Sinopec will spend record amounts this year to increase oil and gas drilling as China aims to bolster its energy security and insulate itself from volatile global commodity markets. Significantly, the news comes as the Chinese giant pauses new investment in Russia projects over sanctions risk.

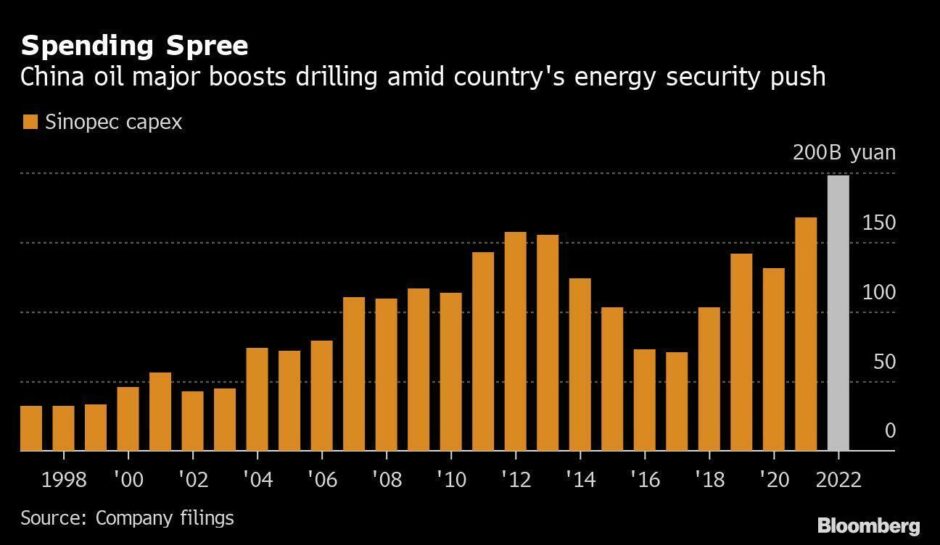

China Petroleum & Chemical Corp., as it’s officially known, will increase capital expenditure 18% to 198 billion yuan ($31 billion), including a 22% boost in drilling, it said in its annual report Sunday.

“The company will redouble its efforts in exploration, especially in shale oil and shale gas,” Sinopec said in the report.

The announced increase comes just weeks after China’s leaders made it clear the nation’s top energy priority this year is securing fuel supplies. The world’s biggest energy importer is trying to prevent soaring costs of oil, gas and coal from derailing efforts to keep its economy on a stable footing.

China’s state-run Sinopec Group has suspended talks for a major petrochemical investment and a gas marketing venture in Russia, sources told Reuters, heeding a government call for caution as sanctions mount over the invasion of Ukraine.

The move by Asia’s biggest oil refiner to hit the brakes on a potentially half-billion-dollar investment in a gas chemical plant and a venture to market Russian gas in China highlights the risks, even to Russia’s most important diplomatic partner, of unexpectedly heavy Western-led sanctions.

Beijing has repeatedly voiced opposition to the sanctions, insisting it will maintain normal economic and trade exchanges with Russia, and has refused to condemn Moscow’s actions in Ukraine or call them an invasion.

But behind the scenes, the government is wary of Chinese companies running afoul of sanctions — it is pressing companies to tread carefully with investments in Russia, its second-largest oil supplier and third-largest gas provider, added Reuters.

Sinopec is the first of China’s three state-owned oil majors to announce earnings, and the spending boost could augur similar actions from competitors. Cnooc Ltd. reports Wednesday, while PetroChina Co. files on Thursday.

Cnooc said in January it planned a modest increase in spending this year, but that was before Russia’s invasion of Ukraine sent energy prices to stratospheric heights.

Sinopec is best known for its oil refining business, but has had success in recent years drilling for natural gas in China’s hard-to-crack shale fields. The company aims to increase gas output by 4.8% this year after a 12% jump last year.

Annual net income for 2021 rose to 72 billion yuan from 33.4 billion yuan a year earlier, as Sinopec’s core refining business experienced a strong recovery on a rebound for travel and freight. That compares with an estimate of 70 billion yuan from analysts surveyed by Bloomberg.

China’s economy has been challenged so far this year, and oil processing has declined on concerns over lower demand as the country grapples with a resurgence in Covid-19 cases.

Recommended for you

© Supplied by Bloomberg

© Supplied by Bloomberg