US gas companies could see a large LNG export potential to China after President Donald Trump and President Xi Jinping reached the bilateral trade agreement last month, said Rystad Energy.

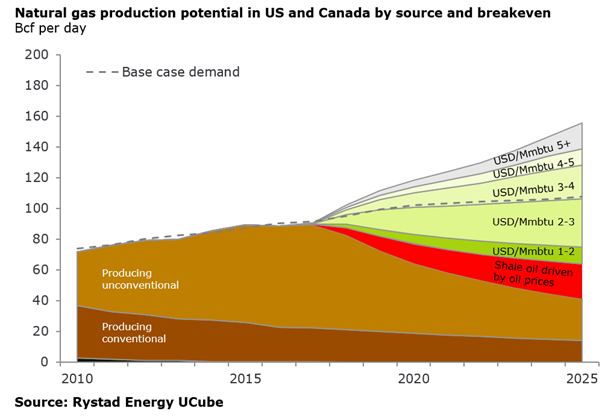

The trade deal between the two companies would allpw 105 bcf/d gas production at 3 USD/MMbtu.

Rystad cited Sinopec’s invitation to welcome Cheniere to their offices in China last week as a first sign of positive knock-on effects for the US gas sector.

Since the start of Cheniere’s Sabine Pass terminals in 2015, 7% of the exported cargoes have reached China, despite no FTA with US, through spot agreements and intermediaries. The agreement between the two countries will encourage China to buy highly competitive US LNG directly through long-term agreements linked to Henry Hub, according to Rystad.

“Henry Hub indexed contracts will outcompete the traditional oil-indexed contracts over the next decade, both in terms of price and flexibility. The vast amount of commercial shale gas resources in North America implies a long term Henry Hub price of close to US$ 3/Mmbtu towards 2025, equivalent to an Asian LNG contract price of around US$ 8-9/Mmbtu. Given an oil price of US$ 80/bbl in the early 2020s, oil-indexed contracts will trade around US$ 10-12/Mmbtu depending on the percent link to Brent,” says Sindre Knutsson, gas market analyst at Rystad Energy.

“Due to a stronger shift towards more complex wells, well costs in gas plays have not been reduced as much as in oil plays. However, switching towards wells that are more complex has generated a significant uplift in well productivity, leading to lower wellhead breakeven prices. Average wellhead breakeven price on Marcellus decline from US$ 1.45 /Mmbtu in 2016 to US$ 1.3/Mmbtu in 2017, a decline of 10%”

The main contributor to the growth in North America is the low cost fields in the Appalachian region with new exit pipeline capacity coming on stream towards 2020. Rystad Energy forecast US plus Canada natural gas production of over 105 Bcf/d to be sustainable at a Henry Hub price of US$ 3/Mmbtu in 2025 due to increasing productivity and declining drilling costs.

Recommended for you