Europe, long-reliant on Russian natural gas, has nearly severed its dependency on the Kremlin in less than two years. Its preferred replacement — gas from the US — is widely viewed as abundant, politically palatable and less likely to be choked off than pipelines from Siberia.

It’s also growing riskier by the day.

On Friday, the White House announced the polarizing decision to halt the approval of new export permits for liquefied natural gas, or LNG, amid a backlash from climate-minded voters. The pause, which won’t affect those plants already under construction or in operation, threatens to delay or even derail some of the massive projects expected to hit the market toward the end of the decade and beyond.

“US LNG continues to be the cornerstone of Europe’s supply diversification strategy,” said Leslie Palti-Guzman, head of research and market intelligence at SynMax. The Biden decision sends a real message “regarding solidarity and the reliability of its supply in the medium to long term. This is particularly crucial at a juncture where supplies from Russia” and other shippers can be “mired in unpredictability.”

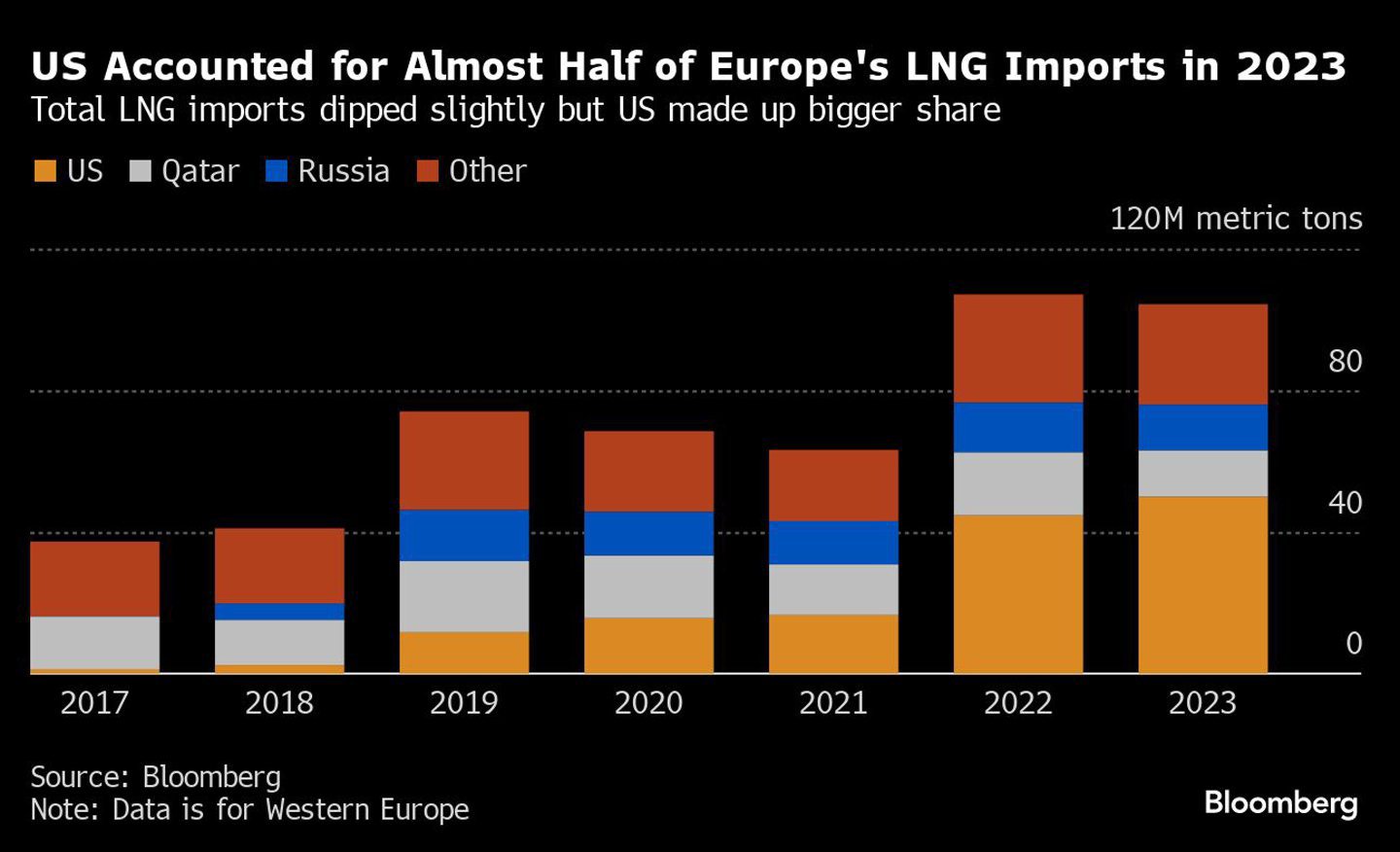

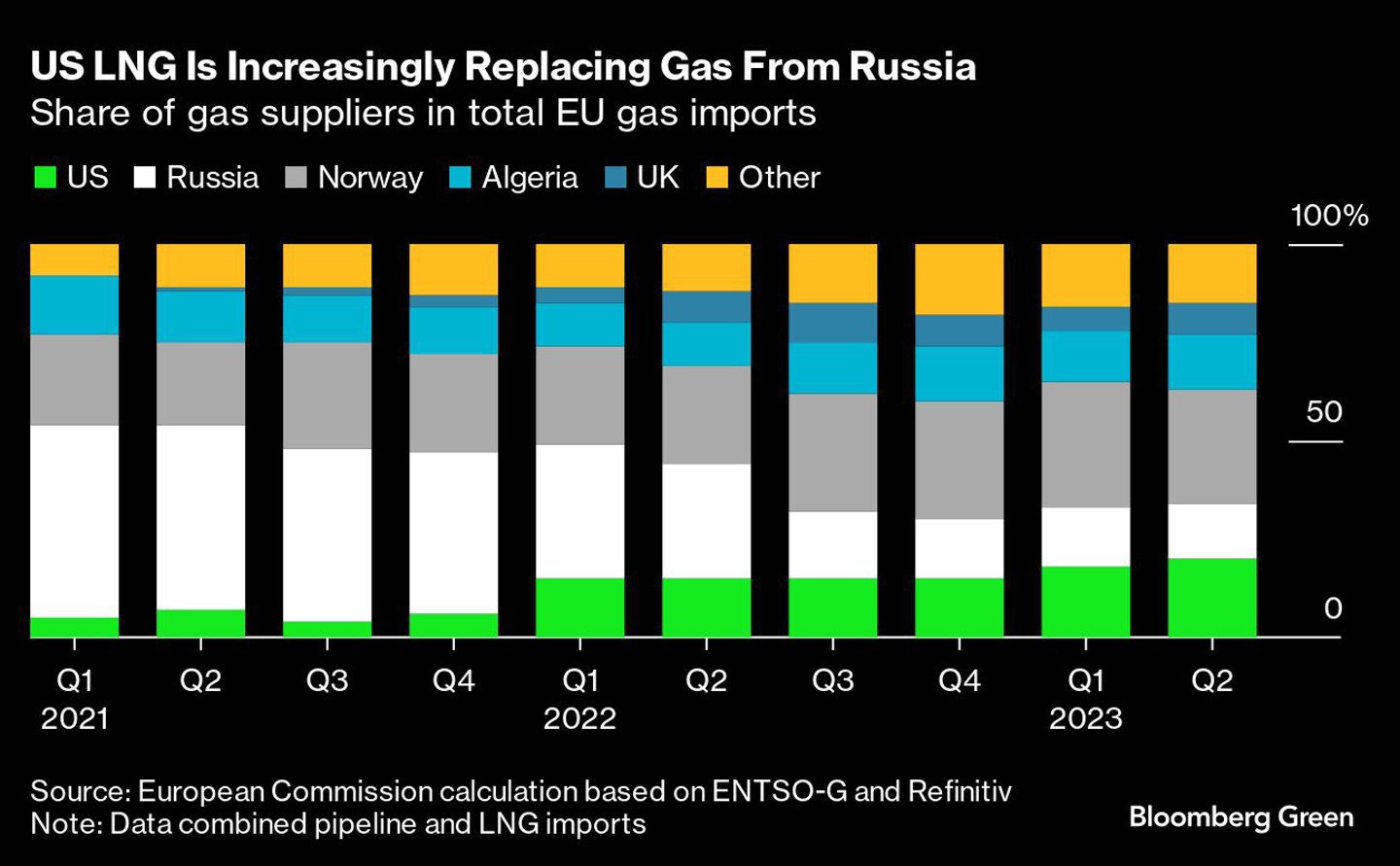

Even before the permit freeze shook buyers across the globe, Europe’s rapidly expanded reliance on US LNG might have given Brussels pause. In a very short window, the US has carved out a meaningful share of Europe’s gas supply, eclipsing any remaining Russian deliveries. America’s booming shipments today account for about half of the region’s LNG imports, a share that is widely expected to grow further. When considering gas shipped through pipelines as well, the US is the bloc’s second-largest gas supplier after neighbour Norway — a serious coup for the North American nation that only began exporting its shale gas in 2016.

Although the US is a major G-7 ally with unsurpassed economic clout and relative political stability, an outsized dependence on even a friendly nation brings risks. Europe’s decision to swap Russian gas for American LNG instead of a harder pivot to renewables means its energy security remains dependent on factors far outside its control, like the Atlantic hurricane season or political gamesmanship in Washington, DC. To procure the fuel that’s key to heating Europe’s homes, generating its power and feeding its industries, energy traders must now factor in events thousands of miles away. Outages at Gulf Coast plants or sudden cold snaps from Houston to Guangzhou can redraw the map for profitable trades overnight.

“European reliance on US LNG will only grow if more Russian gas does not reappear and the Qataris decide not to engage in a price war for market share. The reward for Europe is a diverse set of US suppliers,” said Ira Joseph, senior research associate at the Center on Global Energy Policy at Columbia University. “The risk is a major change in US policy in the future.”

In short, by exchanging fossil-fuel suppliers, Europe has swapped one potential handicap for another, leaving its energy system vulnerable and exposed.

Europe’s decreased reliance on gas from Russia began even before Vladimir Putin’s 2022 invasion of Ukraine. The relationship between the world powers grew strained in 2014 when Russia annexed the Crimea region; tensions further escalated the following year as state-owned gas giant Gazprom PJSC was accused of market-power abuse by the bloc’s competition watchdog.

Months before its most recent Ukraine invasion, Russia pared back pipeline deliveries and stopped offering spot volumes to Europe, tactical moves some said were intended to inflate prices and speed approval of the controversial — and now mangled — Nord Stream 2 pipeline. Two weeks after Russian forces entered Ukraine in February 2022, inciting panic-buying of all LNG cargoes available on the world market, the EU laid out a definitive plan to replace flows from its biggest supplier.

US LNG was the clear choice to fill the gap. A relative geographical closeness meant savings for traders sending US cargoes to Europe instead of Asia; the affluent region also had more purchasing power to snag the pricey shipments. Also working in US gas’s favor: Its contracts are nearly always written to be “destination flexible,” meaning traders are allowed to divert tankers if necessary when the price is right. They can even cancel shipments if demand suddenly collapses. The EU’s LNG imports surged by 60% in 2022, and abundant LNG from Europe’s long-held political ally was the biggest contributor by far.

“I’ve traveled all around the world, especially in Europe, and the message I always hear is: ‘Hooray for American LNG producers,’” US Assistant Secretary of State for Energy Resources Geoffrey Pyatt said in October at the North American Gas Forum in Washington.

That appreciation may be waning with President Joe Biden’s latest move. After Russia invaded Ukraine, his administration made a pledge to the EU to quickly review applications for any new export capabilities, Fred Hutchison, president and chief executive officer of LNG Allies, said Friday. “Today’s announcement does not keep faith with that pledge.”

It’s too early to know if the US review will force any companies to pull their plans permanently; if reelected, Biden might very well allow the process to move forward once safely back in office for another four years.

“This could be a pause for political purposes, to appease Biden’s base in the run-up to the general election. Or it could be a longer halt to permitting that clamps down on the chances of these terminals being approved longer term,” said Energy Aspects gas analyst David Seduski. If a Republican, like Donald Trump, wins the presidency instead, the regulatory halt will “almost certainly be undone” in early 2025, he said.

But even a Trump win wouldn’t be a surefire sign the country’s so-called “freedom molecules” will continue to flow to Europe. During his time in the White House, Trump proved willing to use trade war tactics to push his policies, particularly against China, and there’s no guarantee the EU would stay out of the crosshairs. Even if the permit delay ends up being just a short-term hiccup, it’s still a deafening wake-up call to European buyers that US gas can’t escape US politics.

The European Commission is not concerned about a growing dependency on US LNG because there aren’t the same levels of political risks as with Russia, said a senior EU official who wasn’t authorized to speak publicly.

But others see potential challenges ahead. A growing reliance on US gas is creating a “concentration risk” for the industry, Jonty Shepard, vice president of global LNG trading and origination at BP Plc, said at a late-2023 industry conference in Athens. “The industry as a whole is going to have to learn how to deal with that going forward.”

Here are the other reasons Europe’s appetite for US LNG have some on edge:

- It gives the US outsized geopolitical influence. At the height of the crisis, French Finance Minister Bruno Le Maire blamed LNG exporters for using Russia’s war on Ukraine to encourage “American economic domination and a weakening of Europe” and called for a more balanced economic partnership with the US. Western Europe hasn’t much heeded the warning, importing more LNG from the US last year than from its other eight biggest suppliers combined. The more reliant Europe is on the US, the harder it will be to push back on disagreements, from prices to policy. “Europe risks being dependent on one supplier and ultimately at the mercy of the prices they set,” said Ogan Kose, a managing director at consultancy Accenture.

- It risks inflating Europe’s energy bills. Since most of Europe’s LNG supply is priced off the volatile spot market, buyers there are more exposed to the ebb and flow of global supplies than Asian buyers, who mainly source it under long-term contracts linked to the price of oil, said Massimo Di Odoardo, vice president of gas and LNG research at Wood Mackenzie. LNG shipments can be easily diverted to the highest bidder, so a larger-then-expected surge in Chinese demand or nuclear outages in Japan could shift more American gas to Asia, shortchanging Europe. As extra US capacity hits the market, prices will come down — eventually.

- It means events 5,000 miles away will impact the EU’s energy supply. When natural gas — once shipped only via pipelines — began to traverse the world on tankers, it transformed a once localized market into a global commodity. That carries a whole new set of unpredictable factors. Any issues at US LNG plants an ocean away, from a malfunctioning valve to dense fog, can hit supplies. And disruptions will only get more frequent as climate change worsens the intensity of storms along the US coast. In 2020, Cameron LNG in Hackberry, Louisiana, was shut for weeks after a damaging hurricane; in 2022, a months-long shutdown of Freeport LNG due to an explosion sent prices of Europe’s gas purchases soaring. Of course, LNG’s global nature also brings benefits. “If there is an issue with the LNG supplier, then you can source LNG from anywhere in the world,” said Rob Butler, a partner at law firm Baker Botts LLP, which works on energy transactions.

- It brings a hefty climate impact. Although gas emits less carbon dioxide than coal when burned, some argue methane leaks across the global LNG supply chains can make it worse for the climate. Still, US LNG may emit less methane than some pipeline gas routes to Europe, said Christopher Goncalves, managing director of energy and climate at Berkeley Research Group in Washington.

It risks delaying the deployment of greener energy solutions. In addition to buying more LNG, the EU in 2022 also outlined ambitious plans to boost its investments in renewables, develop green hydrogen and biomethane projects, and bolster measures to save more energy as part of its planned move away from Russian gas. In reality, almost two years later, what stands out is its increased dependency on LNG and — to some extent — reduced gas consumption. Hydrogen projects remain limited, while the renewables push is facing a blow from the offshore wind industry troubles. Current measures being put in place by EU member states aren’t sufficient to cut emissions by the targeted 55% by 2030, and the availability of US LNG won’t do anything to speed that tough transition along.

To be fair, Europe is not sitting idly by. It has started to sign some longer-term contracts to lock in LNG supply, including deals with Qatar’s state-owned operation that push into 2052. Mozambique, Nigeria, Azerbaijan and Norway are also targeting the lucrative European gas market, helping to diversify Europe’s supply.

Still, experts warn it remains far too reliant on American gas, with European companies beginning to feel the tangible effects. Germany’s chemicals industry, for instance, which generated around €230 billion ($250 billion) in sales last year, has been mired in a deep recession, partially triggered by the loss of cheap Russian gas, a key feedstock for fertilizers and source of energy for heavy industry.

“What the European chemicals industry pays for gas is almost 3 to 4 times more than what the US domestic buyer pays,” Accenture’s Kose said, comparing the price of European spot purchases to US futures prices. Even as the cost of gas has come off its record highs, German industrial giants have been cutting jobs and investing in production assets in the US instead, painting a grim picture for Europe’s biggest economy.

“When cheap Russian gas was coming to Europe, it made sense to keep a chemical plant close to the demand source as it was profitable,” Kose said. Now, with more expensive imported LNG, “moving these plants to cheap natural gas sources makes more sense.”

Recommended for you

© Supplied by Bloomberg

© Supplied by Bloomberg © Bloomberg

© Bloomberg © Supplied by Bloomberg

© Supplied by Bloomberg © Bloomberg

© Bloomberg