Merger and acquisition (M&A) activity in Southeast Asia could rebound strongly in 2023 after a relatively muted 2022.

Significantly, around 3 billion barrels oil equivalent (boe) of resources worth a total $5 billion are on the market, estimates from consultancy Rystad Energy showed.

“A raft of assets across different life cycles are on offer and talks are ongoing over transactions potentially worth around $2 billion combined,” Prateek Pandey, vice president analysis at Rystad Energy, told Energy Voice.

“Although there are a number of farm-in opportunities available, involving different sizes of resource, the progress on most large-size opportunities was extremely slow in 2022, potentially due to price volatility, inflation impacts and other risks associated with these portfolios,” he added.

Andrew Harwood, Asia Pacific research director at Wood Mackenzie, noted that activity in Asia Pacific (APAC) started to pick up in the second half of 2022, driven by two major themes – Australasian LNG deals and small independent players acquiring mature assets in Southeast Asia.

The trend, which looks set to continue, after lacklustre M&A activity in 2022, will be driven by the majors continued repositioning of their portfolios for the energy transition, Harwood told Energy Voice.

APAC oil and gas deal activity was down in 2022, both in terms of the number of deals – 12 in 2022 versus 22 in 2021 – and announced deal spend – $4.9 billion versus $15.9 billion in 2021 – data from Wood Mackenzie showed.

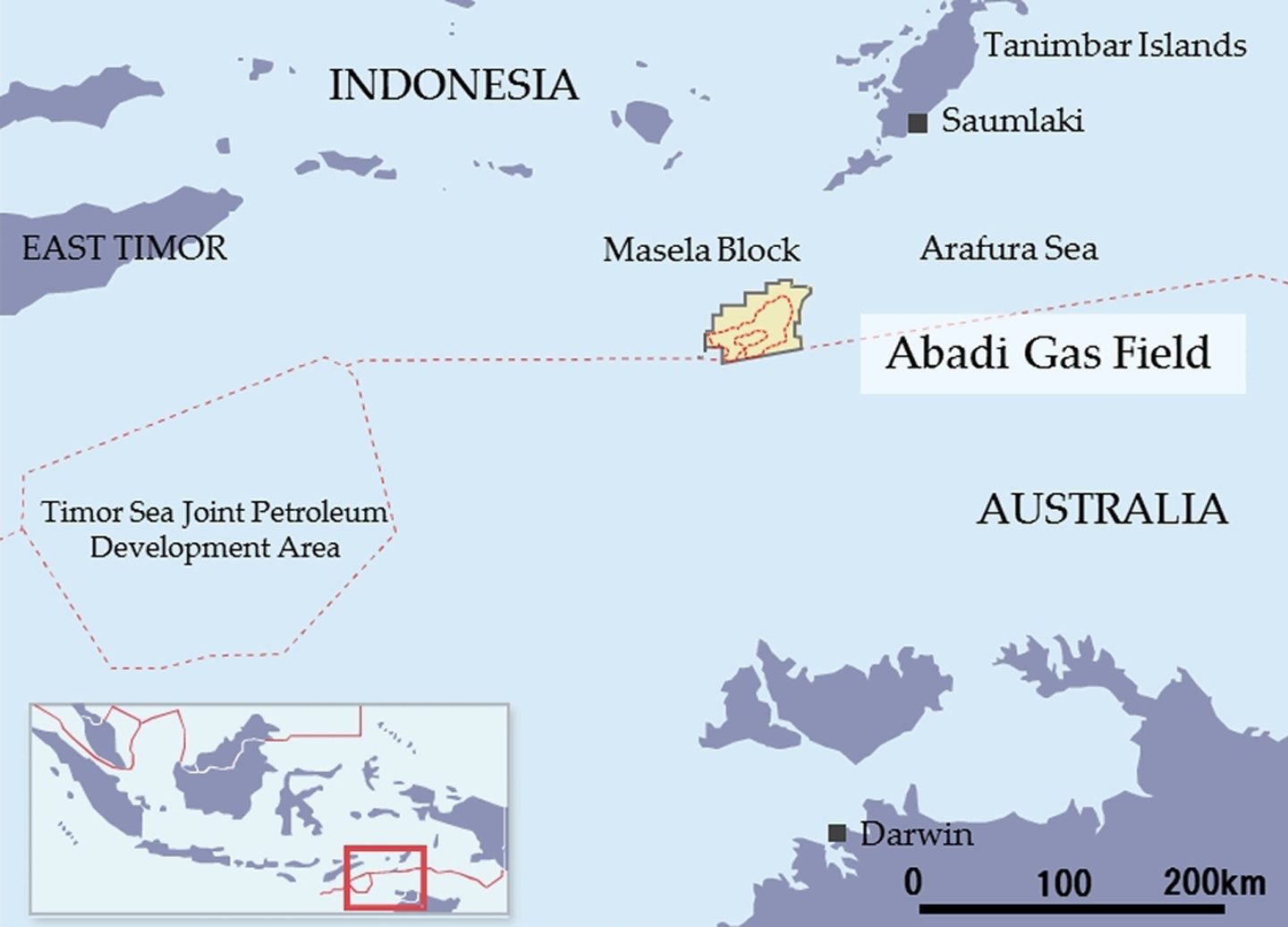

This year “larger players divesting mature and non-core assets will generate additional opportunities for smaller players. We expect Shell to finalise the divestment of its interest in the Inpex-led Abadi project in Indonesia over the next couple of months,” said Harwood.

Indeed, Pertamina looks set to acquire Shell’s 35% share in Abadi, also known as Masela, for at least $1 billion. If the deal completes, it will likely be the leading transaction in terms of value in 2023.

There is also potential for the likes of Chevron, ExxonMobil, TotalEnergies and Shell to trim their portfolios across Thailand, Malaysia, and Brunei.

“Likely buyers include smaller Southeast Asia focused independents, such as Medco Energi, Jadestone Energy, Valeura Energy, PETROS, as well as Hibiscus. We could also see North Sea and European players look to Southeast Asia as a means of diversifying exposure to windfall taxes and anti-industry sentiment at home,” added Harwood.

Rystad’s Pandey agreed that independents will be crucial buyers, as well as some companies from China and Japan seeking to expand their portfolios, particularly in the gas and low-carbon sectors.

In Indonesia, rumours continue swirling that at least two international oil companies (IOCs) are potentially looking to divest their portfolios. “Whilst their final choice to exit or not may be a statement on how they view Indonesia, the greater statement will be the level of interest shown by potential acquirers,” said Marc Howson, head of Asia at research firm Welligence Energy.

Successful divestment of Chevron’s 62% operated interest in the Rapak and Ganal PSCs that contain the long-awaited Indonesia Deepwater Development (IDD) project may also be on the cards. “Eni had been reported to be the likely buyer, but was requesting flexibility on PSC terms,” added Howson.

Rystad’s Pandey noted a number of other packages are up for grabs in Indonesia, including a stake in the Conrad Petroleum-operated Mako development and at the Kuwait Petroleum-operated Anambas development. An opportunity may also arise at Repsol’s Kali Berau Dalam (KBD) gas development.

In Malaysia, M&A opportunities primarily contain mature producing assets from IOC’s portfolios, where the sellers are motivated by declining production trends and emissions intensity. “Several international companies – such as ExxonMobil, Petrofac, Hess and a few others – have been rumoured to be considering bringing their Malaysian assets to the market. TotalEnergies portfolio in Brunei is another similar opportunity, primarily with late-life producing assets,” added Pandey.

Welligence’s Howson noted that while Malaysia is core to Shell, the major is also expected to continue divesting its non-operated assets in the country.

“In Thailand, ExxonMobil and Chevron, may continue with divestments in the country, which is non-core, as they focus on high-grading their portfolios internationally,” added Howson.

Meanwhile, in Australia, Wood Mackenzie’s Harwood reckons potential investors will be deterred by recent policy changes, that have seen the government intervene in the country’s energy markets.

Elsewhere, renewables M&A activity is likely to be a rising theme in 2023, particularly as the regional NOCs look to build out their low carbon portfolios. “Further announcements on CCS/CCUS regulations and incentives could also bring new business development activity, but progress to date has been limited,” said Harwood.

© Supplied by Inpex

© Supplied by Inpex