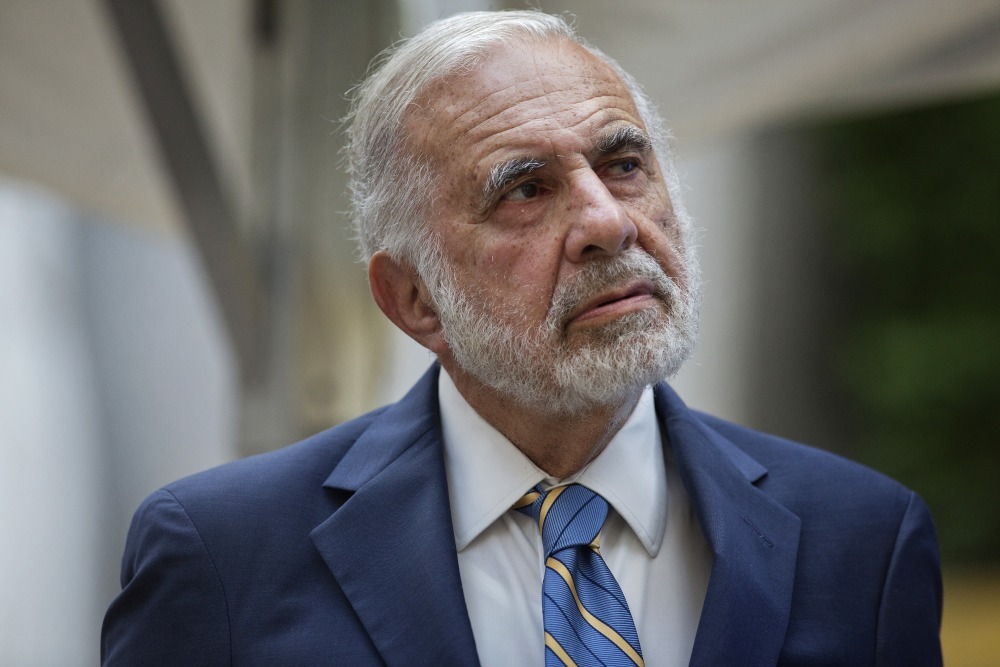

Famed activist investor Carl Icahn on Wednesday launched a bid to shake up Occidental Petroleum’s board over the $38 billion acquisition of Anadarko Petroleum, which has battered Oxy’s stock price and the value of Icahn’s holdings in the Houston oil company.

Icahn, who has a nearly $1.7 billion ownership stake in Oxy, sued the company in May. He is now preparing to call for a special board meeting to replace nearly half of Oxy’s board members, according to a filing with the U.S. Securities and Exchange Commission.

The billionaire investor alleges Oxy took a win-at-all-costs approach in its bidding war with Chevron to acquire The Woodlands-based Anadarko, destroying much of the value of its stock in the process and letting its shareholders suffer the consequences. He contends Oxy is biting off more than it can chew and betting too much on high oil prices in the future.

He aims to replace four of the nine board members and set up a set up strategic review committee, arguing the company “has a lack of effective corporate governance” and board members “made a number of mistakes in how and at what cost they pursued the acquisition of Anadarko.”

Oxy’s stock has plunged about 25 percent since the bidding war went public in April.

In May, shareholders bucked the wishes of Oxy by supporting a proposal to lower the threshold for calling a special board meeting from 25 percent of the shares held down to 15 percent. But the vote wasn’t binding and Oxy hasn’t yet adopted the threshold change.

Icahn controls nearly 5 percent of Oxy’s stock.

Earlier this week, Icahn went out of his way to criticize Occidental’s management while discussing the merger of two major casino businesses. Icahn used Oxy as an example of a deal gone wrong while praising the effort for Eldorado Resorts to acquire Caesars Entertainment in a roughly $17 billion deal.

Icahn, who holds a large stake in Caesars, said Eldorado and Caesars are a great natural fit, while too many boards treat corporations “like feudal systems than democracies,” and shareholders like peasants who can be ignored.

“The recent Occidental Petroleum fiasco is a great example of how CEOs and board will go to great lengths, including ‘betting the company’ to serve their own agendas,” Icahn said in his statement. “If their bet is successful, they and possibly their shareholders win, but if it is unsuccessful, only the shareholders lose.”

In a statement, Occidental said it would review Icahn’s filing.“We maintain an open dialogue with all our shareholders and welcome constructive input toward our shared goal of maximizing long-term value, “the company said. “The board is committed to acting in the best interests of Occidental shareholders and will continue to take actions to drive value on their behalf.

“We remain focused on completing our transaction with Anadarko in the second half of 2019, which we believe will create significant value and enhanced returns for shareholders.”

In order to secure the financing for the deal, Oxy Chief Executive Vicki Hollub led a whirlwind tour to Paris to sell Anadarko’s Africa assets to the French energy major Total for $8.8 billion, and then to Nebraska to convince Warren Buffett to commit $10 billion to help finance the Anadarko deal in exchange for a stake in the combined company.

Oxy was willing to offer $5 billion more than Chevron in part because the company is one of the most efficient operators in the Permian, where Anadarko has extensive holdings, Hollub said.

She estimates Oxy, with Anadarko’s acreage, can save $10 billion in the Permian over time versus its peers. “In the end, this is going to be a great thing for our shareholders, and they’re starting to see that,” Hollub said in May.

The full version of this article first appeared on the Houston Chronicle – an Energy Voice content partner. For more from the Houston Chronicle click here.