BP has sanctioned phase two of its Mad Dog project in the Gulf of Mexico after more than halving costs.

The first phase of Mad Dog has been in production off Louisiana for more than a decade, but in 2009 BP discovered more oil in the southern section of the field.

BP and its project partners have been working to get the project costs down from $20billion to below $10billion.

The firm said today that the sticker price for Mad Dog 2 had been lowered to $9billion.

BP holds the operatorship and 60.5% of the project.

Field partners BHP Billiton, which holds 23.9%, and Union Oil Company of California, an affiliate of Chevron USA, which is on 15.6%, are expected to make their own final investment decisions “in the future”, BP said in a statement.

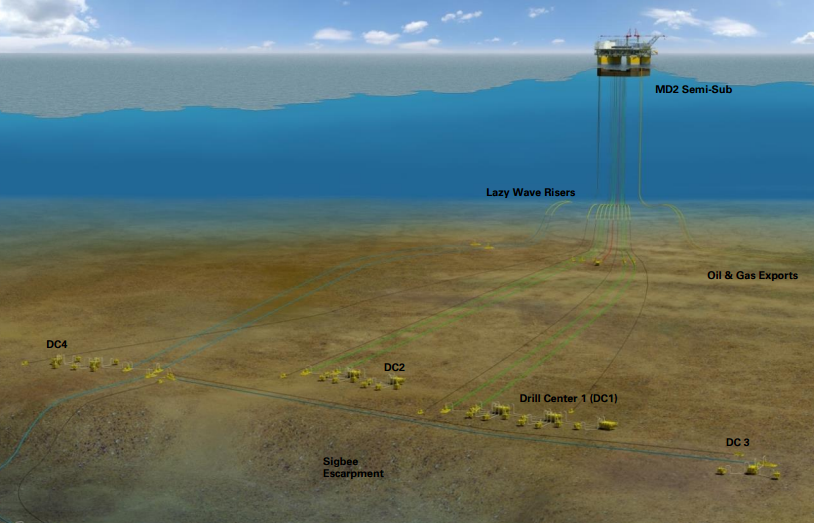

A new floating production platform with a capacity of up to 140,000 barrels of oil a day will be supplied for Mad Dog Phase 2.

It will be moored six miles to the south-west of the existing Mad Dog platform.

First oil from phase two is expected in late 2021.

BP chief executive Bob Dudley said: “This announcement shows that big deepwater projects can still be economic in a low price environment in the US if they are designed in a smart and cost-effective way.

“It also demonstrates the resilience of our strategy which is focused on building on incumbent positions in the world’s most prolific hydrocarbon basins while relentlessly focusing on value over volume.”

Recommended for you