Malaysia’s state-owned energy company Petronas is planning to build a third multi-billion dollar floating liquefied natural gas (FLNG) unit to help solve challenges commercialising gas offshore Sabah in Malaysia as part of an effort to appease ConocoPhillips (NYSE:COP) and Shell (AMS:RDSA) following losses related to an upstream development.

The move seems to be an attempt to appease ConocoPhillips and Shell after they have both suffered significant losses in relation to their Kebabangan (KBB) field due to transportation issues caused by a faulty pipeline that is managed by Petronas. The 512 km onshore pipeline was designed to ship gas to the neighbouring state of Sarawak for export at the Malaysia LNG (MLNG) terminal. Crucially, the proposed FLNG unit would offer an alternative route to market for gas from Kebabangan.

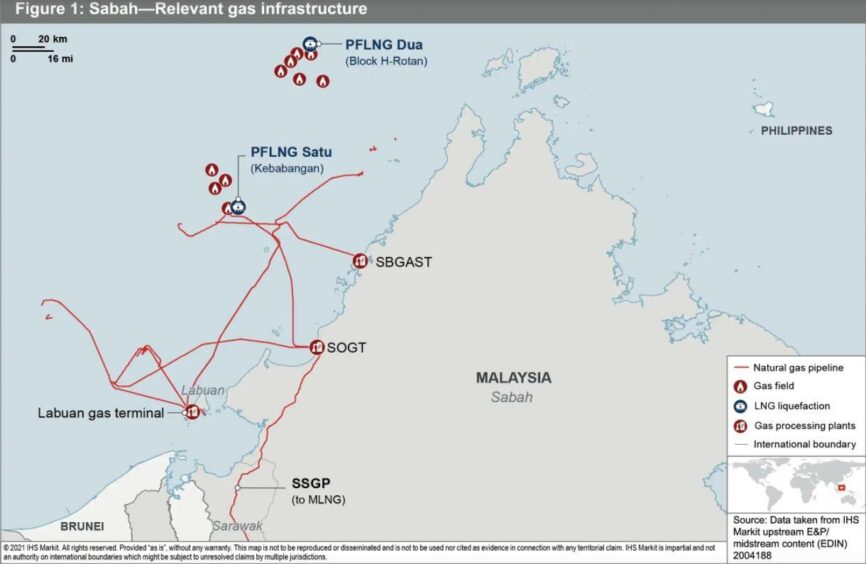

The Kebabangan gas field, which began production in November 2014, sits 130km offshore Sabah, East Malaysia. It is part of the Kebabangan Cluster, which holds two more fields Kamunsu East and Kamunsu East Upthrown Canyon. The cluster is owned by Petronas Carigali (40%), ConocoPhillips (30%) and Shell (30%).

To connect gas discoveries offshore Sarawak to the Malaysia LNG (MLNG) export complex at Bintulu in Sarawak, Petronas conceived the Sabah-Sarawak Integrated Oil and Gas Project. This included the Sabah-Sarawak Gas Pipeline (SSGP), which connects a terminal in Sabah by a 512 km onshore pipeline to the MLNG plant. The pipeline was commissioned in January 2014 and was a crucial plank in commercialising Shell and ConocoPhillips’ Kebanangan cluster.

Pipeline failure

However, the pipeline has failed to work properly since 2014 and has been offline since January 2020. Petronas is targeting to restart the pipeline, which cost RM4.6 billion ($1.1 billion), by January 2023. But this seems ambitious just now.

“If all had gone to plan, then we would not be looking at a third FLNG vessel. However, the SSGP has been beset with issues including leaks and explosions, with the first in June 2014 and the most recent in January 2020. This has seen the pipeline shutdown for extended periods for repairs and testing and it has been off-stream since January 2020. As a result, gas volumes exported from Sabah to Sarawak have been far below plan and, in-turn, this has limited the production rates at the upstream fields in Sabah, whilst also decreasing the feedstock for the MLNG plant,” Robert Chambers, director, upstream research at IHS Markit, noted in his recent report PFLNG Tiga – Another sticking plaster or a long-term solution?

The fact that the pipeline has had multiple problems – it basically has not worked – has caused significant losses for the Kebabangan partners, which includes Petronas Carigali, Shell, and ConocoPhillips. “I have heard from ConocoPhillips and Shell folks that this is a major financial blow for Kebabangan,” a Kuala Lumpur-based industry source told Energy Voice.

“The pipeline was built by an Indian contractor who it appears did not appreciate some of the topographic and other difficulties, and I’ve heard may have poorly laid the line and also not properly inspected the welds,” added the source.

“There is no real clarity on the SSGP situation. It’s all typically kept out of the news by Petronas and the Malaysian media. However, the SSGP failure and problems are so serious that it must have gone to court, arbitration most likely, and therefore nobody can speak about it,” said the source.

Another industry analyst said that they were unsure whether the pipeline was poorly built or just poorly designed. “There are a lot of little landslides in the jungle, and these put a lot of stress on the line when it moves, which can then rupture,” the analyst told Energy Voice.

The Kebabangan development came onstream in November 2014, with the field expected to export gas at a rate of 750 million cubic feet per day (MMcf/d), with both the gas and liquids exported to the Sabah Oil & Gas Terminal (SOGT) through separate pipelines, with the gas then sent to MLNG through the SSGP, noted Chambers.

Given the SSGP issues, a decision was made to move Petronas’ maiden FLNG unit, dubbed PFLNG Satu, which has a processing capacity of 1.2 million tonnes per year (t/y) of LNG, to the Kebabangan field, and, in May 2019, the FLNG unit received its first gas from Kebabangan. “Whilst this was a good and innovative solution, it was far from ideal for the Kebabangan partners as the capacity of PFLNG Satu is only about 20-25% of the SSGP, thus continuing to limit the production from the field,” wrote Chambers.

“A solution needs to be found for the monetisation of gas resources in Sabah and I am not convinced that the SSGP will reliably come back into operation, let alone at full capacity,” Chambers told Energy Voice.

Flexible Solution?

The solution appears to be a third FLNG unit, named PFLNG Tiga, as it provides a flexible solution and optionality based on the future of the SSGP and the Kebabangan field, reckons Chambers.

Petronas already has a second FLNG unit in operation at PTTEP’s (BKK:PTTEP) Block H in the deep waters off Sabah. Following the success of the first two floaters, Petronas has now issued a tender for the third FLNG facility, which based on a 2 million t/y capacity, will likely cost between $2.5 billion and $3.5 billion, Chambers told Energy Voice.

The vessel is expected to be located close to the Sabah Oil & Gas Terminal and combined with the first FLNG facility that currently processes gas from Kebabangan, will provide total export capacity of 3.2 million t/y of LNG, but still well under the planned production rates for Kebabangan, noted Chambers.

However, this solution offers a huge amount of flexibility that covers various future scenarios of the SSGP, added Chambers.

Still, upstream investors have significant concerns about gas commercialisation in Sabah. “This has limited their desire to invest in exploration unless it is oil focused. Whilst PFLNG Tiga should provide a reliable commercialisation option that will also give Petronas flexibility to adapt to the potential future reliability of the SSGP, it would seem almost the entire capacity of PFLNG Tiga would be utilised by the Kebabangan field, leaving little room for other players,” noted Chambers.

“If the SSGP was to reliably come back onstream, then Petronas could consider relocating either PFLNG Satu or PFLNG Tiga to commercialise other gas fields in Sabah or Sarawak,” he said.

“Will this be enough to bring upstream investors back to exploring for gas in Sabah? I’d say that for now at least, they will be watching with interest, but not moving or spending,” cautioned Chambers.

Meanwhile, the MLNG export complex, which can process 30 million t/y of LNG, remains under-utilised. It is currently exporting at a little over 24 million t/y, with the lack of supply from Sabah being one of the key factors behind the shortfall, as well demand weakness following the COVID-19 pandemic, and some long-term contracts rolling off, said Chambers.

© Supplied by IHS Markit

© Supplied by IHS Markit