Energean has taken the final investment decision (FID) on its North El Amriya and North Idkunea (NEA/NI) subsea tieback, offshore Egypt.

The company expects capital expenditure on the project to be around $235 million, most of which will come in 2022. Energean expects first gas in the second half of 2022.

The work will provide 90 million cubic feet (2.5 million cubic metres) per day fay of gas and 1,000 barrels per day of condensates. It will develop a 2P resource of 49 million barrels of oil equivalent.

It selected TechnipFMC to carry out engineering, procurement, installation and commissioning (EPIC) on the project.

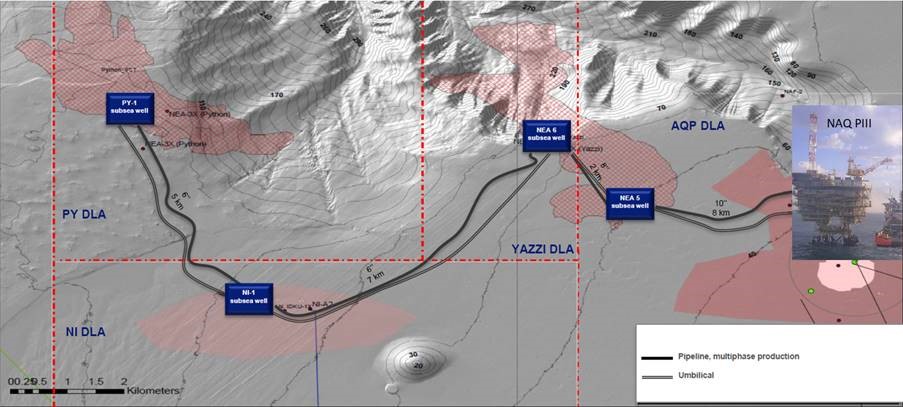

The NEA concession holds two discovered and appraised gas fields, Yazzi and Python. The NI concession holds four discovered gas field, of which one is ready for development.

Energean described NEA/NI as key for its Egyptian portfolio. The work “will provide substantial benefits to the long-term production profile in the country, whilst bringing additional cost efficiencies and strategic benefits”, it said.

Pricing for the plan looks attractive. The company said it would sell gas from NEA/NI at $4.6 per mmBtu, when Brent is over $40 per barrel. This is the highest price paid for for shallow water gas production offshore Egypt, it said.

Drilling on NEA/NI will come as part of the broader Abu Qir campaign, Energean said, which should cut costs.

Energean reported production of 35,400 boepd in 2020, mostly from Abu Qir, of which 86% was gas. Output is expected to drop in 2020, to 26,000-30,000 boepd, as a result of investments deferred while Energan was buying assets from Edison E&P.

Egypt makes up the largest share of Energean’s production.