Activist investor Carl Icahn said Occidental Petroleum Corp.’s new target for assets sales won’t be achieved without a “fire sale” that includes its pipeline system, Western Midstream Partners LP, which was already shopped to potential buyers earlier this year.

Occidental’s Chief Executive Officer Vicki Hollub said Wednesday in a statement she was “highly confident” the company will exceed the upper end of its $10 billion to $15 billion asset sale plan by the middle of 2020. The oil producer also said it had closed its joint venture with Ecopetrol, raising $1.5 billion in cash and carried capital, and announced $200 million of non-core asset sales.

The new timing should be a “slight positive” for Occidental stock because it’s six months ahead of schedule, Leo Mariani, an analyst at KeyBanc Capital Markets Inc., said in a note.

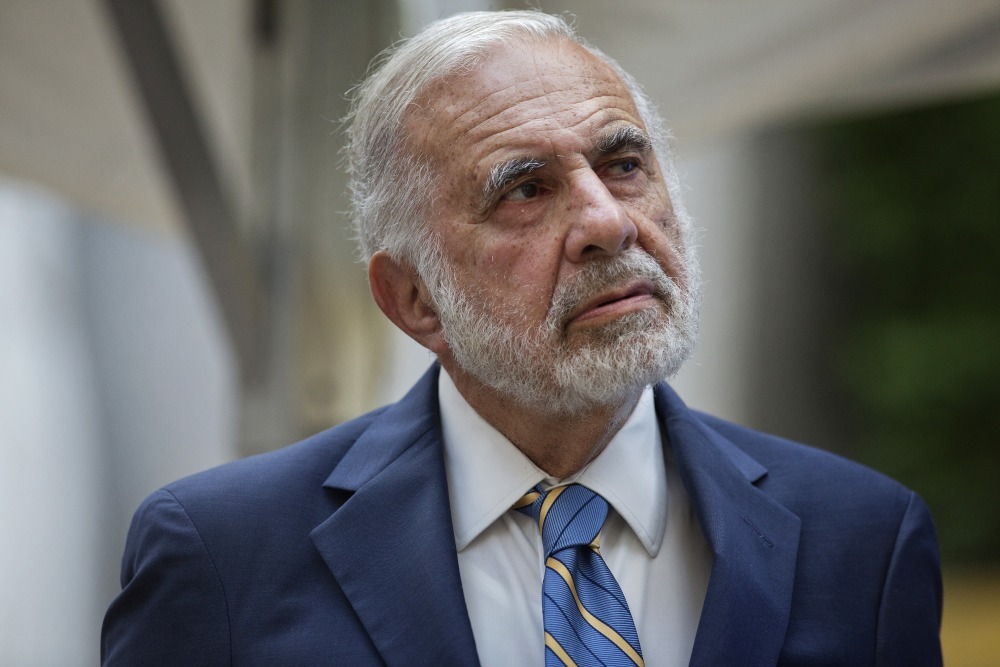

Icahn disagreed. The investor, who’s planning a proxy battle for Occidental next year, said in an interview Hollub’s new sales target and the promise of dividend growth “clearly takes stockholders and the market for fools.” Icahn has said he recently reduced his stake in Occidental to 23 million shares, worth roughly $900 million. He owned 33 million shares, or 3.7%, as of June 30, according to data compiled by Bloomberg.

“Results are not achieved through endless repetition,” he said. “Instead, they require disciplined and prudent decision-making from the start, which certainly hasn’t occurred here.”

A representative for Occidental didn’t immediately respond to a request for comment.

A key to beating Hollub’s target is the potential sale of Occidental’s stake in Western Midstream, a pipeline system it inherited in the Anadarko takeover that has a market value of $8.7 billion. The oil producer said it expects to close a “deconsolidation” of Western Midstream by the middle of 2020 along with “the value acceleration of non-strategic or non-core upstream and midstream assets.” The bulk of the asset sale target is made up of an $8.8 billion sale of Anadarko’s African assets to Paris-based Total SA, agreed to in May.

Icahn said he believed Hollub assumed Western Midstream was worth more than $15 billion because that’s the valuation she paid for it. “She certainly didn’t do her homework when she bought it from Anadarko,” Icahn said. “Its purchase price valuation is turning out to be a fiction.”

The billionaire investor said last week he was planning to launch a proxy fight at Occidental after its $37 billion takeover of Anadarko Petroleum Corp. earlier this year. The billionaire argued the deal, which did not go before a shareholder vote, has put the company’s financial future, including its dividend, at risk if oil prices falter.

Shares in Occidental fell about 0.8% in New York to $38.12, giving the company a market value of roughly $34 billion.

Hollub said in the statement that she has made debt reduction and protecting Occidental’s dividend her “top priorities” following the Anadarko takeover. The stock is trading at the lowest in about 14 years as investors balked at the amount of borrowing needed to complete the deal, and then questioned whether Occidental can produce enough oil to manage the debt burden.

“Hollub and her board should be on notice. Stockholders are watching and fire sales will not be tolerated,” Icahn said, adding that investors will not allow the company to pay down debt “by further punishing stockholders.”