South Korea’s LNG imports in September dropped to levels last seen in 2017.

The country’s customs data reported it received 2.5 million tonnes of LNG in September. For the same month of 2018, South Korea received 3.32mn tonnes. The last time import volumes were lower was September 2017, when the country took 2.36mn tonnes.

Supplies increased from Malaysia and the US on the year, while Australian, Indonesian and Omani volumes all fell by around half. Qatari supplies also fell, although less markedly.

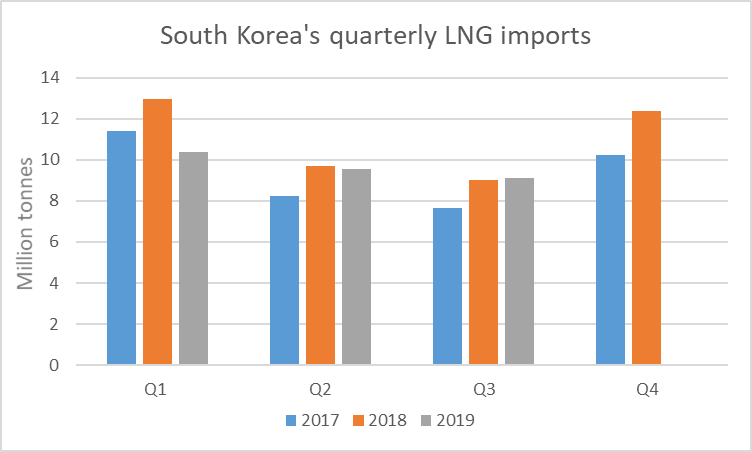

In the year to date, South Korea imported 29.04mn tonnes, down from the 31.64mn tonnes imported in 2018 to September – a reduction of around 9%.

Looking at previous years of South Korean data, volumes are likely to rise for the rest of the year. The third quarter tends to be the weakest for South Korean imports, with the cold first quarter needing the greatest quantity of gas imports.

The cost to date this year has reached $13.89 billion, down from $14.15bn in 2018, a reduction of just 1.9%. This disparity, between volume and price, highlights that while spot LNG prices are under pressure, contracted supplies have seen much less change.

China and Japan are yet to report detailed import statistics for September. Chinese volumes are set to be higher still in 2019 than in 2018, reaching 38.56mn tonnes as of August, versus 32.79mn tonnes at the same point in 2018. Japan’s imports are falling, reaching 51.51mn tonnes as of August, versus 56.4mn tonnes at the same point in 2018.

Recommended for you