Sunda Gas is busy completing various studies that could lead to the commercial development of the shallow-water Chuditch gas discovery offshore East Timor with a potential floating liquefied natural gas (LNG) development under consideration.

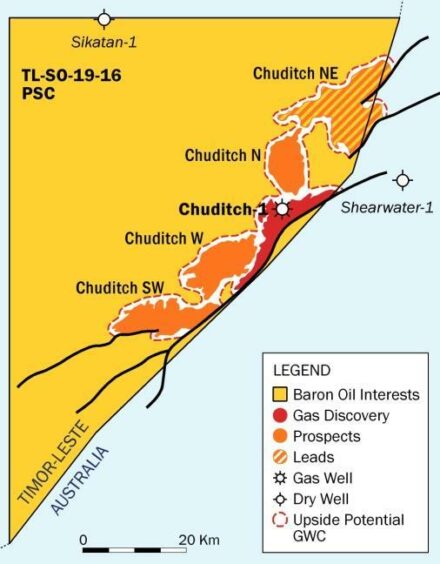

Sunda Gas, which is 100% owned by AIM-listed Baron Oil (LON:BOIL), is currently reprocessing 1270 square kilometres of 3D seismic around Chuditch, which was discovered by Shell in 1998. The reprocessing work is being done by TGS in the UK.

Crucially, the seismic work, which is being carried out alongside geological and commercial studies, should be complete by mid-year, Andy Butler, chief executive of Sunda Gas, told Energy Voice.

Butler added that the company will make a judgement later this year regarding the viability of the project, when a “drill or drop decision” will be taken.

“Going forward, if the reprocessed data merits it, we would like to drill an appraisal well, which is an obligation on the Chuditch discovery. But we would also like to drill at least one additional exploration well to establish the presence of gas resources in adjacent features. We would effectively be looking at a cluster development for all that gas,” he said.

Sunda’s targeted reserves will be refined considerably once 3D reprocessing is complete. “At the moment we’re carrying about 750 billion cubic feet of gas for the Chuditch discovery with a mean resource for the adjacent features of about 3.4 trillion cubic feet of gas, across four prospects and leads, including Chuditch. The adjacent prospects are considered extremely low risk due to reservoir and structural configuration. These numbers would merit a standalone development,” added Butler.

Shell previously collected an enormous amount of technical data on the find. This covered everything from coring to running all sorts of logs that give Sunda a good basis of understanding. But Shell did not test it. They drilled in 1998, when there was no gas infrastructure and nothing like the gas markets today. Therefore, Shell, which was hoping for an oil discovery, let it go. “For us it’s a much more interesting commercial opportunity today,” he said.

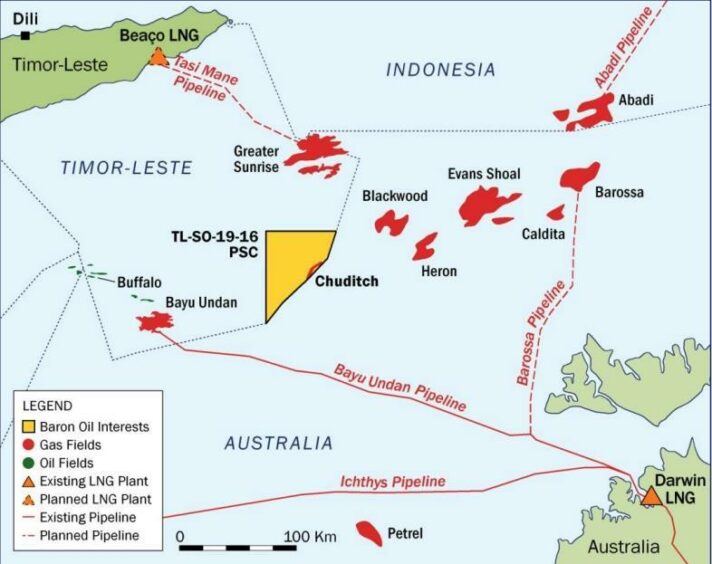

“It’s a good discovery and it’s the same plover reservoir system you see in everything from Bayu Undan to Abadi, going through Barossa and Sunrise. The reservoirs encountered by the Chuditch well are very good. We are confident of very good flow rates,” added Butler.

The explorer is interested to bring new investors into the project either via farm-ins or through a direct corporate investment.

If the results of the 3D seismic merit it, Sunda will be drilling an appraisal well in 2023 and the company would like to drill more exploration wells following that. Each well is expected to cost around $20 million.

East Timor’s national oil company, which holds a 25% stake in the TL-SO-19-16 PSC, is free carried, which is the norm in the country, also known as Timor Leste.

Any significant upstream discovery would provide a welcome windfall for East Timor, which has been heavily reliant on revenues from oil and gas. However, production from its sole producing field Bayu Undan is waning and operator Santos expects to shut down the field within a couple of years.

Development Options

If the potential appraisal and exploration campaigns are successful there are several development options under consideration for Chuditch and the cluster of features around it.

The Timorese aspire to develop the Greater Sunrise field, to the north of Chuditch, via a greenfield LNG export facility onshore East Timor. However, there are some complexities around that, in terms of getting the gas to the island of Timor due to the deepwater between the fields and the coastline. There are also challenges developing greenfield LNG projects in a remote location. But this represents one pathway for Chuditch.

To the south of Chuditch, there is the Darwin LNG (DLNG) terminal in northern Australia and Santos’ Barossa field that is currently being developed to backfill DLNG. “We can see various ways to fit into that picture. It has third-party challenges, but it’s a more definable timeline and a definable set of challenges. Although the complexity is cross border arrangements,” said Butler.

Sunda is also looking at standalone developments. “In some ways, these are probably the most likely to work out. We’re looking at LNG facilities at Chuditch itself, probably through a floating LNG (FLNG) facility,” he added.

“We are looking at possibilities of fixed platform-based LNG facilities given we are in shallow waters. This is innovative but simple given the underlying technologies. Although it is not really being done globally yet,” said Butler.

“FLNG is probably the simplest solution. It takes away third-party issues, as well as the need for long pipelines. It also takes away waiting to see what happens with Sunrise or elsewhere,” he continued.

Sunda is considering FLNG facilities of similar scale to those pioneered by Petronas in Malaysia. “A unit capable of processing around 1.5 million tonnes per year of LNG is likely achievable with the field we have. If anything, we are a bit larger than the fields Petronas are working with offshore Sabah and Sarawak,” said Butler.

Petronas was the world’s first oil and gas company to successfully deploy two FLNGs, which are designed to tap stranded gas fields economically instead of building expensive land-based facilities. Petronas is currently planning to build a third FLNG unit.