The US could add 70 to 190 million tonnes per year of LNG production by 2030, more than doubling current exports.

The projections come from Wood Mackenzie, which suggests investments might reach $100 billion in new developments.

Freeport LNG is in the process of restarting, the producer said yesterday. This addition should bring the US to the top of the league table, surpassing Australia and Qatar this year.

“Record-high prices and the need for energy security drove buyers, which included portfolio players and US producers and infrastructure companies, to seek long-term US LNG deals in 2022 and created huge contracting momentum for projects,” said Giles Farrer, head of gas and LNG asset research for Wood Mackenzie.

Farrer said that companies had signed deals covering 65mn tpy of long-term supplies from the US. In 2021, in contrast, only 18.5mn tpy were contracted.

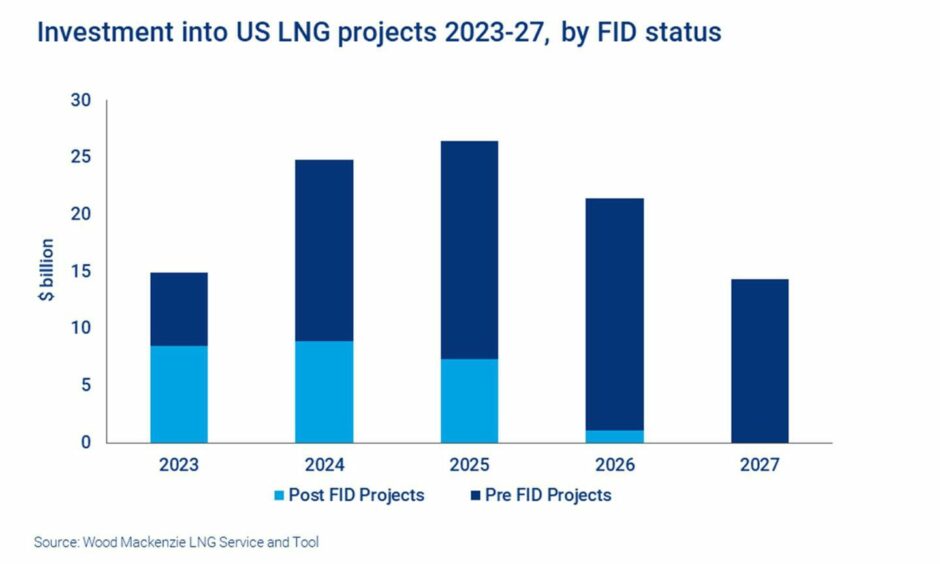

“This activity has pushed a host of pre-final investment decision (FID) US projects forward and we could see a wave of FIDs this year and next,” he said.

In the next year, four new LNG projects are due to start up, WoodMac said. Golden Pass LNG, Plaquemines LNG Phase 1, Corpus Christi Stage 3 and New Fortress Energy’s (NFE) Louisiana Fast LNG project will add nearly 45mn tpy.

Fund flow

One risk WoodMac identified for LNG growth is in financing.

Analyst Sean Harrison said inflation for projects had passed 20% on the US Gulf Coast.

“As developers continue to push more projects forward, competition for service contracts will rise, creating a squeeze on both work force and material prices. This could cause further cost inflation, along with delays to some projects,” he said.

While costs are increasing, builders also face pressure from customers to keep fees low.

“The combination of low fees and increasing costs mean we estimate unlevered internal rates of return (IRRs) as low as 5-6% for some projects. Based on these returns, some projects are finding it challenging to secure finance, particularly via equity raises,” said Harrison.

Companies will consider a range of ways in which to secure more value, he continued. One such area would be “charging customers for additional services to reduce project emissions”, Harrison said.

© Supplied by WoodMac

© Supplied by WoodMac