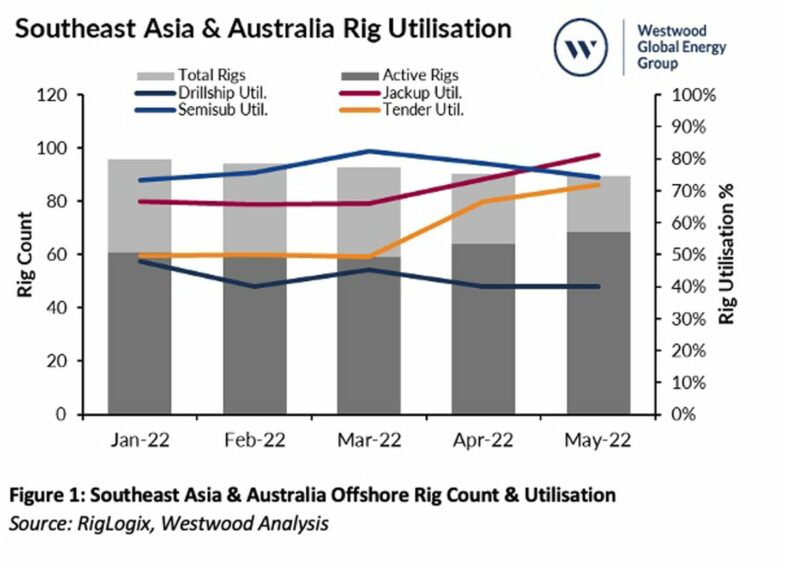

Global and regional upstream activities, including in Southeast Asia, are rising, as more exploration and development projects are evaluated and approved. Yet, the drilling rig market in the region is not as exciting as it should be, especially with global oil prices ranging between $100 and $120 per barrel in recent months.

However, utilisation rates in Southeast Asia are improving, as jack-up drilling rigs are being pulled to the Middle East following a large tender by Saudi Aramco. Singapore’s Keppel Offshore & Marine has recently signed charter deals covering the supply of four jack-up rigs to the Middle East.

“With more attractive terms on offer in the Middle East and immediate commitments, it is not difficult to see why jack-ups are not hanging around Southeast Asia,” Paul Ezekiel, a senior rig analyst at Westwood Energy told Energy Voice.

Indonesia, the only country that has outstanding needs, is seeking three to four jack-up rigs, that will most likely be satisfied by units already in the country, said Ezekiel.

“The recent award announced by Borr Drilling for the 400ft Saga jack-up, has raised some eyebrows because it is a four-year deal in Southeast Asia with a day rate reportedly just below $105,000. Other recent short-term awards in Vietnam are still within the $70,000 and $80,000 mark. Even national drilling contractors like Malaysia’s Velesto and Vietnam’s PV Drilling are looking for work outside their own country. In a booming market, they should be satisfying their own markets first,” he added.

Still, Lin Lin Goh, a Kuala Lumpur-based analyst at consultancy Rystad Energy told Energy Voice that “in Malaysia, jack-up rig demand remains at encouraging levels, with expected utilisation hovering above 60%, supported by PTT Exploration & Production’s (PTTEP’s) (BKK:PTTEP) exploration campaign.”

Following PTTEP’s exploration success at its Lang Lebah gasfield last year, the Thai-state backed upstream player is planning more than 10 exploration wells offshore the Malaysian state of Sarawak this year.

Malaysia’s Velesto remains a significant player in its domestic market after signing a call-out umbrella contract with Petronas Carigali for all its NAGA rigs, which is expected to boost the group’s utilisation over the next two years. It marked a strategic move on Petronas’ part and in a way solved their rig needs, said Westwood’s Ezekiel.

Velesto recently reported that three of its available jack-up drilling rigs are working while another three are undergoing works and being prepared to meet the needs of potential clients for contracts being tendered.

Elsewhere, the tender-assist market has picked up with five units heading to work for PTTEP in Thailand from July onwards, noted Ezekiel. They are a mixture of long-term contracts lasting three years and short-term five-month contracts. PTTEP is desperately trying to reverse domestic gas production declines at Erawan, which it recently took over from Chevron. A drilling frenzy will be needed it PTTEP is to arrest falling output in the Gulf of Thailand.

In terms of hotspots for drilling activity, Malaysia and Thailand top the list. But there is speculation that Murphy Oil has a long-term campaign planned next year in Vietnam, said Ezekiel.

“Borr Drilling has made its mark in the region and is presently the most visible contractor with two jack-ups in Thailand for PTTEP and three units in Malaysia, with a fourth preparing to mobilise to the Joint-Development Area (Malaysia & Thailand) in June,” he added.

Deep-water Drilling Flat

The market for deep-water drilling remains relatively flat. “There are only three active drill ships and three semi-submersibles in Southeast Asia. All the semi-submersibles are contracted. Two of the drill ships are contracted, and the third is expected to secure work in India by the end of the year,” said Ezekiel.

“The semi-submersible Hakuryu-5 is in Japan and will return in August for a contract offshore Malaysia. While Indonesia has just started a deep-water drilling campaign in the Andaman Sea with the drillship Capella. There are also two planned deep-water campaigns in Malaysia for 2022-2023; PTTEP offshore Sabah and Sarawak of which the bid evaluation is on-going, as is the Petronas Carigali Limbayong tender for a drillship. Both operators need the drillship to be fitted with Managed Pressure Drilling (MPD). Day rates in this region are still lagging other regions,” he added.

Rystad’s Goh noted that the floater sector in Southeast Asia lacks the robustness of the jack-up market. In Malaysia, both Shell and PTTEP make up for half of the floater demand, with Shell’s Gumusut Kakap Phase 3 drilling four wells currently. Meanwhile, Petronas has lined up four exploration wells offshore Sarawak with the Hakuryu-5 rig from Japan Drilling. The contract covers the initial four wells plus option for six more wells, she added.

“Mubadala is also currently drilling two wildcats, Lada Putih and Cengkih, with the Deepwater Nautilus on Block SK320. It is unclear if the Limbayong development, Petronas’s first deep-water project will be able to proceed with drilling 10 wells early next year, having encountered a few snags in its FPSO tendering process,” said Goh.

Over in Indonesia, floater activity remained muted in 2021, but after a slow start this year, activity has started to increase. “The demand is driven by Repsol and Harbour Energy’s deep-water campaign in the Andaman PSC. In mid-May this year, Harbour Energy spudded its Timpan-1 exploration well using the Capella ultra-deep-water drillship. The second well of the two-well campaign has been sublet to Repsol. In addition, MedcoEnergi is finishing up their drilling program in June this year and both ENI and Pertamina have contracted rigs for drilling in 2022,” added Goh.

Still, it is too early to get excited in Southeast Asia. Although the rise in activity rates looks impressive year-on-year, it’s important to note that activity was almost dead in some corners of the region one year ago, Readul Islam, an Asia upstream specialist at Rystad told Energy Voice.

Simon Molyneux, managing director at Perth-based upstream consultancy Molyneux Advisors, said that the market would appear to be re-bounding from a very low base.

“Indonesia, and to some extent Malaysia, have been re-invigorating their upstream terms. This in turn is leading to more drilling activity. However, without any new material finds or large final investment decisions (FIDs) activity will not return to the levels seen in previous eras,” he told Energy Voice.