After being tapped over the past two years by politicians scrambling to plug budget holes, Norway’s massive $1 trillion wealth fund is about to get some relief.

Spending next year will mean a 0.1 percent “fiscal impulse,” down from 0.4 percent this year, the Finance Ministry said in a statement ahead of the full budget release at 10 a.m. in Oslo. Oil cash spending will be 2.9 percent of the wealth fund in 2018, below the 3 percent spending rule and unchanged in percentage terms from this year. Mainland economic growth will accelerate to 2.5 percent next year, with unemployment dipping to 4 percent and employment surging by 1.1 percent, the ministry said.

“The fiscal policy rule allows for phasing in of oil money from one year to the next, but what we have been clear about is that we are giving less gas because things are going better,” Finance Minister Siv Jensen told reporters in Oslo on Thursday. “This is a budget that looks very well adapted to the new reality.”

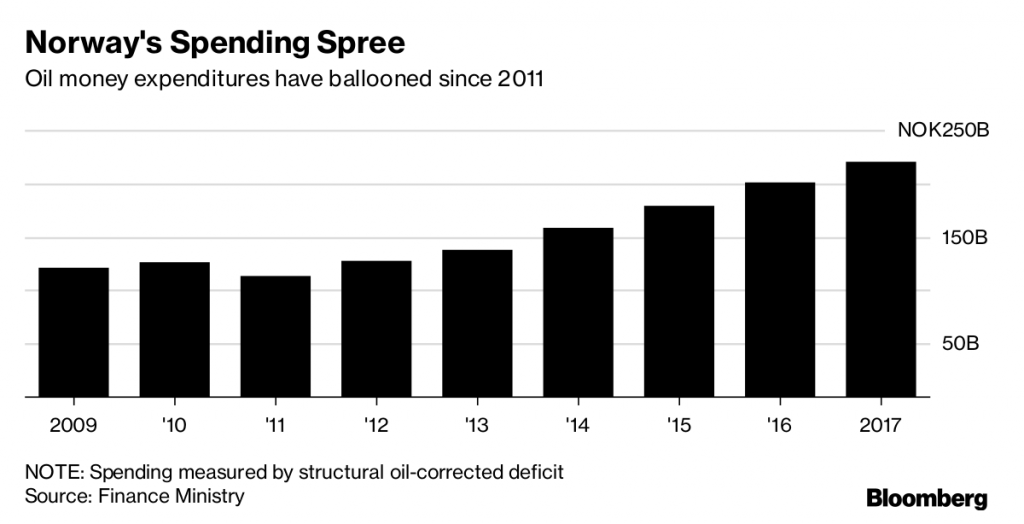

Norway’s newly re-elected Conservative-led government is slowing the growth in oil wealth spending — and cutting the cash it takes out of the fund — as a deep slump in its oil industry has come to an end and stabilizing crude prices lift revenue. Hit hard by a drop in crude prices in 2014 that sent shock waves through the economy and saw more than 50,000 jobs lost in oil-related industries, the government rapidly boosted spending to avoid an outright recession. It had flagged it will use 221 billion kroner ($28 billion) of its oil revenue and wealth this year, up from 159 billion kroner in 2014.

There are now signs that the rapid growth is over. Data showed that the government took out only 2.5 billion kroner from the fund in August, down from more than 10 billion kroner a month at the start of the year. That will be a relief to the fund, which has struggled to keep up returns amid record low interest rates. It will also give it added money as it expands its holdings of stocks to 70 percent from 60 percent.

“The arrows have turned up — unemployment is now falling, growth in the economy is picking up and more are getting into the labor market,” Jensen said.

The government will release new forecasts with the budget, but most estimates suggest that mainland economic growth will top 2 percent this year for the first time since 2014 as a decline in investments comes to halt and exports pick up.

But given Norway’s massive wealth there’s still plenty of cash to spend and it may be hard for the government to turn off the spigot entirely. Oil cash spending is regulated by a rule that sets a limit of about 3 percent of the fund’s size, which means as the fund grows so does the money available to spend.

“They will spend more oil money next year, but they will still remain under the 3 percent spending rule,” said Kyrre Aamdal, senior economist at DNB, Norway’s biggest lender.

Overall spending is more than 7 percent of mainland GDP, a massive dose of stimulus.

But economists also warn that keeping oil spending close to the 3 percent fiscal spending rule is dangerous amid a potential correction in the world’s financial markets and as the Norwegian krone is set to strengthen.

“The fund is a bit inflated, given that the krone is exceptionally weak and as the economy is normalizing in the next few years,” Aamdal said. “One should take into account that the currency will strengthen, and in isolation, will contribute to a lower value of the fund in kroner.”

And that could force the central bank’s hand to tighten earlier than planned if fiscal stimulus is too expansive, according to Danske Bank’s Frank Jullum.

“It will now be much more challenging for the politicians,” said Jullum.

Recommended for you