Mosman Oil and Gas has confirmed it has cancelled its involvement in an Australian oil and gas project after failing to secure a land access permit to proceed.

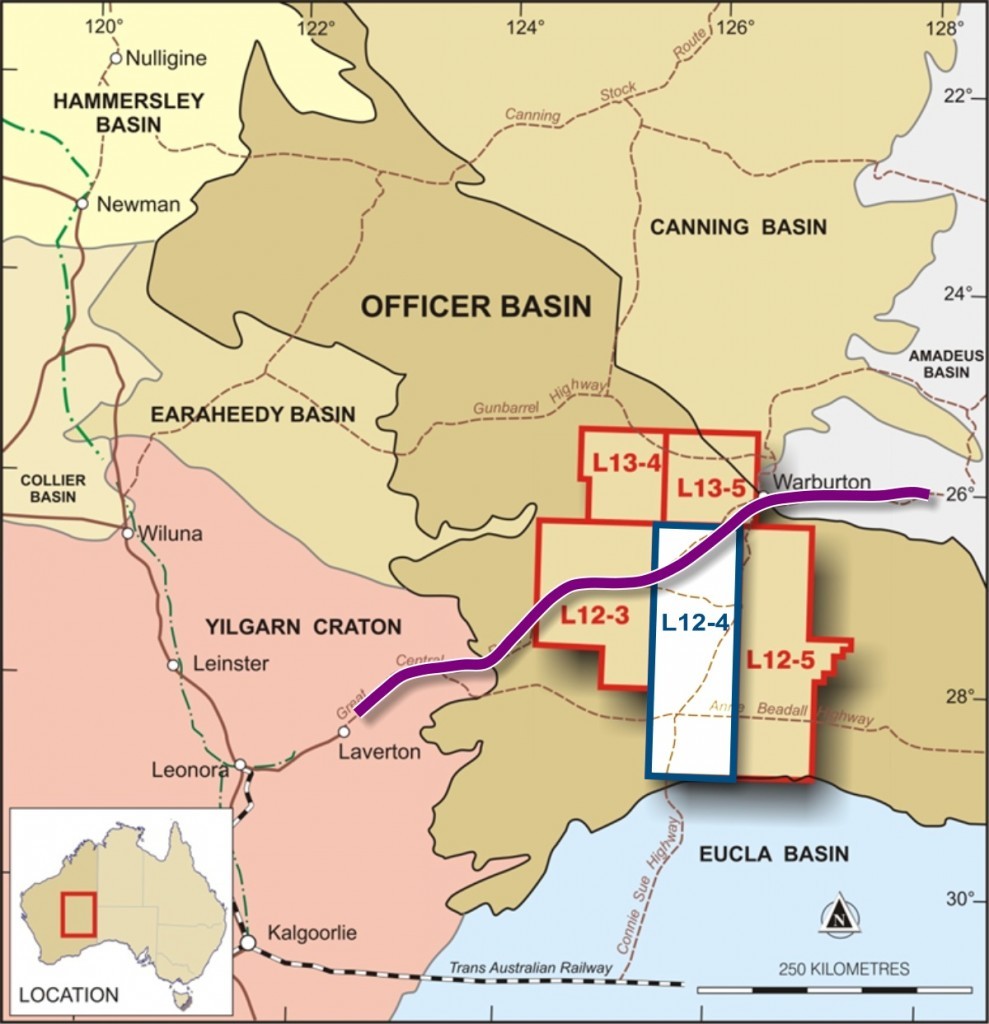

Mosman held a 25% in the Officer Basin onshore application, which is an early stage exploration project.

The permit may only be awarded after the Native Title Act requirements are met which deal with heritage clearance, land access and other traditional land owner issues.

“Unfortunately this has not been achieved and Mosman will now withdraw from the application and seek to cancel its involvement in the project,” the company said in a statement to shareholders.

Mosman acquired the interest in the application by acquiring the shares of Petroleum Portfolio Pty Ltd, which had rights to 25% of the application from Andy Carroll (Technical Director of Mosman) for the issue of 9 million ordinary shares in the company.

Under the terms of that agreement, if the application was not granted by 15 January 2016 then Carroll has 90 days to advise Mosman whether he will acquire the share for Aus$900,000 or relinquish them for a nominal Aus$1.

Mosman said the second alternative appeared to be the most likely outcome, and in that case a shareholder meeting would be called in approximately 90 days time to approve the buy back.

“That meeting must be held by within 120 days after the advice from Mr Carroll is received,” the company said.

If this is the eventual outcome the issued number of shares will reduce from 215,591,008 to 206,591,008 by the cancellation of nine million shares held by Mr Carroll, with Mosman’s shares in PPL reverting to Mr Carroll on the cancellation of the Consideration Shares

Executive chairman John Barr, said: “It is very disappointing that the joint venture parties have not been able to secure the title after over two years of negotiations but, given market conditions, Mosman’s primary focus remains making progress on its core assets in its portfolio and in other advanced project opportunities.”