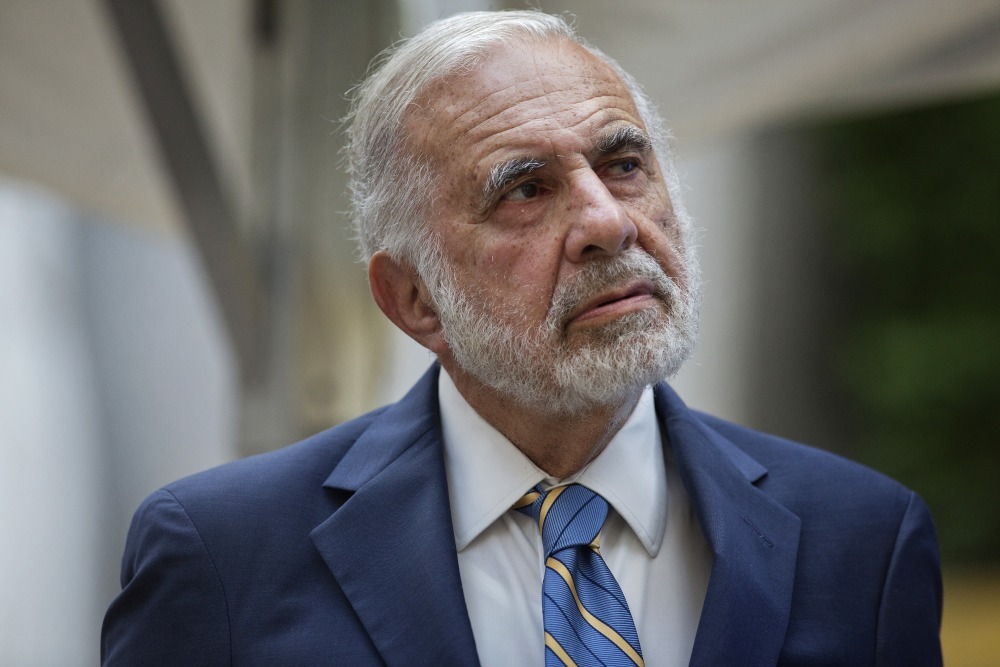

Famed corporate activist Carl Icahn couldn’t help but take another shot at the alleged “fiasco” caused by Houston’s Occidental Petroleum while discussing his deal to help combine two major casino businesses.

After all, Icahn is suing Oxy for its pending $38 billion acquisition of The Woodlands-based Anadarko Petroleum, arguing the deal is destroying shareholder value as he seeks a potential special board meeting to appoint new members and possibly sell the company.

Icahn used Oxy as an example of a deal gone wrong while praising the effort for Eldorado Resorts to acquire Caesars Entertainment in a roughly $17 billion deal combining two Nevada gaming giants. That deal closed the door on Tilman Fertitta’s bid to acquire Caesars.

Icahn said Eldorado and Caesars are a great natural fit, while too many boards treat corporations “like feudal systems than democracies,” and shareholders like peasants who can be ignored.

“The recent Occidental Petroleum fiasco is a great example of how CEOs and board will go to great lengths, including ‘betting the company’ to serve their own agendas,” Icahn said in his statement. “If their bet is successful, they and possibly their shareholders win, but if it is unsuccessful, only the shareholders lose.

“Too many boards like Occidental’s believe they are unaccountable and cannot be removed, and therefore can do almost anything they please,” Icahn added, calling this attitude a major threat to companies and the middle-class Americans who are investing their savings.

In a prepared statement to Icahn’s lawsuit in late May, Occidental said it is focused on maximizing long-term value for all shareholders.

“Our acquisition of Anadarko will create a global energy leader with a highly complementary asset portfolio and a unique opportunity to deliver compelling value and returns to the shareholders of both companies,” Oxy said.

Occidental recently outbid Chevron to acquire Anadarko, including its crown jewel acreage in West Texas’ booming Permian Basin.

But Oxy’s stock has plunged about 25 percent since the bidding war went public in April.

In order to secure the financing for the deal, Oxy Chief Executive Vicki Hollub led a whirlwind tour to Paris to sell Anadarko’s Africa assets to the French energy major Total for $8.8 billion, and then to Nebraska to convince Warren Buffett to commit $10 billion to help finance the Anadarko deal in exchange for a stake in the combined company.

Oxy was willing to offer $5 billion more than Chevron in part because the company is one of the most efficient operators in the Permian, drilling the most successful wells with lower costs and using a process known as enhanced recovery business to get more oil out of maturing wells, Hollub said.

She estimates Oxy, with Anadarko’s acreage, can save $10 billion in the Permian over time versus its peers.

“We were not going to let it be taken away,” Hollub said last month. “This is too important for our shareholders.”

Hollub has argued the deal will help secure Oxy’s future growth and that the combination will result in lots of cost savings in the years ahead.

“In the end, this is going to be a great thing for our shareholders, and they’re starting to see that,” Hollub said, acknowledging that she has some convincing left to do.

The full version of this article first appeared on the Houston Chronicle – an Energy Voice content partner. For more from the Houston Chronicle click here.