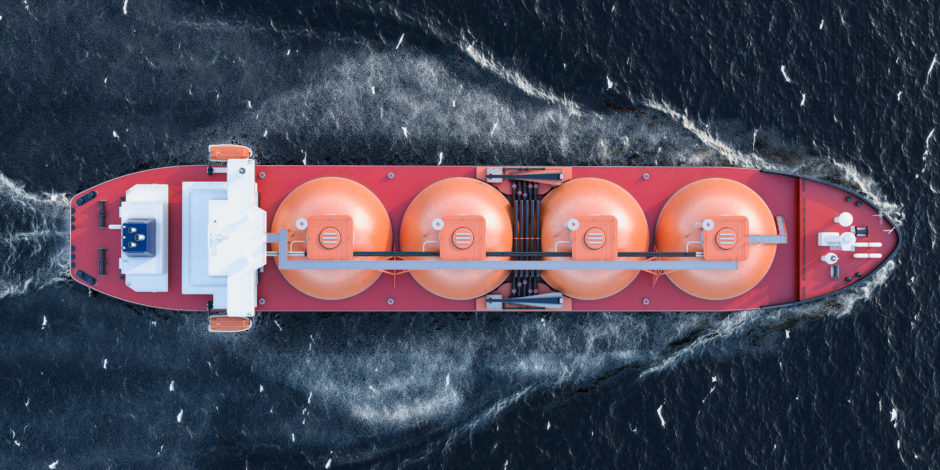

Asian liquefied natural gas (LNG) traders are rushing to secure shipments from the US, where prices are among the cheapest in the world, amid a dash to replenish supply before the winter.

Firms in China and Japan, the two biggest importers, are seeking to procure LNG specifically from the US, and are in discussions with exporters and portfolio players to lock in deliveries through March, according to traders with knowledge of the matter. The companies want LNG linked to the Henry Hub index, the US benchmark that’s trading at a fraction of prices in Asia and Europe.

A global energy squeeze has sent prices for gas and coal surging from Australia to the Netherlands. Utilities are busy stocking up on fuel before winter descends on the Northern Hemisphere and heating demand soars.

While US gas prices have more than doubled this year, they still are much lower than overseas markets in large part because of the bounty of North American shale fields. That means Henry Hub-linked LNG contracts are currently cheaper than most deals linked to Brent crude or other gas benchmarks.

US LNG sent to Asia this winter can turn an attractive profit, with the netback at roughly $25 to $26 per million British thermal units, according to analysis from BloombergNEF. That’s near the highest ever. It is also in stark contrast to last year’s summer, when U. LNG shipments to Asia and Europe weren’t profitable as the Covid-19 pandemic pared demand for the fuel.

Margins are so good that a single cargo from the US is exchanging hands as many as eight times, as firms are eager to resell the same shipment and get a slice of the profit, according to traders.

The Asian LNG importers are eager to buy US gas on a loading basis from Gulf Coast terminals, then charter the shipping themselves, according to the traders. That’s resulted in higher charter rates in both the Atlantic and Pacific, and has also stoked fears about Panama Canal congestion when winter shipments peak.

Chinese firms are also increasingly turning to the US for LNG amid improving relations between the two nations, traders said. Some of the smaller importers have been encouraged to avoid procuring additional Australian supplies, and the US has emerged as an alternative, according to the traders.

Recommended for you