At one of Perth’s most affluent beach-side suburbs, police were already in wait on an early morning in August as climate campaigners arrived near the home of Woodside Energy Group’s Chief Executive Officer Meg O’Neill.

Thousands of people at the company’s swank 32-story headquarters in the city’s business district were evacuated by a prank gas leak in June, and this month Greenpeace activists unfurled a giant banner declaring “Stop Woodside” from a 140-meter-high crane at an adjacent site.

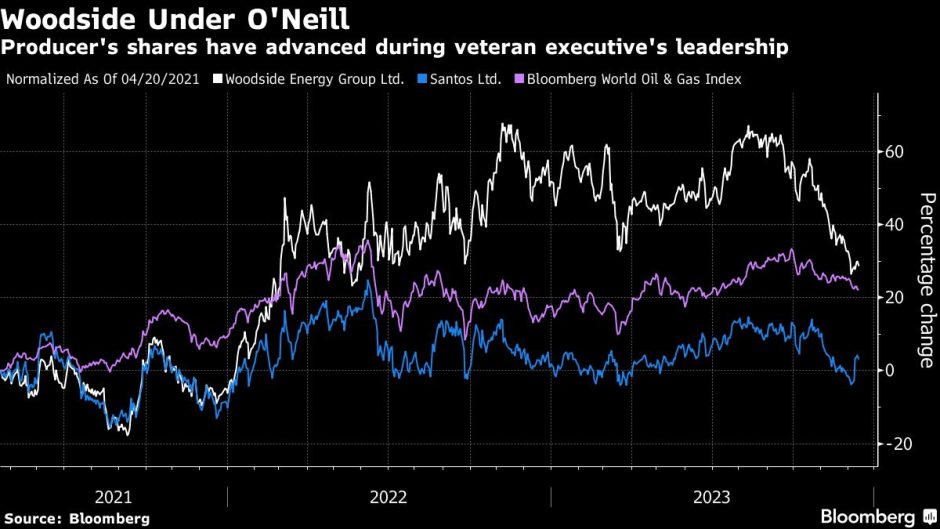

O’Neill’s push for growth since taking control of Australia’s biggest oil and gas producer in 2021 helped boost output by almost three-quarters last year, and has supported about a 30% gain in the company’s shares during her tenure. It’s also drawing fierce opposition from critics of fossil fuels.

After completing the $18.6 billion acquisition of BHP Group’s petroleum unit, the 53-year-old engineer is now in tentative talks to extend the energy sector’s US deals spree into Asia-Pacific — opening discussions with local rival Santos on a tie-up that would deliver a dominant exporter of liquefied natural gas.

Consumption of some fossil fuels will remain resilient for decades as populations and economies grow, and be driven by energy demand on Woodside’s doorstep in Asia, according to O’Neill.

“We know that the world will continue to need oil and gas,” she said in a September interview in Singapore. “We think LNG is going to play an increasingly important role.”

Woodside (ASX:WDS) met last week for initial talks with Santos over a proposal that would see O’Neill lead a combined company, according to people familiar with the discussions, who requested anonymity to discuss private details.

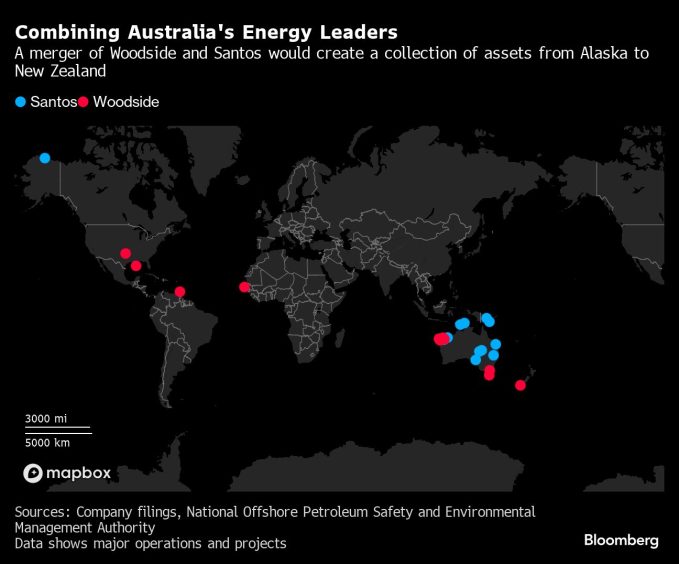

With operations and projects from Alaska to Papua New Guinea, a merged entity would rank among the world’s top 10 oil and gas producers by output, UBS Group AG said in a Dec. 8 note.

After a period of caution on project spending under predecessor Peter Coleman, O’Neill’s leadership has seen Woodside move aggressively. Months after her confirmation as permanent CEO in August 2021, Woodside sanctioned a $12 billion investment in the Scarborough and Pluto Train 2 developments in Australia to add more LNG from 2026.

In June, the producer authorized the Trion oil venture off the coast of Mexico and is currently advancing developments worth a total of about $24 billion. A roster of prospective future options would be strengthened significantly by the addition of Santos, according to analysts.

“Additional investment in gas and oil is required” across the industry as projects currently in operation or development globally won’t be sufficient to meet demand, O’Neill told investors last month.

That view puts the former Exxon Mobil executive — who worked in locations including the US, Indonesia and Norway for the oil giant — at odds with the International Energy Agency, which forecasts net-zero emissions policies could curb fossil fuel demand by 80% by mid-century.

“No new long-lead-time upstream oil and gas projects are needed,” the IEA said in September.

Boulder, Colorado-raised O’Neill’s outlook prompted an attack this month from Australian billionaire Andrew Forrest, the Fortescue Ltd. founder who advocates a faster global shift away from fossil fuels.

“Meg is hard-edge trained by the biggest liar we’ve ever seen around climate change over the last 40 years, and that’s Exxon Mobil,” Perth-based Forrest told 6PR radio. “Meg is driving an agenda to get carbon bombs going as quickly as possible.”

Woodside criticized Forrest’s remarks as “personal vitriol” and has warned over a tone of debate that could “turn community sentiment against the urgent actions required to achieve the energy transition.” Exxon has long disputed claims that it publicized uncertainties associated with climate science to protect its fossil fuel business.

Other major gas producers like Shell support O’Neill’s view on demand and have also positioned for growth. LNG consumption will double across China, South Asia and Southeast Asia by 2030, according to researcher Wood Mackenzie.

O’Neill left the US for Perth in 2018 to become Woodside’s chief operating officer, quickly emerging as the leading internal candidate to replace Coleman. She’s talked of embracing the outdoors-and-sports focused culture of Australia’s energy capital, where she lives with her wife and daughter.

She’s also sought to use her executive position to advocate for LGBTQ people in the sector. “It is important for me as a senior gay woman in the industry to be visible,” O’Neill told The West Australian newspaper in June.

After arriving at Woodside, O’Neill pursued a hands-on approach to LNG contracts and has occasionally weighed in on trading strategies, according to company insiders familiar with her approach.

As CEO, she’s encouraged the company’s traders to sign more gas purchase pacts and lift exposure to short-term transactions, said the people, who requested anonymity to discuss the details.

That multi-year push to expand trading desks helped position Woodside to capitalize on the energy price boom triggered by Russia’s invasion of Ukraine. Underlying earnings in 2022 more than tripled to a record $5.2 billion.

As an executive responsible for marketing, O’Neill “took an active interest in LNG markets and contracts along with LNG trading and risk management strategies,” Woodside said in a statement.

New deals to buy more LNG from third parties in North America have helped expand supply sources outside of Australia, while the producer has also locked in customers in Europe to complement more usual trade flows to Japan, South Korea and China.

“She does have an implacable ability to deliver on a strategy,” according to Alex Hillman, who worked in strategy, climate and engineering roles at Woodside for more than eight years until 2021. “She’s extremely measured and extremely methodical.”

However, in a period of rapid change, an ability to “bed down a strategy and unblinkingly deliver that over multiple years might not be the set of skills that you really need,” said Hillman, now lead analyst at the Australasian Centre for Corporate Responsibility, which has urged Woodside to abandon expansion plans.

Landing a deal with Santos to merge companies with a combined market capitalization of around A$81 billion ($54 billion) would see O’Neill complete a consolidation of Australia’s energy sector that has eluded other major executives for years.

To do so, O’Neill is likely to have to pay up — potentially offering more than A$8 a share for Santos, according to Matthew Haupt, a portfolio manager at Wilson Asset Management, which holds both companies. That would represent at least a 15% premium on the company’s close on Dec. 7, before talks were confirmed.

“Santos is worth much more than the current share price,” Haupt said.

© Bloomberg

© Bloomberg © Sources: Company filings, Nation

© Sources: Company filings, Nation