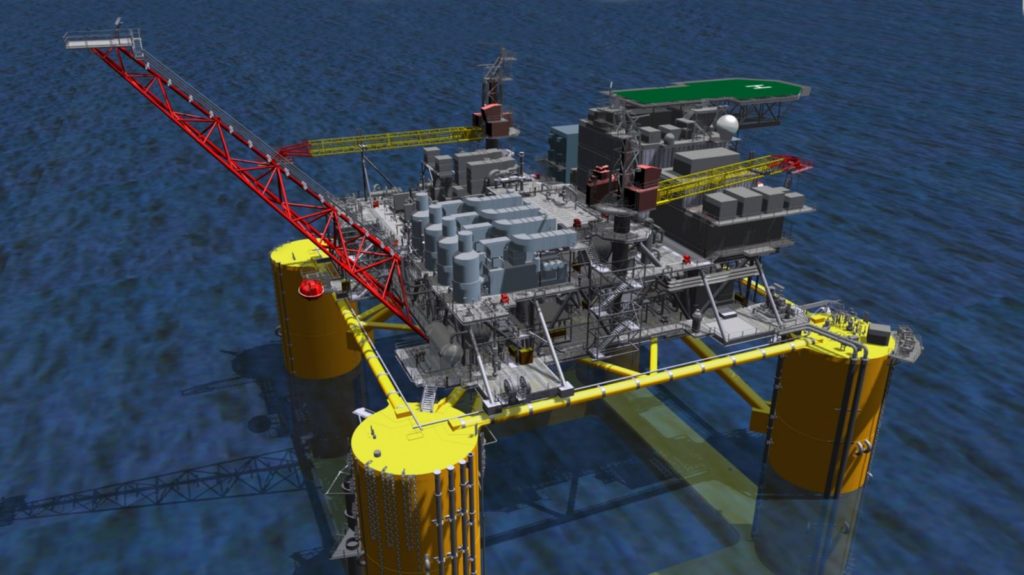

Shell said yesterday that it had taken a final investment decision on the 300million barrel Vito project in the US Gulf of Mexico.

Located 150miles south-east of New Orleans, Vito is expected to produce about 100,000 barrels of oil equivalent (boe) per day at its peak.

First oil is slated for 2021.

Shell said the development’s break-even price would be below $35 per barrel.

The company managed to reduce costs on Vito by more than 70% by redesigning the project.

Shell upstream director Andy Brown said: “With a lower-cost developmental approach, the Vito project is a very competitive and attractive opportunity industry-wide.

“Our ability to advance this world-class resource is a testament to the skill and ingenuity of our development, engineering and drilling teams.”

Operator Shell holds a 63.11% stake in Vito and has 36.89%.