Canada’s Imperial Oil said profit in the fourth quarter sank as oil remained near 12-year lows amid rising production.

The company’s upstream operations recorded a loss in the quarter of C$289 million compared with a gain of C$218 million a year ago.

Net income in the quarter fell to C$102 million ($73 million), from C$671 million a year earlier, Imperial reported.

Imperial Oil, based in Calgary, is the Canadian affiliate of Exxon Mobil.

The company said its 2015 upstream financial performance was significantly impacted by low crude prices.

“Consistent with our long-standing approach we continue to focus on what we can control. As a result, we reduced operating and capital costs by $1.5 billion relative to earlier plans.”

Since bringing on new production, upstream unit cash costs were 25% lower in the second half of 2015 than our 2014 annual average. Disciplined operating and capital cost management remains a priority, the company stated.

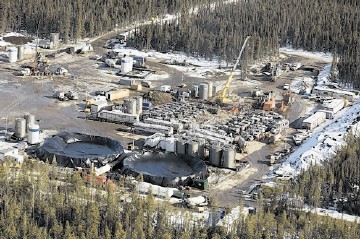

It operates three refineries, Esso-brand gas filling stations and is a producer of bitumen from oil-sands mining and thermal technology in Alberta.

The company is boosting output at its Kearl mine and at leases in the Cold Lake area.

Revenue from Imperial refineries helped offset lower crude prices that weighed on production.

Output in the quarter averaged 400,000 barrels per day, compared with 315,000 barrels in the year-earlier period, the company said.

Recommended for you