Aberdeen based Plexus Holdings (AIM: POS) has surged back into the black with £2.2m pre-tax profits in its half-year results.

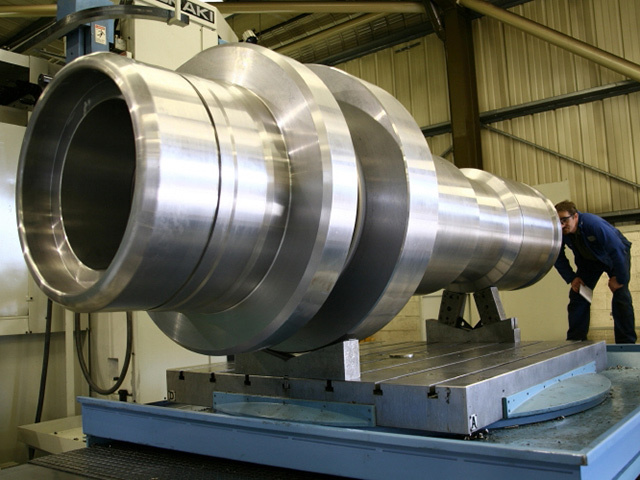

It reverses a £2m loss in the same period in the prior year, to the end of December, for the firm which produces specialist wellhead technology.

Sales revenue has soared more than seven-fold, from £709,000 in the first half of its 2022 financial year to more than £5m for the six months to December 31.

Plexus CEO Ben van Bilderbeek said the firm’s entry into the decommissioning market plugging and abandonment (P&A) space “is proving well judged as an increasing number of aging wells now require decommissioning.”

The firm said P&A is a key sector for the firm, with more than 1,000 North Sea wells to be plugged and abandoned by 2027.

Mr Bilderbeek said: “Demand for Plexus’ P&A related technology, recognised for its role in safe and eco-friendly well closure, is building as highlighted by recent contract wins with several leading North Sea operators.

“Looking ahead, Plexus remains committed to advancing its POS-GRIP friction-grip engineering methodology to align with the energy sector’s increased focus on sustainability and regulatory compliance, especially in relation to reducing methane emissions and anticipates broader adoption of our technology across the value chain.”

The period saw key contract awards, including a new license with SLB for its POS-Grip wellhead technology at a cash consideration of $5.2m.

Other measures included loans to improve cash flow and a divestment of Plexus’ 49% stake in Kincardine Manufacturing Services Limited in December.

Plexus said it continues to pursue opportunities in the rental exploration market for Jack-up rigs and the P&A sectors.

Recommended for you