Shell has taken the final investment decision (FID) on the Whale project, in the US Gulf of Mexico, copying many of the aspects of its Vito project.

Shell Offshore has a 60% stake in Whale and is the operator, while Chevron USA has the remaining 40%. The project should start up in 2024 and will reach 100,000 barrels of oil equivalent per day. It has 490 million boe of recoverable resources.

“Whale is the latest demonstration of our focus on simplification, replication and capital projects with shorter cycle times to drive greater value from our advantaged positions,” said Wael Sawan, Shell Upstream Director.

The company said Whale will feature a 99% replicated hull with an 80% replicated topsides. Given this cost effective design, Shell expects the internal rate of return to be more than 25%.

Sawan went on to say the project would “yield high-margin barrels so that we are able to meet the energy demands of today while generating the cash required to help fund the development of the energy of the future”.

The plan includes energy efficient gas turbines and compression systems, it said. The company went on to tout its Gulf of Mexico portfolio as having among the lowest greenhouse gas intensity in the world for oil production.

From Vito to Whale

The Whale development will have a semi-submersible production host in water depths of more than 2,621 metres. It will have 15 oil wells.

Shell discovered the Whale field in January 2018. At the time, it said the find was one of the company’s largest discoveries in the region for a decade. The company had planned to approve the project in 2020.

The discovery well in the Alaminos Canyon Block 772 found 427 metres of net pay. The production facility will be in Alaminos Canyon Block 773.

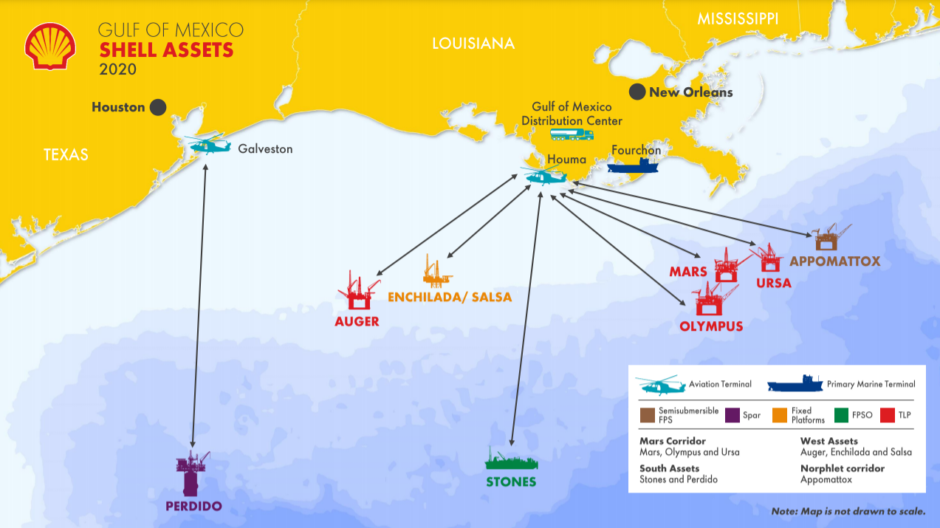

The field is adjacent to Silvertip, around 10 miles from the Perdido platform.

Shell took FID on the 100,000 boepd Vito development in April 2018, with a 300mn boe resource.

This had been due to start producing in 2021 but is now expected to come in 2022. The company redesigned Vito in 2015, allowing to cut cost estimates by as much as 50%.

Recommended for you