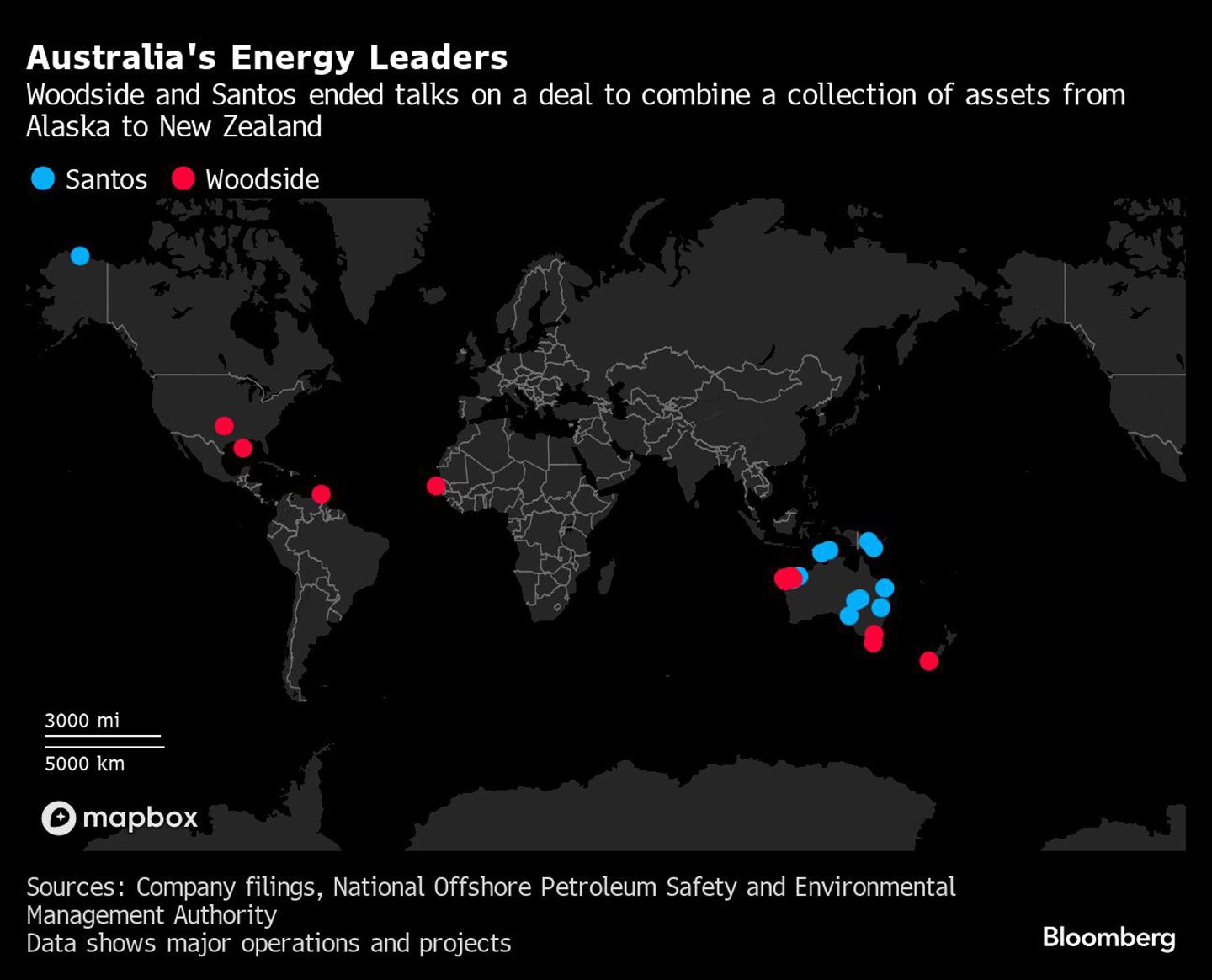

Woodside Energy Group Ltd. (ASX:WDS) and smaller rival Santos Ltd. (ASX:STO) ended talks over a potential merger that would have created an Australian gas export powerhouse after the companies failed to agree on a valuation.

Adding Santos’s portfolio would have positioned Woodside as one of the biggest liquefied natural gas producers in the Asia-Pacific — a region poised for further demand growth. However, executives had warned any pact would need to reflect the low premiums in other recent major oil and gas sector deals.

Santos said in a statement Wednesday that “sufficient combination benefits were not identified to support a merger,” while Woodside said it would only pursue transactions that are “value accretive for its shareholders.”

The companies, with a combined market valuation of about A$86 billion ($57 billion) on Wednesday, disclosed talks over a prospective deal in December. Santos previously flagged it was working with advisers on options to boost its value, after its shares plunged in the second half of last year.

Shares in Adelaide-based Santos tumbled as much as 8.6% in Sydney following news that merger talks had ended. Woodside, Australia’s largest oil and gas producer, advanced as much as 2.5%.

“While the discussions with Santos did not result in a transaction, Woodside considers that the global LNG sector provides significant potential for value creation,” Chief Executive Officer Meg O’Neill said in a statement Wednesday. She added that the company would “continue to be disciplined in our approach to mergers and acquisitions.”

Gas is expected to play a long-term role in the energy transition, and since many countries in Asia don’t have sufficient domestic resources or pipelines, exported LNG will be needed to meet those growing needs.

Woodside, which has lifted production over the past two years, has operations in Australia — including the Scarborough LNG development — along with assets in the US and Trinidad.

Santos, which last month raised its forecasts on costs for its flagship Barossa gas project, will “continue to review options to unlock value for shareholders,” the company added Wednesday.

The producer is likely to continue to study potential asset sales or breakup options, according to Saul Kavonic, an energy analyst at MST Marquee.

© Supplied by Bloomberg

© Supplied by Bloomberg