Harbour Energy (LON:HBR) and its Russian partner Zarubezhneft have successfully completed their appraisal drilling campaign at the Tuna Block in the Natuna Sea offshore Indonesia with positive results at both wells.

Rikky Rahmat Firdaus, chief representative of Northern Sumatra region at upstream regulator SKK Migas, reported that Harbour had discovered gas and condensate at both Singa Laut-2 and Kuda Laut-2 appraisal wells.

Harbour declined to comment about its operations, but industry sources told Energy Voice that the company will provide more details about the Tuna appraisal drilling in early December at their capital markets day.

Two successful exploration wells have previously been drilled at Tuna, which has estimated reserves of 100 million barrels of oil equivalent and lies close to the maritime border with Vietnam.

The next stage of development for the Tuna Block, operated by Premier Oil, which is now a Harbour Company following a takeover, is under consideration by Harbour management. But the fact the appraisal campaign was considered a success implies that the outlook is good, said one industry source.

Reports that Chinese vessels have been meddling in the Tuna Block as part of Beijing’s efforts to assert its claims to territorial rights in that part of the South China Sea had no impact on Harbour’s operations, added the source.

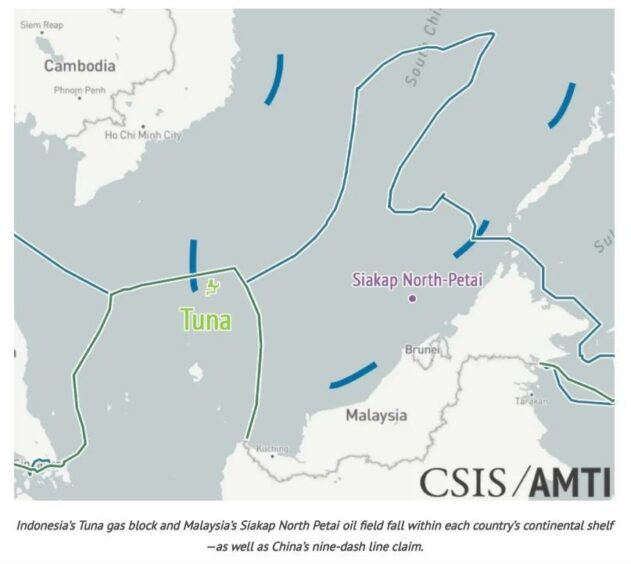

The Tuna Block lies within Indonesia’s exclusive economic zone (EEZ), but Chinese law enforcement vessels remain active in the area, according to the latest analysis published 12 November by Asia Maritime Transparency Initiative (AMTI). Indeed, Indonesia’s navy and coast guard have been busy chasing the Chinese intruders away in recent months.

Still, Harbour experienced no disruption due to the Chinese presence and the company will continue to progress its development plans, said the source.

Premier Oil, which operates Tuna, SKK Migas and PetroVietnam, previously signed an MoU for the sale of gas to Vietnam, via a proposed new cross-border pipeline linking the Nam Con Son gas infrastructure in Vietnam. “This remains the most likely development option, given Harbour and Zarubezhneft’s existing interests across the border in Vietnam – Block 12W is operated by Harbour Energy, while Zarubezhneft operates the Lan Tay and Lan Do gas fields in Block 06-1. Both blocks are within 100 kilometres of the Kuda Laut and Singa Laut discoveries,” Andrew Harwood, Asia Pacific research director at Wood Mackenzie, told Energy Voice.

Prateek Pandey, vice president analysis at Rystad, told Energy Voice that the recent activity involving Chinese vessels around the Tuna block could prove to be a “major hurdle in terms of potential timeline for the development at the Tuna production sharing contract (PSC)”.

To avoid getting tangled up in China’s sweeping territorial claims to the South China Sea, Harbour Energy is considering a pipeline route to Vietnam via Malaysian waters. The viability of this option will probably be a major factor in approving investment for a new upstream development cluster tied to acreage in Vietnam, added Pandey.

Harbour’s drilling has attracted the attention of Beijing as the Tuna discovery sits in an area also claimed by China through its sweeping claim to most of the South China Sea within its U-shaped ‘nine-dash line’, which is not recognised by its neighbours or internationally by the United Nations Convention on the Law of the Sea. The Tuna PSC lies about 10 nautical miles from the Indonesia-Vietnam maritime border.

“Under President Xi Jinping, China has doubled down on asserting its jurisdictional claims to resources that lie within its so-called nine-dash line in the South China Sea. As Xi consolidates power, there will be no letup in China’s pressure on Southeast Asian countries to end joint development projects with foreign companies that fall within that line. We should therefore expect China to disrupt operations in the Tuna field by deploying coast guard cutters and survey ships. Although the Indonesian government does not appear to have lodged a protest with China yet, as these activities increase it will face growing domestic pressure to do so,” Ian Storey, a senior fellow and Asian security expert, at the ISEAS Yusof Ishak Institute in Singapore, told Energy Voice.

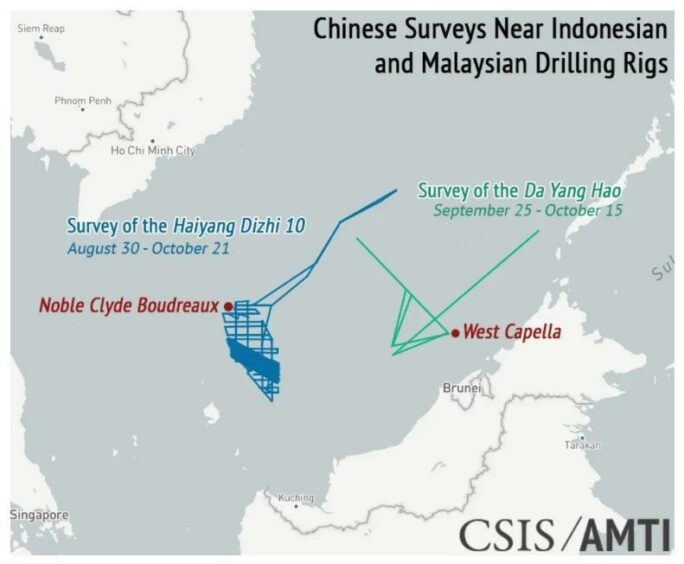

The Chinese have been busy carrying out surveys near drilling rigs operating in Malaysian and Indonesian waters this year, including the Noble Clyde Boudreaux, hired by Harbour for the Tuna appraisal campaign. Behind closed doors this has stoked tensions with both Jakarta and Kuala Lumpur, who remain unimpressed with Beijing’s actions.

But Harbour Energy does not publicly appear phased by the rising tensions between China and Indonesia in the Natuna Sea. A spokesperson for Harbour said that the company does not comment on geopolitical issues.

With Harbour Energy pushing aside the potential geopolitical issues, it might approach the market for front-end engineering and design (FEED) bids covering a floating production storage and offloading (FPSO) unit to exploit its Tuna discoveries, said Pandey.

Russian state oil and gas producer Zarubezhneft, which acquired a 50% share in Tuna in May, is keen to create a new gas cluster with neighbouring assets in Vietnam and Indonesia following recent deals involving Premier Oil and Rosneft, it said in June.

The completion of its farm-in to the Tuna block forms part of Zarubezhneft’s strategy to create a new upstream development cluster bringing together the company’s existing Block 12/11 in Vietnam, as well as Block 11-12 in Vietnam – where Korea National Oil Company (KNOC) has a 75% stake and PetroVietnam has a 25% share – and the Tuna discovery, according to the company.

Premier Oil was renamed Harbour Energy after a reverse takeover by private equity-backed Chrysaor completed early 2021.

China has also been targeting Thailand’s PPT Exploration & Production’s (PTTEP’s) (BKK:PTTEP) operations in Malaysian waters recently.

© Supplied by AMTI

© Supplied by AMTI © Supplied by AMTI

© Supplied by AMTI