The majority of UK North Sea assets are being dismantled in Britain, new figures have revealed amid concerns of overseas yards winning decommissioning work.

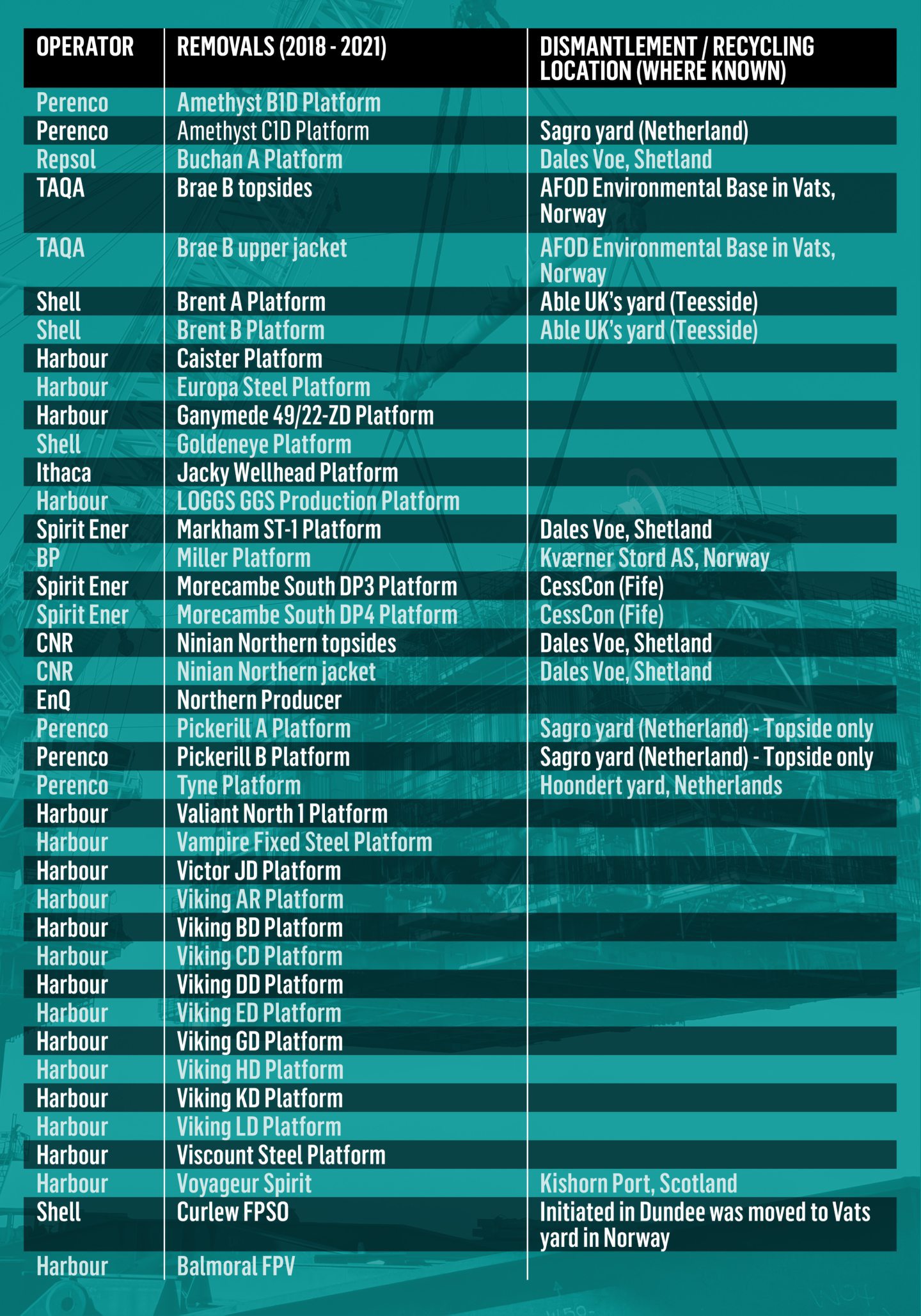

Information obtained by Energy Voice shows that British yards have won dismantling for 26 of the 39 oil and gas assets removed from the UK North Sea between 2018-2021.

That includes a series of heavy, high value assets like the Brent and Ninian platforms, alongside smaller prizes like the dozen V-field assets from Harbour Energy’s Southern North Sea portfolio.

The 26 do not include the Shell Curlew FPSO, which ultimately went to Norway for dismantling, or the Voyageur Spirit vessel, currently laid up at Kishorn but not being recycled at this stage.

It comes amid a series of high-profile wins for overseas yards in recent months, such as the Foinaven FPSO heading to Denmark for dismantling, despite bids from a yard in Scotland just 20 miles away from where it is currently laid up, and the Brae Bravo going to Norway.

FOI gaps

A freedom of information request to the North Sea Transition Authority (NSTA) showed that records had not been kept for 22 of the 39 assets which were removed from 2018-2021, raising concerns about local content targets.

However, a response from Harbour Energy has stated that 17 of these “unknowns” – assets from the Southern North Sea – have all been dismantled at Veolia and Able facilities at Great Yarmouth and Teesside, respectively.

Harbour said: “The NTSA is aware of the dismantling and recycling arrangements for all these installation.”

Industry commentator Will Rowley, CEO of Offshore Solutions Group and former head of industry body Decom North Sea, said: “The poor record keeping is still an issue as every operator has to submit a detailed plan to the NSTA to gain approval.

“This reflects the continued low priority of decom within the wider NSTA’s thinking.”

On the figures and its decommissioning commitment, the NSTA pointed to actions to support the supply chain to win work.

A spokesperson said: “The NSTA has taken action to answer the UK supply chain’s calls for a clearer picture of upcoming UKCS project activity, including decommissioning, both through our Pathfinder website and Decommissioning Data Visibility Dashboard. Improving visibility of near-term contracting opportunities gives suppliers more confidence to invest in skills and technologies.

“In line with revised guidance published on 30 August 2022, Supply Chain Action Plans will be used to monitor and track the UK local content commitments outlined in the North Sea Transition Deal relating to energy transition projects and decommissioning activity.”

The regulator also pointed to its advocacy of well decommissioning campaigns to deliver “deliver substantial cost efficiencies, reduce emissions and give suppliers confidence to invest”.

Competition with wind for UK decommissioning

According to the data from the regulator, seven of the 39 assets have gone overseas and the remaining three are not known.

Last week, Atlas Decom issued criticism at Teekay and BP over the Foinaven FPSO being sent to Denmark for decommissioning, rather than its yard nearby to where its laid up at Hunterston.

Several other assets have gone to neighbouring North Sea countries in recent months, rather than UK yards.

Ricky Thomson, decommissioning manager at OEUK, said onshore recycling isn’t the only potential prize.

“While dismantling assets is an important part of the process, decommissioning is a broad operation with many onshore and offshore activities which over the next decade represent £16.6 billion of potential activity for the UK supply chain.

“We’re committed to working with companies, industry, regulators and government to realise the full potential of our homegrown decommissioning capabilities and we continue to identify where we can work together to help deliver meaningful change.”

UK success

Will Rowley said that onshore dismantling and offshore well plugging and abandonment, are both booming areas for the UK sector.

The UK has an “increasingly dominant role” across the North Sea on the latter.

“Whether with rigs (Well-Safe) or rigless (Acteon/Claxton), the UK sector is the technical and innovative powerhouse in well P&A.

“A rough estimate would put the UK position at >60% of the entire North Sea (UK, Norway, Netherlands). As the number of wells increase then this ratio should be maintained.”

Looking at the assets on the list, Mr Rowley highlighted that, by tonnage – and thereby value – the Brent and Ninian platforms are important wins the UK has claimed.

“If you tried to assess the ‘value’ of all of this work it may well end up close to the target of 50% (remember 1x Brent is worth more than a dozen small Vikings)”, he said.

Other issues to consider for UK yards going forward are the competition for space with offshore wind; a potentially more lucrative business.

“Compared to two years ago some yards may choose to undertake offshore wind work in preference to decom, especially if the schedule is longer and/or the chance of follow on sustained activity rather than a single projects,” added Mr Rowley.

© Supplied by DC Thomson

© Supplied by DC Thomson © Supplied by Atlas Decom

© Supplied by Atlas Decom