

Africa will “dominate” new floating LNG (FLNG) projects in the period to 2027, adding 10.2 million tonnes per year of capacity, according to a note from Westwood Global Energy Group.

The report, written by director Mark Adeosun, predicts 18.3mn tpy of new FLNG capacity onstream by 2027 around the world. This will carry a total value of $13 billion in engineering, procurement and construction (EPC) costs.

Projects sanctioned during the years to 2027 but starting up after will add 36.5mn tpy, with an EPC value of $22bn.

Four plans are under way in Africa, Adeosun wrote.

Golar LNG’s Gimi vessel is due to start producing in the fourth quarter of this year for BP’s Greater Tortue Ahmeyim (GTA) project, off Mauritania and Senegal.

Eni’s Tango FLNG is expected to start producing in December this year, at the Marine XII block offshore Congo Brazzaville.

The company has commissioned a second FLNG unit for the same block from China’s Wison Heavy Industry. Wison carried out its steel-cutting ceremony for this FLNG unit on March 31 at the Nantong yard.

Perenco took a final investment decision (FID) for a 0.7mn tpy project in Gabon, at the Cap Lopez terminal.

Furthermore, UTM Offshore has set out a plan for a unit on OML 104 in Nigeria, with JGC working on the front-end engineering and design (FEED) plans. However, as the Westwood note pointed out, UTM has not yet reached a deal with block owners ExxonMobil and Nigerian National Petroleum Corp. (NNPC).

Full bloom

Companies have raised the prospect of approving other projects during the period to 2027. Eni may add another vessel to expand FLNG output at Area 4 in Mozambique. Similarly, BP may add more off Mauritania and Senegal.

Golar LNG recently bought a 148,000 cubic metre LNG carrier, which it could convert into a 3.5mn tpy FLNG unit.

“If the unit acquisition completes in [the second quarter of] 2023 as planned, Westwood anticipates that the converted unit could be deployed offshore Africa, with Golar stating that yard availability is confirmed for 2025 delivery and advanced EPC negotiations are underway.”

FLNG plans have not always run smoothly, with Shell’s Prelude FLNG a notable example of high costs and operational challenges. Adeosun noted high gas prices and the need for Europe to move away from Russian gas. As such, “the time is nigh for the stuttering FLNG industry to fully bloom”.

© Supplied by Wison / Westwood

© Supplied by Wison / Westwood © Supplied by Wison / Westwood

© Supplied by Wison / Westwood