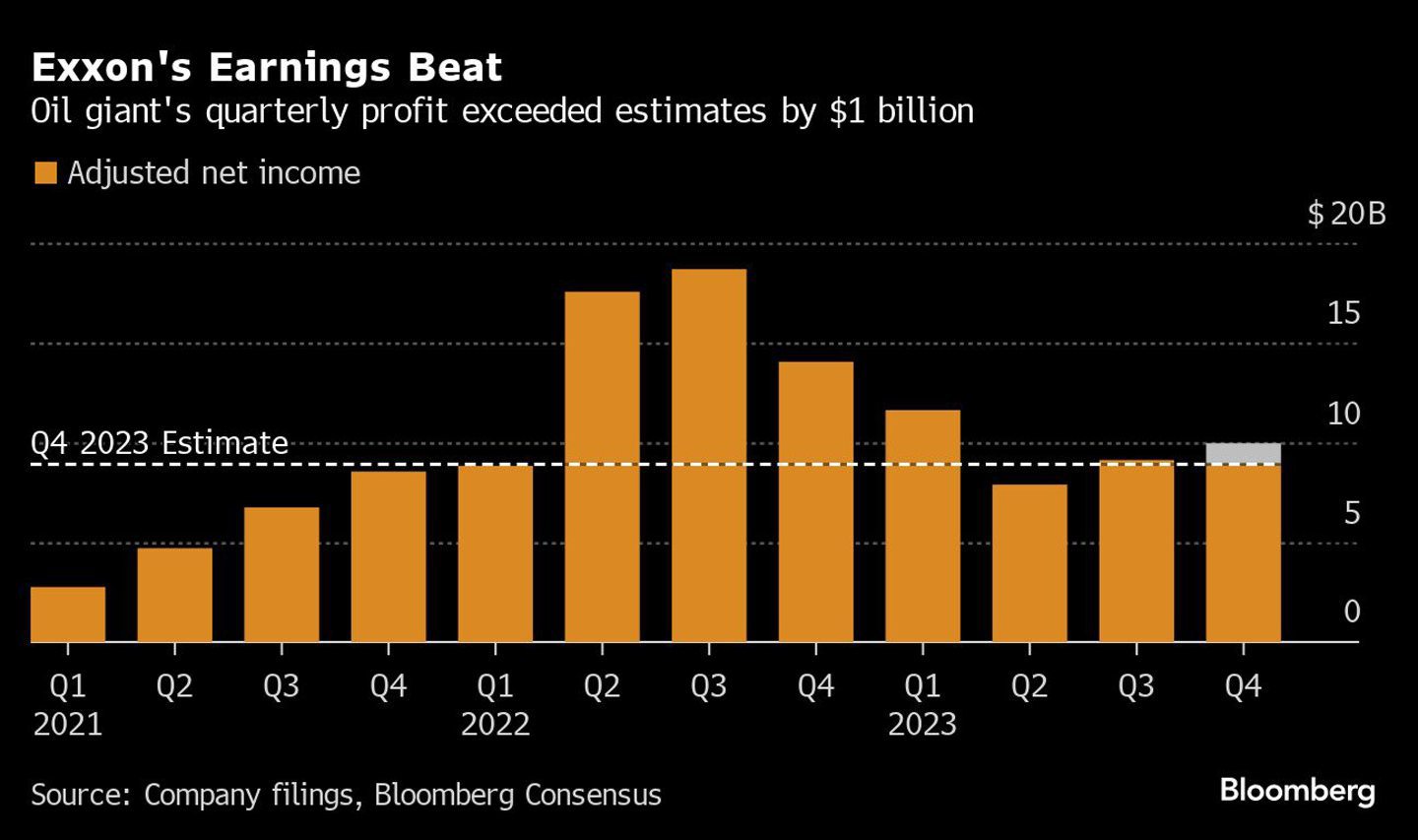

Exxon Mobil Corp. (NYSE:XOM) and Chevron Corp. (NYSE:CVX) surpassed earnings forecasts as bigger-than-expected oil output from shale fields helped cushion the blow from weakening crude prices.

Exxon rose more than 2% and Chevron climbed 1.9% in pre-market stock trading. Exxon’s outsized result also was aided by a $1.14 billion boost from unsettled derivatives and record fuel production at its refineries.

Chevron, meanwhile, posted adjusted earnings of $3.45 a share that exceeded the Bloomberg Consensus estimate by 23 cents. The oil explorer also raised its dividend by a higher-than-forecast 8%.

The upbeat reports by North America’s biggest crude drillers follow similar results at Shell Plc, which kicked off Big Oil earnings season on Thursday with adjusted net income that was more than $1 billion higher than the average forecast. BP Plc and TotalEnergies SE are scheduled to disclose results next week.

Exxon’s trading unit delivered handsomely, reaping more than $1 billion in gains that more than offset the $410 million hit inflicted by lower crude prices. That strategy is a departure for a company that historically shunned trading as too risky and outside its traditional areas of expertise.

“We’re continuing to grow our trading footprint, and we saw strong trading results this year that flowed through” to the bottom line, Chief Financial Officer Kathy Mikells said during an interview.

Both Exxon and Chevron are under pressure from investors to bolster cash flow by pumping more oil while simultaneously avoiding a price-killing supply glut.

Exxon is attempting to thread the needle with a $60 billion takeover of Pioneer Natural Resources Co., which it expects to close around the middle of the year. The all-stock deal preserves cash for shareholders and widens Exxon’s portfolio of prime drilling targets in the Permian. Meanwhile, Chevron Corp. is taking a page from the same playbook with a $53 billion deal for Hess Corp.

Pivoting to more profitable oil production is a key part of Exxon Chief Executive Officer Darren Woods’ plan to double earnings from 2019 to 2027. The Texas oil giant paid out the S&P 500’s fourth-largest combination of dividends and buybacks during the past 12 months. Its stock declined more than 9% last year despite a 24% gain in the broader market.

Exxon ended the quarter with $31.6 billion of cash, about 4% lower than the previous period, mainly due to shareholder payouts. The company recorded a $2.3 billion one-off loss, which it previously flagged was related to the declining value of oil wells and other assets in California.

As for Chevron, the No. 2 US oil explorer incurred $3.7 billion of charges stemming mostly from assets in its home state of California and the dismantling of decades-old infrastructure in the Gulf of Mexico. Annual production climbed 4%, primarily boosted by rising output in the Permian Basin and other US fields.

Chevron is ramping up Permian production with a target of 10% growth this year that sets the company on course to pump 1 million barrels a day from the region in 2025.

“We are in the best parts of the Permian,” Chief Financial Officer Pierre Breber said during an interview. “Our growth is higher likely than the basin average but it is representative of our activity level and the activity level of our partners.”

© Supplied by Bloomberg

© Supplied by Bloomberg © Supplied by Bloomberg

© Supplied by Bloomberg