Deepwater upstream projects are increasingly important for Southeast Asia, where new investment in production is critical to meet rising demand for oil and gas, as economies continue to expand.

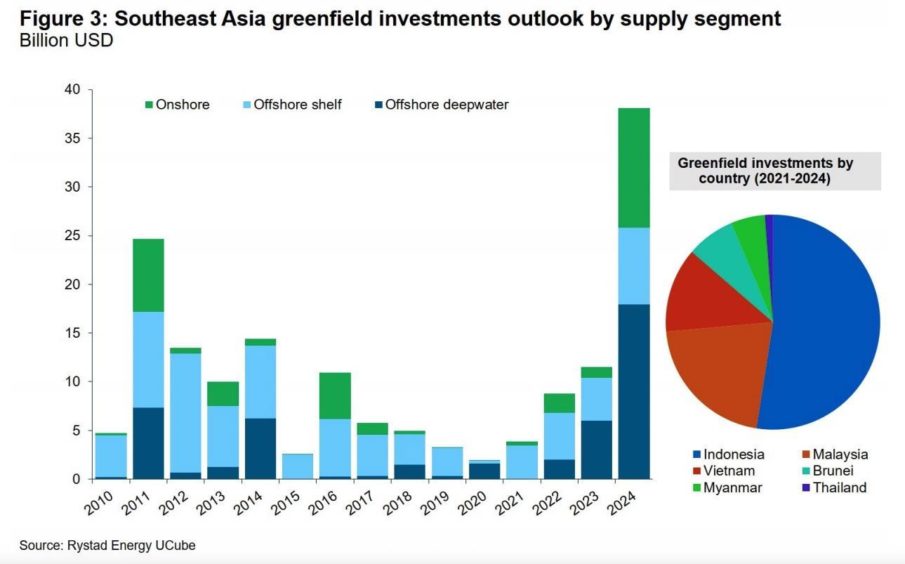

Research from Rystad Energy suggests that deep-water upstream assets will likely make up a larger share of projects reaching final investment approval – from 20% in 2022 to around 70% in 2024.

Malaysian national oil company Petronas looks set to be the biggest investor in deep-water projects over the next three years, based on its plans in Brunei and Malaysia, followed by the majors.

Final investment decisions (FIDs) expected between 2022 and 2024 are targeting resource volumes of around 5 billion barrels of oil equivalent, which is double total deep-water resources sanctioned in Southeast Asia in the past two decades, Rystad said in a report.

“Volumes from deep-water projects will be crucial for the production outlook of countries in the region. The deep-water investments from Southeast Asia can potentially recover to pre-2013 levels, whereas the investments on Shelf and Onshore assets are likely to be far behind those peak levels of 2010-2014,” said Prateek Pandey, vice president analysis at Rystad.

“Almost half the greenfield investments expected in the period to 2024 will be in Indonesia – around $25 billion – followed by Malaysia and Vietnam,” said the research consultancy.

However, this optimistic outlook, which would be welcome news for service companies, hinges on operators and their hopes for asset sales, as well as other transactions, warned Rystad.

“The top four projects in terms of investments have either the operator or a partner looking to drop out, which might potentially impact the timeline of these developments,” added Rystad.

Indeed, it is hard to see the Inpex-led giant Abadi gas project in the Masela Block offshore Indonesia take FID by 2024. Shell, which has a 35% equity stake in the struggling project, is looking to fully divest.

Chevron is also seeking to sell out of the giant Indonesia Deepwater Development (IDD), which is widely expected to be bought by Italy’s Eni. However, the sales process appears to be moving slower than the Indonesian government expected.

ExxonMobil is also looking to exit Blue Whale in Vietnam, while Murphy Oil is seeking to drop Block CA-2 in Brunei.

“Excluding these projects, Petronas will be the operator with the highest share of deep-water investments with its planned projects in Brunei and Malaysia by 2024, followed by majors. Shell is likely to focus on planned developments in Malaysia and Brunei, TotalEnergies in Myanmar, and Eni in Indonesia,” reported Rystad.

Deep-water drilling activities are bouncing back in Southeast Asia following a lackluster 2020 with overall spending expected to rise 51% this year to $504 million, data from Rystad showed.

© Supplied by Rystad

© Supplied by Rystad