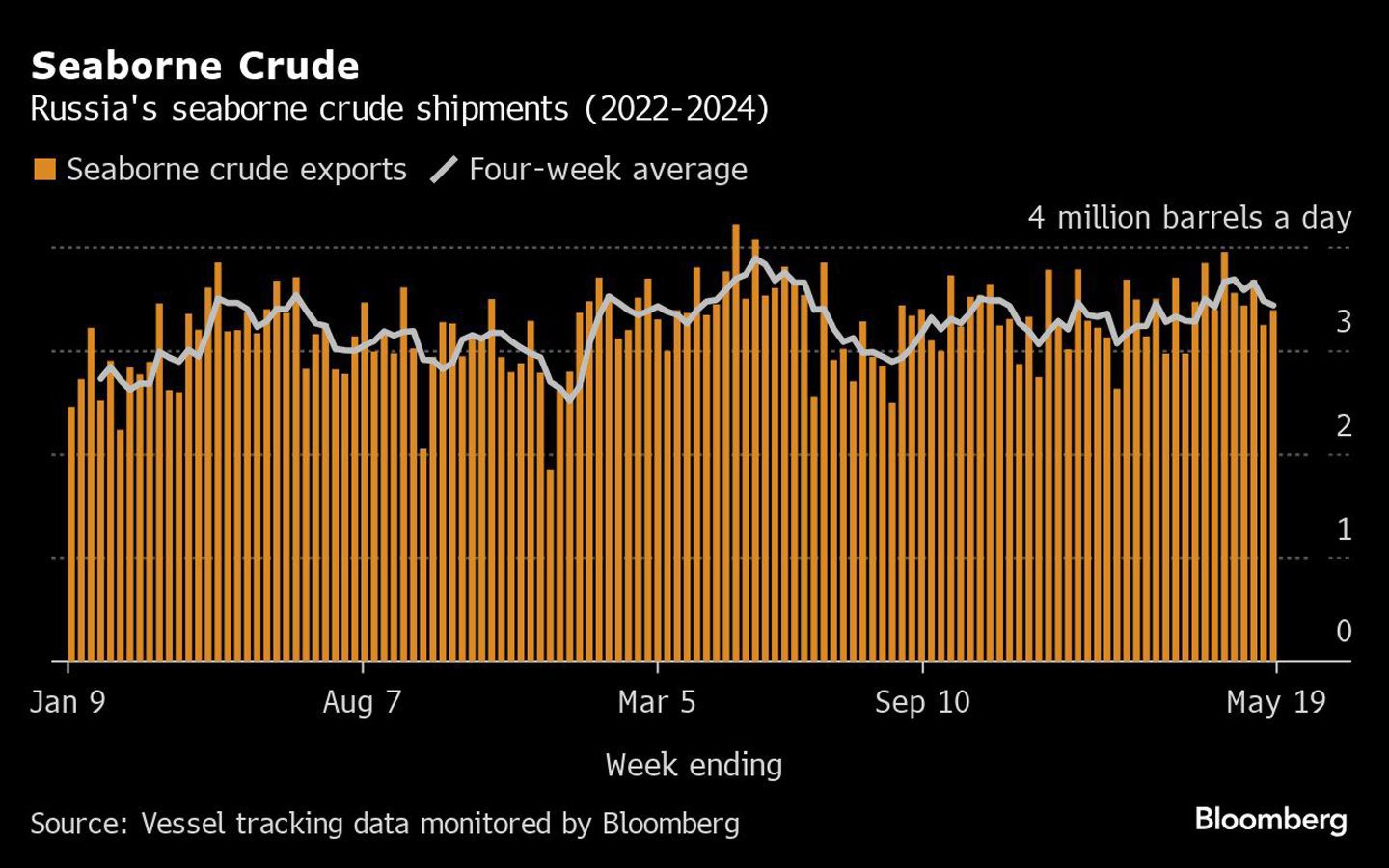

Russia’s crude exports edged higher in the week to May 19, as Moscow prepares to replace a ceiling on overseas shipments with a production limit favored by its OPEC+ partners.

An increase in cargoes from the country’s Baltic and Arctic terminals was mostly offset by a dip in flows from the Pacific oil ports, and the less volatile four-week average slipped for a second straight week.

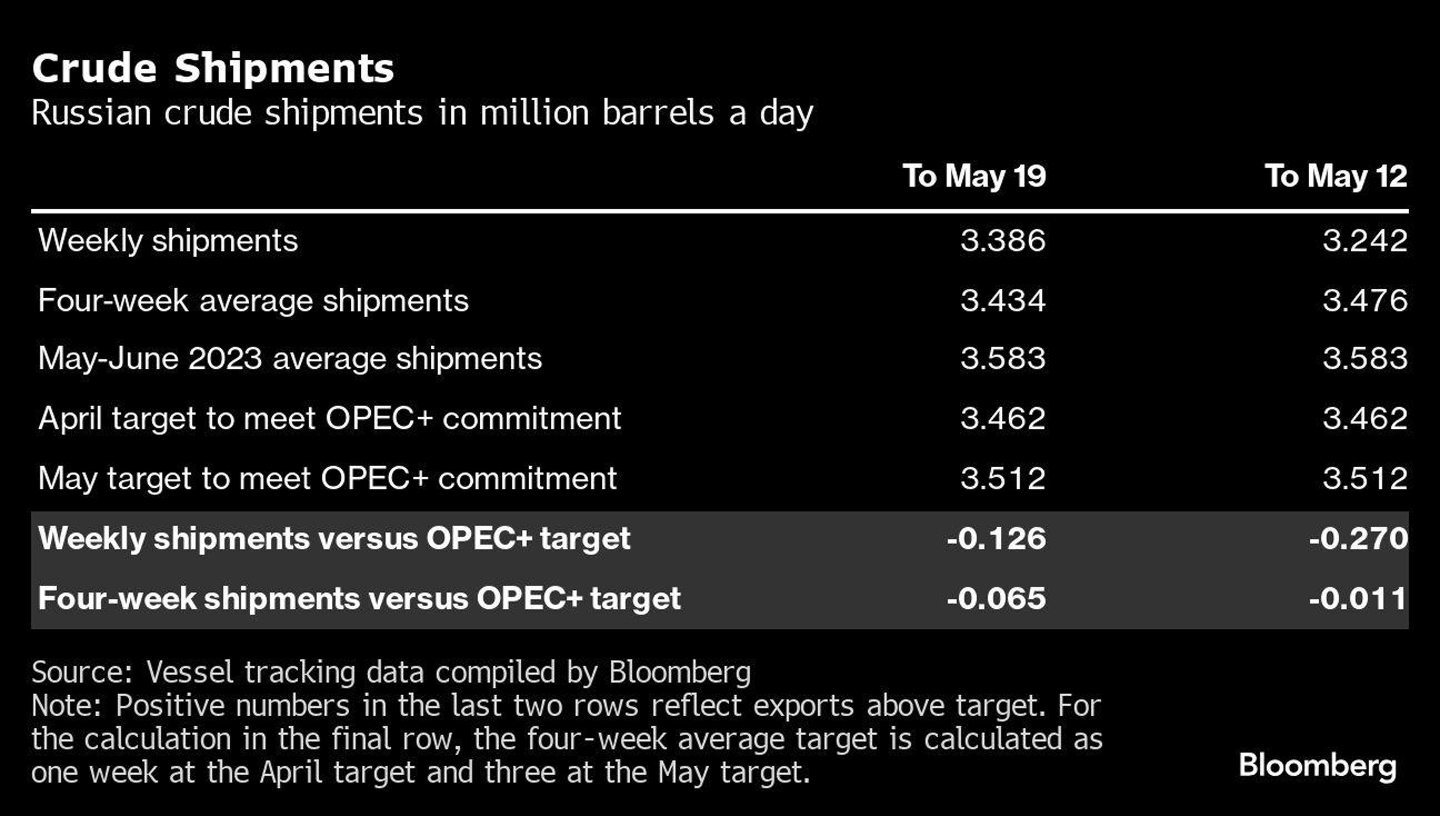

Russia’s exports goal for this month is more accommodating than April’s, as the Kremlin moves away from curbs on overseas shipments and transitions to the deeper output cuts that will bring it into line with its peers next month. OPEC+ oil ministers are due to convene on June 1 to discuss production policy and Russia, along with several other group members, is expected to decide whether to extend additional voluntary output cuts into the third quarter.

The gain in weekly flows came as Russia also raised refinery runs in the first half of May, as some of Rosneft PJSC’s refineries recovered from Ukrainian drone strikes earlier in the year, before another flurry of attacks that began on Friday. If run rates are maintained for the rest of the month, it would be the first increase in processing since December. Higher weekly export volumes more than offset another week-on-week decline in prices, driving a modest recovery in the value of Russia’s shipments.

Tankers in the shadow fleet that has been built up with the help of proxy companies to get around the Group of Seven’s restrictions on shipping services have been involved in at least 50 accidents since Russia’s invasion of Ukraine in February 2022 — which prompted the curbs — including fires, engine failures, collisions and oil spills.

The first sanctioned Russian tanker to load crude after being listed is now passing through the Strait of Malacca. The SCF Primorye, cited by the US in October for breaching a G7 price cap, loaded Urals at Novorossiysk on the Black Sea in late April and is now showing a destination of Singapore. It is most likely en route for China, whose ports have been more willing than those elsewhere to handle vessels owned by sanctioned entities.

If it is able to discharge its cargo without difficulty, it could pave the way for other sanctioned tankers owned by state-controlled Sovcomflot PJSC to return to work. Until now, no other sanctioned Sovcomflot tanker has loaded a cargo.

The company has renamed and reflagged at least 10 of its 21 ships that have been listed by the US Treasury Department for breaching the price cap, perhaps with the intention of distancing them from the sanctions.

Crude shipments

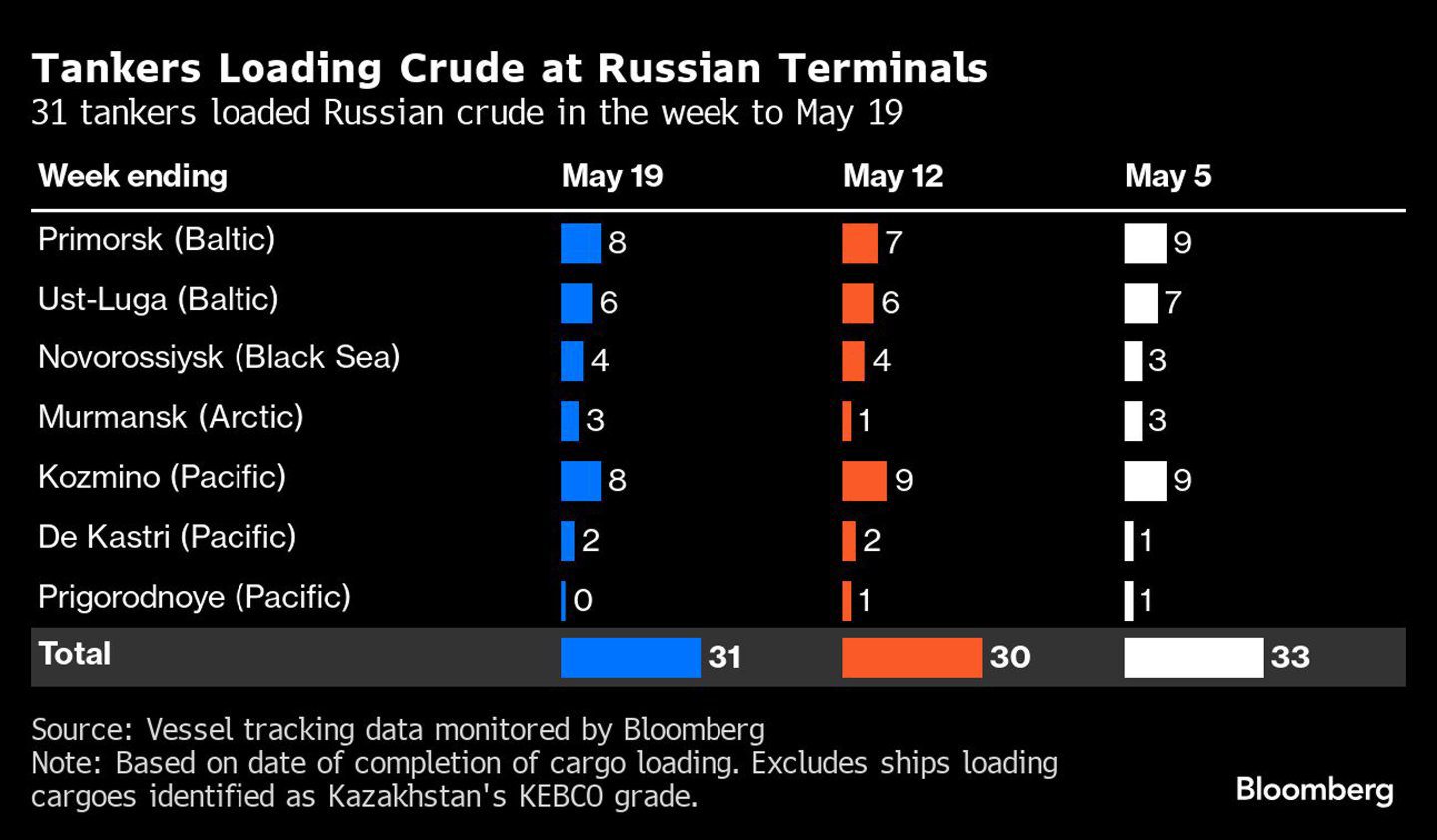

A total of 31 tankers loaded 23.7 million barrels of Russian crude in the week to May 19, vessel-tracking data and port agent reports show. That was up by about 1.01 million barrels from the previous week.

Russia’s seaborne crude flows in the week to May 19 rose by about 140,000 barrels a day to 3.39 million from 3.24 million for the week to May 12. In contrast, the less volatile four-week average fell by about 40,000 barrels a day to 3.43 million.

The increase in the weekly figures was driven by more shipments from the Baltic port of Primorsk and the Arctic terminals at Murmansk, which were partly offset by fewer departures from the Pacific ports of Kozmino and Prigorodnoye.

Crude shipments so far this year are running about 20,000 barrels a day above the average for 2023.

Russia told OPEC+ that it would cut crude exports during April by 121,000 barrels a day from their average May-June level, while May shipments would be 71,000 barrels a day below the same starting point. Weekly shipments were about 130,000 barrels a day below the target for this month, while the four-week average was about 65,000 barrels a day below. Seaborne shipments in the first three months of the year exceeded Russia’s target level for that period by just 16,000 barrels a day.

Saudi Energy Minister Prince Abdulaziz bin Salman said he would have preferred to see Russia reduce output as its contribution to an effort to balance the market in the first quarter of 2024 but couldn’t convince his counterpart Alexander Novak to do so. Moscow has long argued that freezing weather and other geological conditions make it more difficult to curb production in the first few months of the year. “We did try,’’ Prince Abdulaziz said at the time “We also know it’s extremely tough for Russia to cut production in the winter.’’

But when key members of the producer group agreed in early March to extend the reductions through the second quarter, Russia relented, pledging to phase out the export measure and shift to deeper production cuts.

Two cargoes of Kazakhstan’s KEBCO were loaded at Novorossiysk during the week.

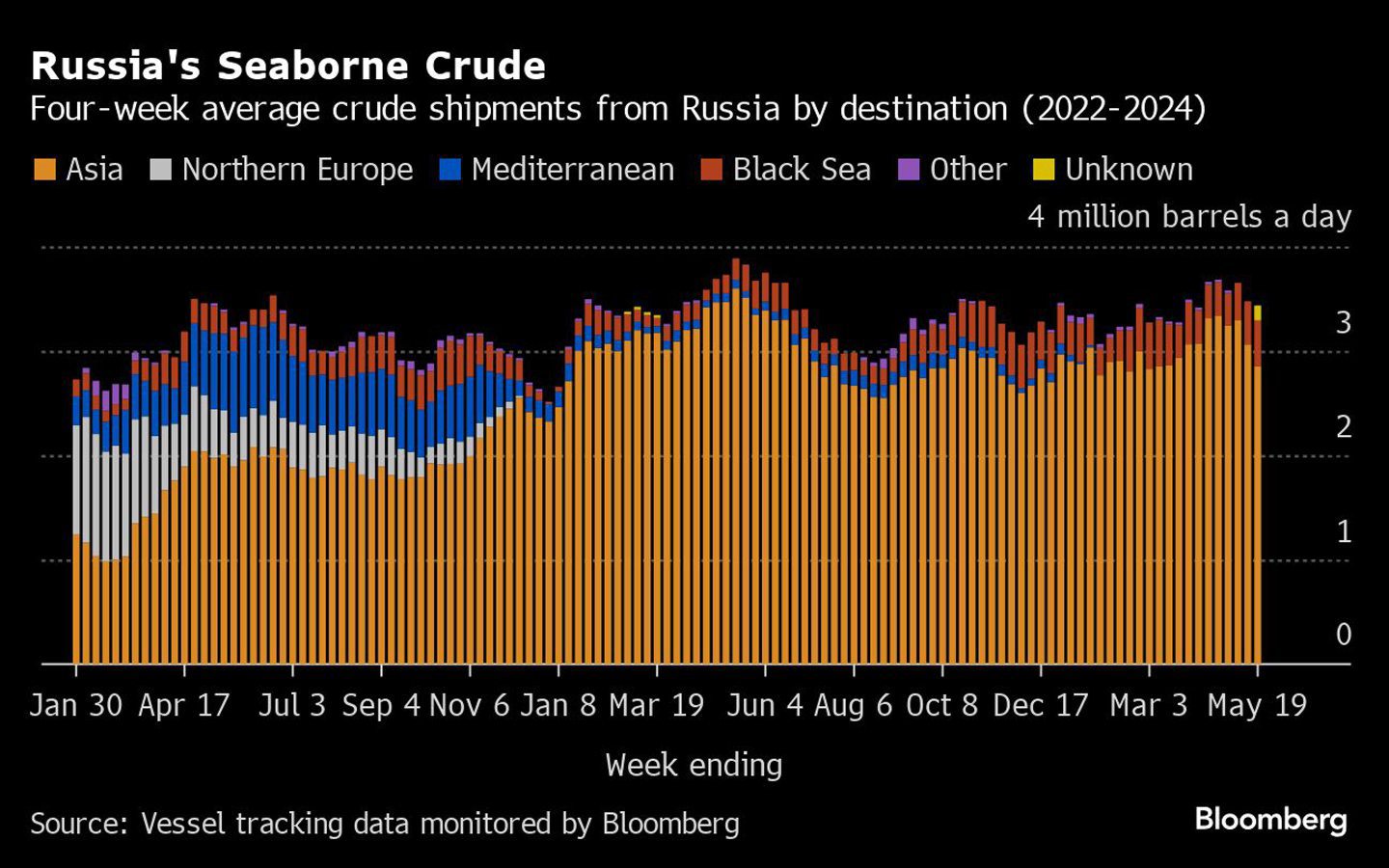

Flows by destination

Asia

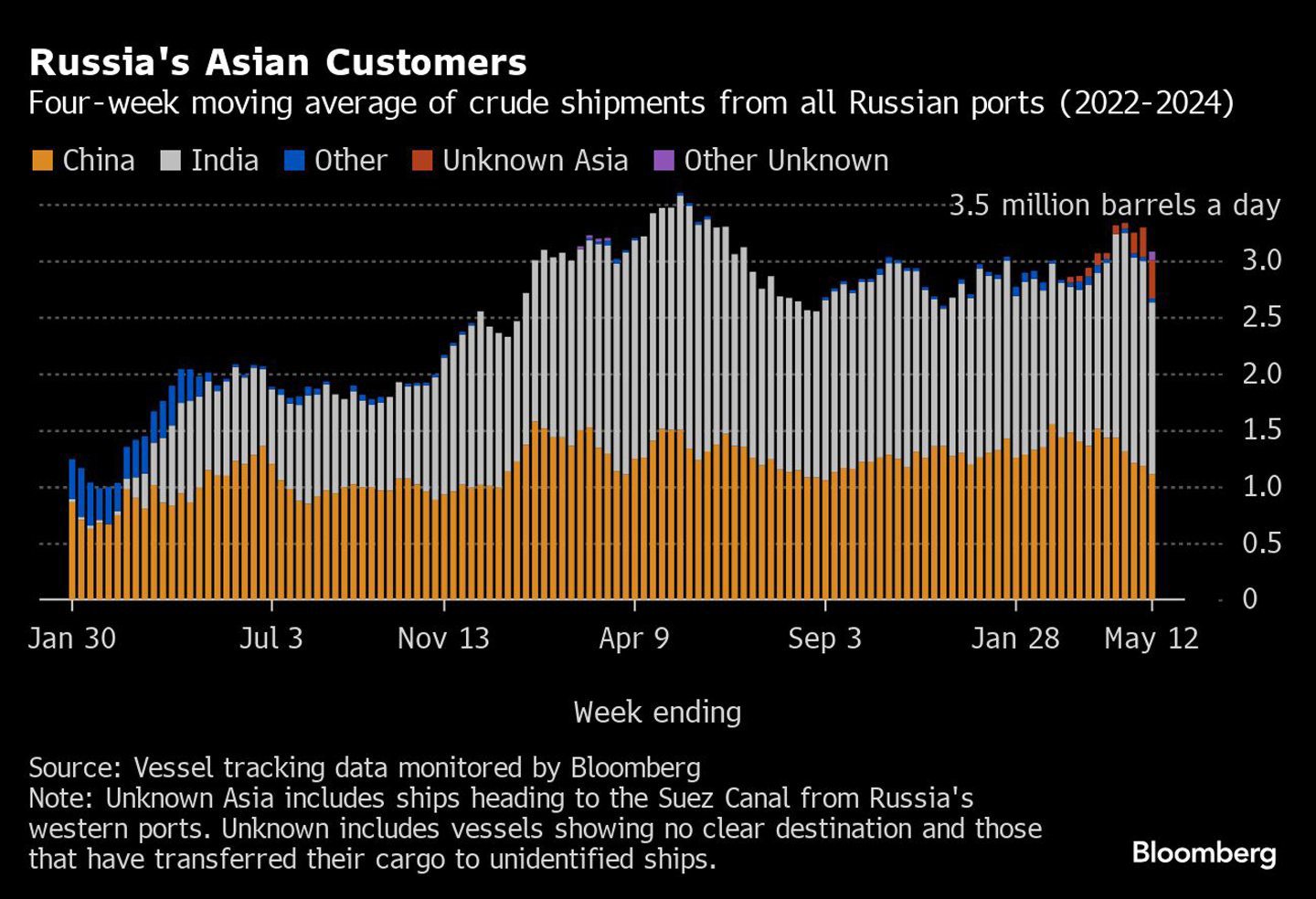

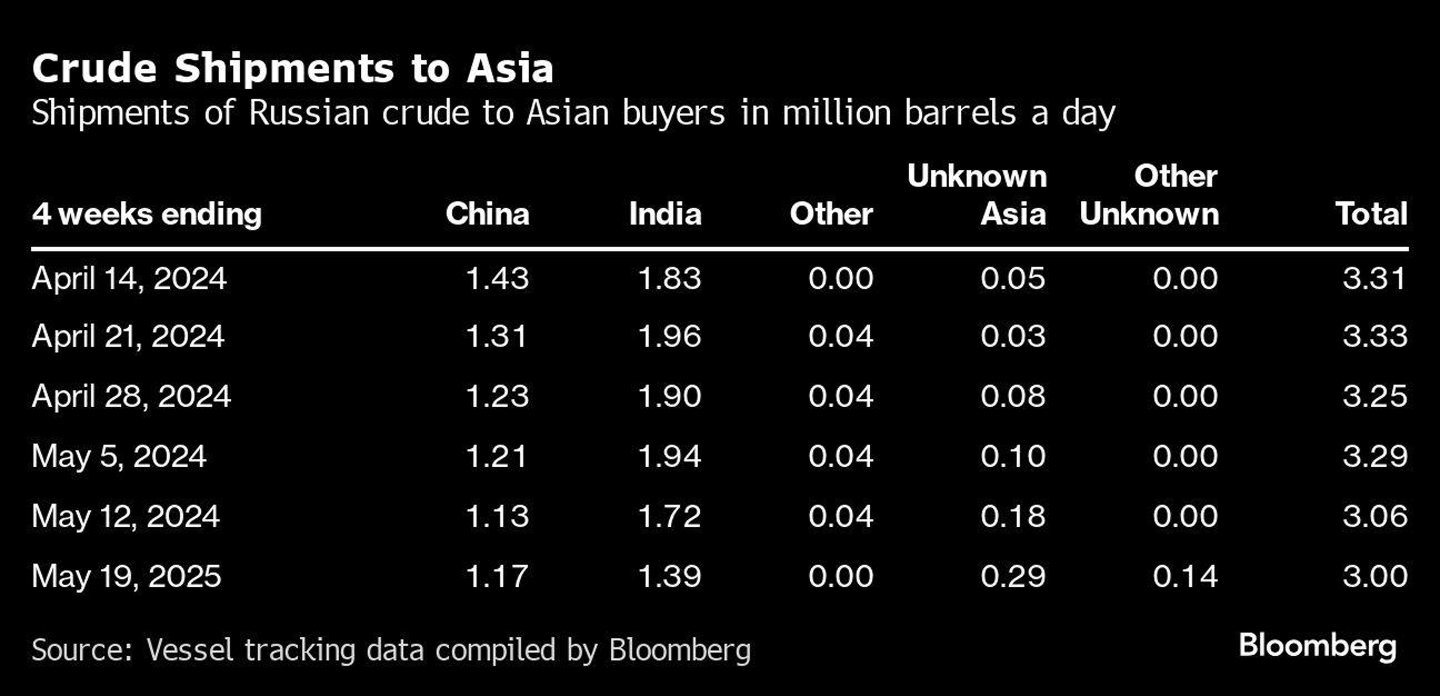

Observed shipments to Russia’s Asian customers, including those showing no final destination, fell to an eight-week low of 3 million barrels a day in the four weeks to May 19, from 3.06 million in the previous four-week period.

About 1.17 million barrels a day of crude was loaded onto tankers heading to China. The Asian nation’s seaborne imports are boosted by about 800,000 barrels a day of crude delivered from Russia by pipeline, either directly, or via Kazakhstan.

Flows on ships signaling destinations in India averaged about 1.39 million barrels a day.

Both the Chinese and Indian figures are likely to rise as the discharge ports become clear for vessels that are not currently showing final destinations.

The equivalent of about 290,000 barrels a day was on vessels signaling Port Said or Suez in Egypt. Those voyages typically end at ports in India or China and show up as “Unknown Asia” until a final destination becomes apparent.

The “Other Unknown” volumes, running at about 140,000 barrels a day in the four weeks to May 19, are those on tankers showing no clear destination. Most originate from Russia’s western ports and go on to transit the Suez Canal, but some could end up in Turkey. Others may be moved from one vessel to another, with most such transfers now taking place in the Mediterranean, or more recently off Sohar in Oman.

Russia’s oil flows were also complicated once again by the Greek navy carrying out exercises in an area that’s become synonymous with the transfer of the nation’s crude. The activities, which briefly halted on May 19, have resumed and will continue until June 3.

Europe and Turkey

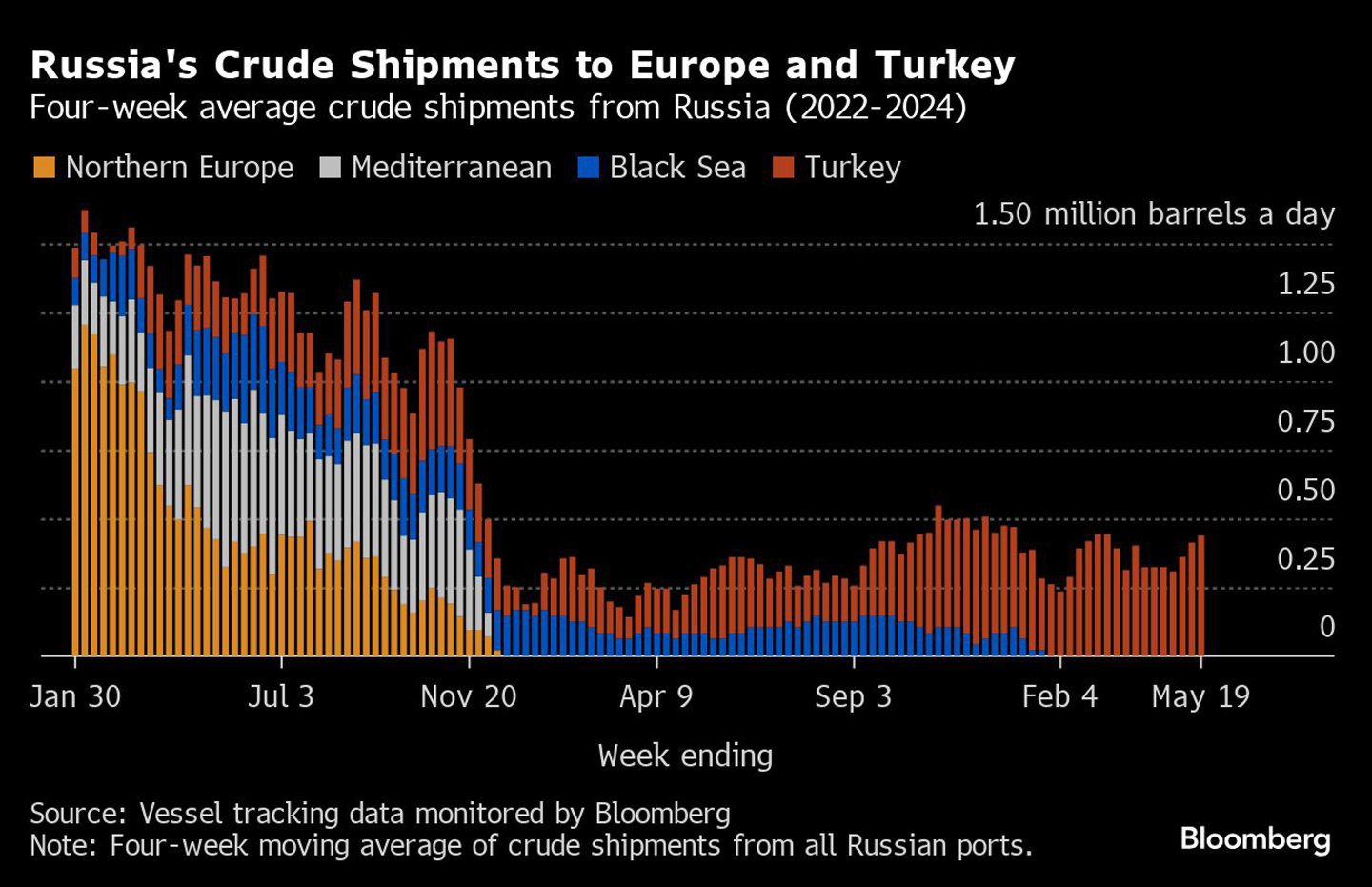

Russia’s seaborne crude exports to European countries have ceased, with flows to Bulgaria halted at the end of last year. Moscow also lost about 500,000 barrels a day of pipeline exports to Poland and Germany at the start of 2023, when those countries stopped purchases.

Turkey is now the only short-haul market for shipments from Russia’s western ports, with flows in the 28 days to May 19 rising to a 10-week high of 438,000 barrels a day.

Export value

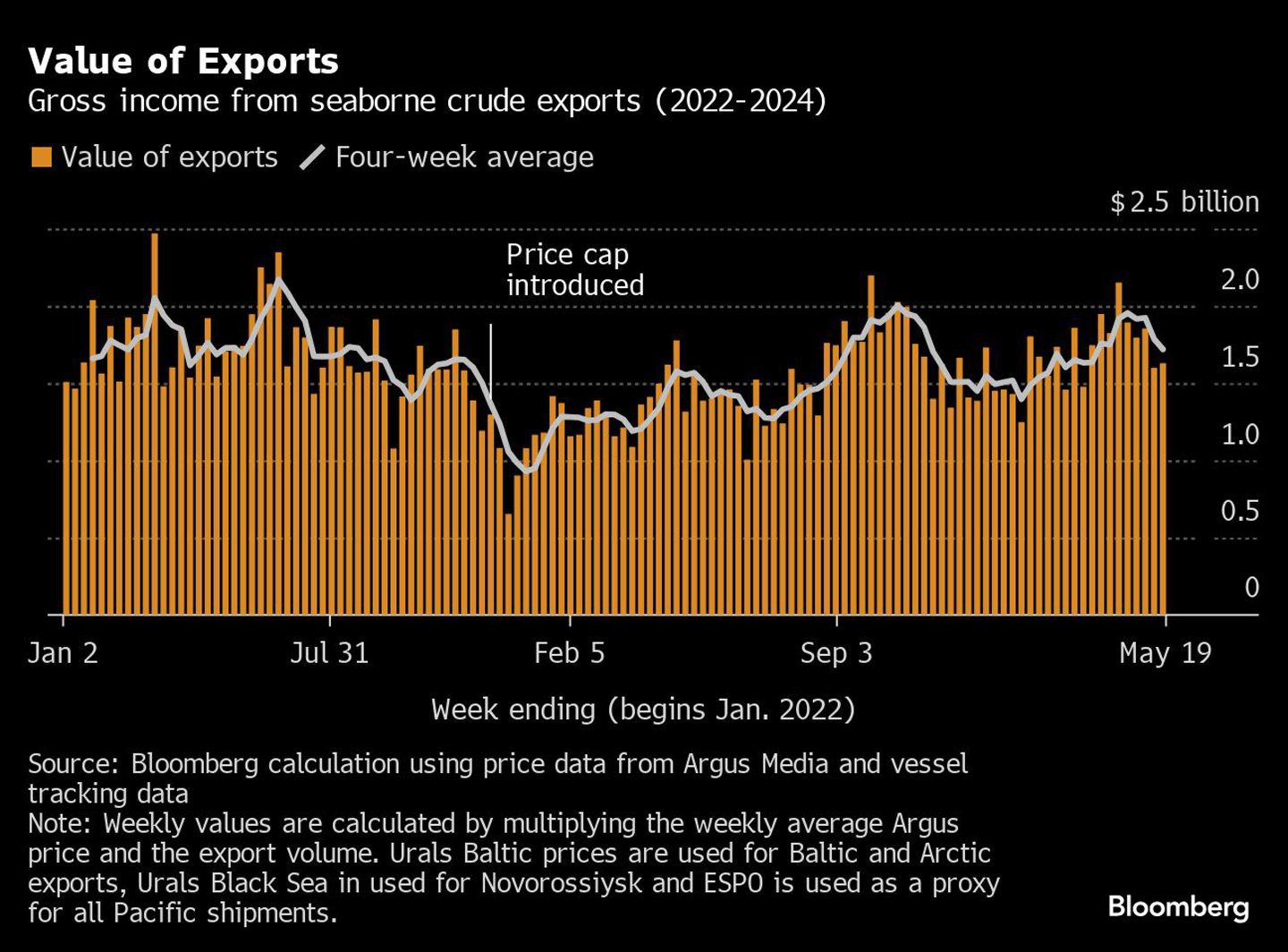

The gross value of Russia’s crude exports rose to $1.63 billion in the seven days to May 19 from about $1.6 billion in the period to May 12. But four-week average income was down, dropping by about $70 million to $1.72 billion a week. The four-week average peak of $2.17 billion a week was reached in the period to June 19, 2022.

An increase in the amount exported more than offset lower prices week on week to drive the modest recovery in oil revenues. Four week average export value saw its second straight drop, falling to an eight-week low.

During the first four weeks after the Group of Seven nations’ price cap on Russian crude exports came into effect in early December 2022, the value of seaborne flows fell to a low of $930 million a week, but soon recovered.

© Bloomberg

© Bloomberg © Bloomberg

© Bloomberg © Bloomberg

© Bloomberg © Bloomberg

© Bloomberg © Bloomberg

© Bloomberg © Bloomberg

© Bloomberg © Bloomberg

© Bloomberg © Supplied by Bloomberg

© Supplied by Bloomberg