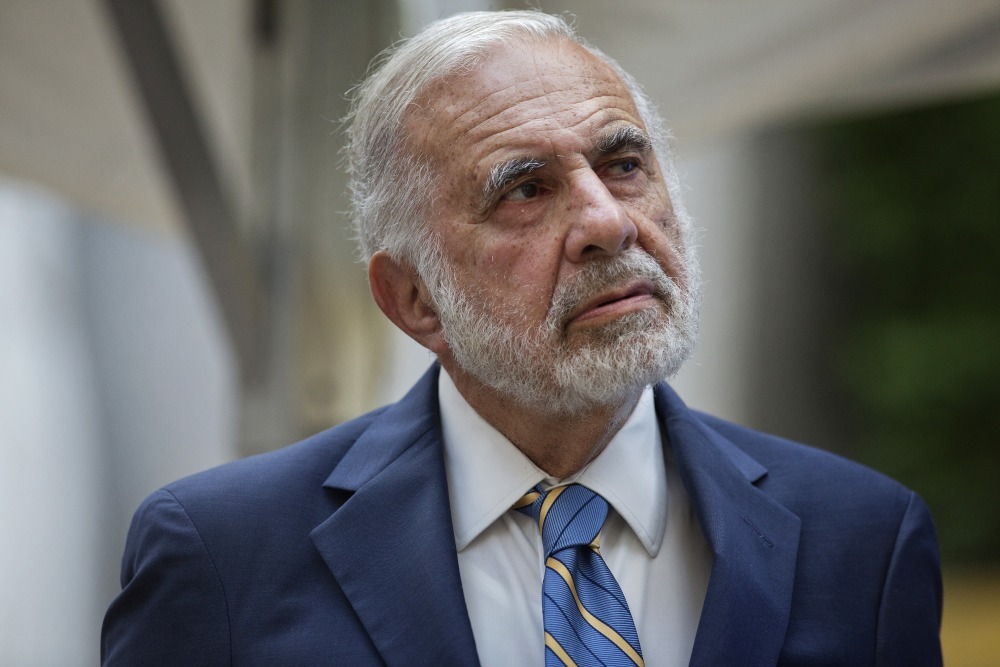

Activist investor Carl Icahn launched a lawsuit against Occidental Petroleum with the goal of potentially seeking board seats and a sale of the company.

The billionaire investor said in the suit filed Thursday in Delaware Chancery Court that he’s built a $1.6 billion stake in the Houston company and is upset by its decision to acquire Anadarko Petroleum for $38 billion and the $10 billion financing deal it lined up from Warren Buffett’s Berkshire Hathaway Inc. without a shareholder vote.

“The Anadarko deal is very much a bet-the-company deal from the point of view of the common stockholders. Not consulting them on the deal was disenfranchising at a minimum,” Icahn said in the suit.

Icahn said he’s considering soliciting other shareholders to call a special meeting to potentially elect new board members. Occidental shareholders voted earlier this month to lower the threshold to call a special meeting to 15 percent from 25 percent, going against the board’s recommendation.

In a prepared statement response, Occidental said Thursday it is focused on maximizing long-term value for all shareholders.

“Our acquisition of Anadarko will create a global energy leader with a highly complementary asset portfolio and a unique opportunity to deliver compelling value and returns to the shareholders of both companies,” Oxy said.

Analysts from the Swiss investment banking firm UBS said there’s very little chance of the lawsuit derailing the Anadarko acquisition, despite Icahn’s valid arguments against the merits of the deal. Oxy’s stock value has plunged more than 20 percent since its bidding on Anadarko became public in April.

The suit also questions Occidental Chief Executive Vicki Hollub, who fended off a competing takeover offer for Anadarko from Chevron, as well as her deal with Buffett. “A 90-minute deal ‘negotiation’ with one of history’s canniest investors, is no place to gain M&A experience – at least if you care about protecting your stockholders,” the suit said.

Occidental should also consider other options, Icahn said, including potentially paying down debt more aggressively than the company’s current plans and creating a pure-play oil and gas producer focused on the best basin.”Both Chevron and the company appear to have prized Anadarko because of its strong position in the Permian Basin,” the suit said. “Occidental has an even stronger Permian position and there is little doubt that it could have attracted strong and competitive bids at a premium to its stock price.”

The suit also criticizes the $8.8 billion sale of Anadarko’s Africa assets to the French energy major Total. “From all appearances it seems that Occidental sold these assets in a quickly arranged fire sale before it even owned them.”

Hollub herself has downplayed her experience in mergers and acquisitions, and she credited a team effort at Occidental’s annual meeting earlier this month.

She said Senior Vice President Michael Ure identified Anadarko as an ideal takeover candidate two years ago, praising the mergers and acquisitions team that made it happen.

“The thing you should know about me is I’m an engineer,” she said, “and I have very little experience with M&A.”

The two biggest moves to secure the financing included whirlwind trips to Paris and Omaha, Neb. They flew to Paris to sell Anadarko’s Africa assets to Total. Then they went to Nebraska to meet with Buffett and convince him and his company, Berkshire Hathaway, to commit $10 billion to help finance the Anadarko deal in exchange for preferred shares and a stake in the combined company.

Hollub herself confirmed a tentative deal was in place with Buffett in less than 90 minutes.

If oil prices fall below $45, the suit says there’s “substantial risk” that Occidental will have to cut its dividend. Icahn sent a letter to Occidental on May 21 seeking records related to the deal. On May 28, Occidental responded that it was considering the demand.

Icahn said in the filing he believes Occidental board and management “are in far over their heads, have made numerous blunders in recent months and might continue to trip over their feet if the board is not strengthened.”

–With assistance from Bloomberg’s Kevin Crowley and Rachel Adams-Heard. The Houston Chronicle’s Jordan Blum contributed to this report.

This article first appeared on the Houston Chronicle – an Energy Voice content partner. For more from the Houston Chronicle click here.