The Santos-led Barossa LNG export project is on track for a final investment decision (FID) within six months after drastically cutting costs and securing a major Japanese buyer for some of Australia’s dirtiest LNG.

This appears to give Santos an edge over rival projects in Australia and Papua New Guinea, that will cost more to develop, at a time when the market is expected to become more competitive.

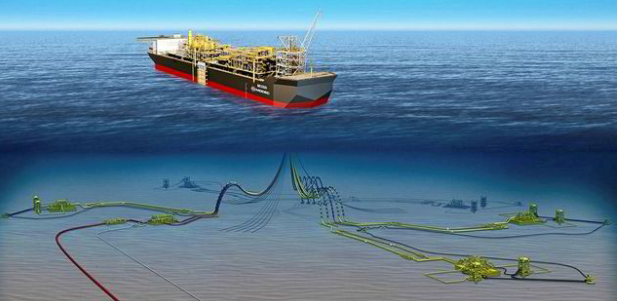

Barossa, which will backfill the Darwin LNG plant in Northern Australia, made headlines at the Santos investor day on 1 December with news of a massive cut in the estimated capital cost from US$4.7 billion to US$3.6 billion, due to innovative financing for the FPSO. Under a hybrid financing agreement, the Barossa joint venture will lease the FPSO following an upfront prepayment of around half the capital cost and hold an option to buy-out.

A chart shown at the investor day suggested, without naming competing projects, that Barossa-to-Darwin LNG would be slightly lower cost than PNG LNG and significantly below Woodside Petroleum’s brownfield projects in Western Australia, Australian research and consultancy firm EnergyQuest said in its latest report.

LNG developers in Australasia are racing against each other, as well as more competitive low-cost suppliers in Russia, Qatar and the U.S., to fill a projected market supply gap post 2025. Still, Barossa looks well positioned, as Santos has taken steps to boost the capital efficiency with a breakeven price of US$5/million British thermal units delivered to Asia.

FID on Barossa is targeted for the first half of 2021, with first gas expected in the first half 2025. However, Santos managing director, Kevin Gallagher, said on 1 December that an unspecified level of offtake would need to be contracted before FID. Although he was confident of the necessary deals.

This confidence was underscored when Santos announced on 7 December a 10-year deal to supply 1.5 million tonnes per year (mtpy) of LNG to Diamond Gas International, a unit of Japan’s Mitsubishi Corporation. The agreement marks a significant step towards reaching FID for the Barossa project.

The sales deal represents over 80% of Santos’ equity LNG volume from the Barossa project at the company’s expected 50% interest level. Once FID is taken, Santos will sell down 12.5% of its 62.5% stake in Barossa to Japan’s JERA. South Korea’s SK E&S holds the remaining 37.5% interest. The Darwin LNG plant, which currently processes 3.7 mtpy of LNG, is supplied by the aging Bayu-Undan field. Bayu Undan is expected to be exhausted by 2024.

Australia’s dirtiest LNG

Significantly, Barossa’s reservoir, with 16% to 20% carbon dioxide, makes it one of Australia’s dirtiest LNG developments, and would concern any investor focused on climate risks. Japan, the world’s top LNG buyer, is increasingly pushing a carbon neutral energy agenda. This likely explains why Santos and Diamond Gas, also signed an agreement to jointly consider opportunities for carbon neutral LNG from Barossa.

Carbon neutral means the producer has offset the amount of carbon dioxide equivalent associated with the whole carbon footprint of the LNG cargo, including the production, liquefaction, shipping and regasification. Carbon neutral LNG is a novel idea that is increasingly gaining traction. So far, seven carbon-neutral cargoes have been delivered or agreed, all to buyers in Asia, with more understood to be under discussion, reported energy research company Wood Mackenzie.

LNG is among the most emission-intensive resource themes across the oil and gas sector, added Wood Mackenzie. Significant emissions are released through the combustion of gas to drive the liquefaction process and any carbon dioxide removed prior to entering the plant is often vented into the atmosphere. This is leading buyers in Asia to place the carbon footprint of LNG under greater scrutiny, with more calls for carbon emissions to be detailed in tenders.

While LNG is generally considered a cleaner fuel than coal or oil, there is no standardised definition of a carbon-neutral cargo yet.

Lucy Cullen, principal analyst Asia Pacific gas and LNG at Wood Mackenzie, is “in no doubt that demand for cleaner LNG will only grow, with the carbon footprint of LNG cargoes set to become an important differentiator for buyers and sells alike”.

“It’s interesting that while carbon-neutral LNG is sold at a premium, all cargoes so far have been bought by companies in Asia, a region where carbon policies and investor pressure are relatively weak. I think there are several reasons for this,” said Cullen.

“Demand for LNG in Asia continues to boom, and the region is set to be the engine room for global LNG demand growth. And as concerns with air quality rises in many Asian countries, attention is turning to emissions and cleaner burning fuels,” she explained.

“There’s no doubt that positive headlines are motivating deals. For a modest premium, companies have been rewarded with widespread coverage of their green credentials. An easy win. But beyond this, deals have also allowed buyers early experience with carbon-neutral transactions and marketing, valuable experience for what lies ahead,” added Cullen.

“But economics also play a part. Innovative ways of reducing costs and an affordable market for forestation projects right now have helped create competitively priced volumes in the current market. But looking forward, any significant cost premium could see a divergence in buyer attitudes – those that are carbon conscious and those whose primary concern is price,” she concluded.

Recommended for you