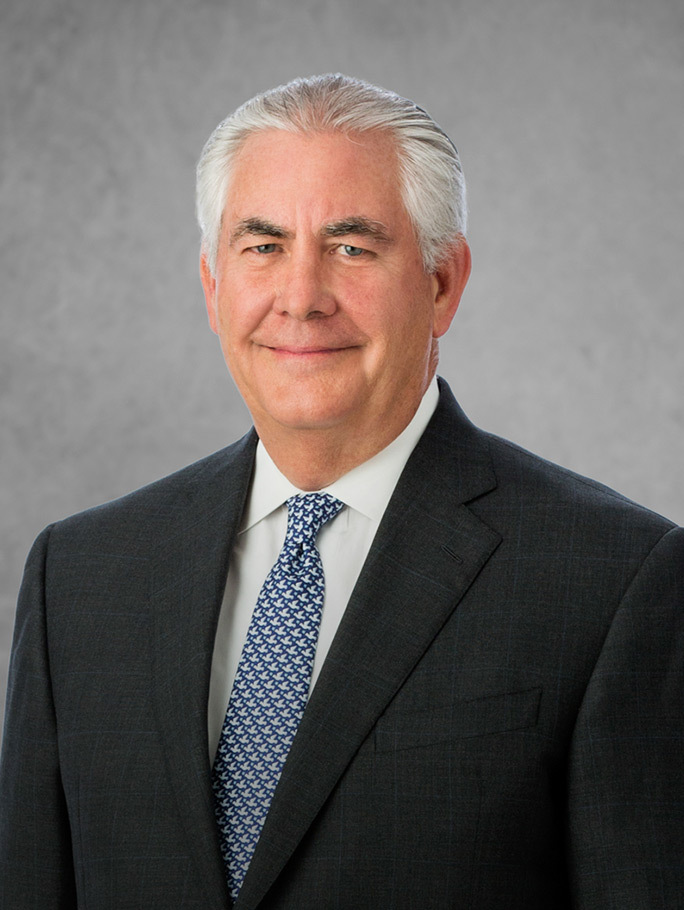

Rex Tillerson’s personal investment portfolio includes stakes in some of the toughest competitors he battled for market share as chairman and chief executive officer of Exxon Mobil Corp.

Tillerson, who stepped down from Exxon just days ago as President-elect Donald Trump’s prospective secretary of state, holds shares in Royal Dutch Shell Plc, Chevron Corp. and Total SA, three of the four largest Western oil explorers after Exxon itself, according to a public disclosure filed with the U.S. Office of Government Ethics on Wednesday.

The bulk of Tillerson’s personal fortune is tied to Exxon, where he spent all of his professional career. His holdings in the oil major total almost a quarter of a billion dollars. Apple Inc. is his biggest non-energy investment.

The disclosure doesn’t require Tillerson to spell out the precise size of each holding; rather, each stock, bond or other instrument was described with various ranges. In the case of his Shell, Chevron and Total holdings, each was valued at between $15,001 and $50,000, which means the combined value didn’t exceed $150,000.

Notably, Tillerson doesn’t own any stock in BP Plc, a competitor whose practices he openly criticized after the 2010 Deepwater Horizon catastrophe as a “dramatic departure” from industry safety norms.

Other Holdings

Other energy-industry holdings in Tillerson’s accounts include Houston-based oil refiner Phillips 66 and China Petroleum & Chemical Corp., known as Sinopec, according to the filing. He also owns interests in Schlumberger Ltd., the world’s largest oilfield-services provider, and General Electric Co., which sells equipment to crude drillers.

“If you are CEO of a large company, it is hard to hold a large investment portfolio without holding some suppliers or customers,” said Erik Gordon of the University of Michigan’s Ross School of Business. “You disclose the holdings to the board of directors and divest anything the board thinks is inappropriate.”

Outside the energy arena in which Tillerson spent the last 41 years as an Exxon employee, the 64-year-old Texan also holds interests in Caterpillar Inc. and Deere & Co., as well as municipal bonds from Texas towns such as Bastrop and Grapevine. His Caterpillar and Deere stakes are valued at as much as $100,000 apiece, while his Apple holding is worth as much as $300,000.