A report by the Global Underwater Hub (GUH) released today has emphasised the strength of the UK supply chain but warns a continuing lack of project surety is impeding necessary investment.

The GUH 2023 Business Survey found the supply chain believes it has the necessary capabilities to actively diversify into new market sectors, supporting the energy transition.

However, the survey also said a lack of clarity around future project timelines is affecting confidence, impeding investment and hampering efforts to tackle bottlenecks in the supply chain and increase capacity.

GUH said respondents noted concerns and challenges around market diversification, skills and investment, which could impede the development of global offshore energy, subsea cabling or aquaculture projects.

The report follows a warning issued by GUH chief executive officer Neil Gordon that the UK subsea industry had lost 20% of its capability due to recent oil downturns.

‘Huge opportunities’ for underwater supply chain

GUH strategic programme manager and leader of the survey Steve Fernie said the survey asked three questions around the underwater industry supply chain’s capacity, capability and confidence in delivering upcoming projects.

“We have gone behind the numbers to investigate the supply chain’s viewpoint on demand, its ability to meet that demand and where it sees challenges in doing so,” Mr Fernie said.

“The results give a pragmatic perspective of how the underwater industry supply chain views the upcoming investments in offshore energy, subsea cables, aquaculture and subsea minerals.”

Mr Fernie said there is confidence across the underwater sectors, yet industry leaders are aware of the challenges impacting the speed of project development and delivery.

“As the global drive to net-zero continues, there are huge opportunities for the UK’s world-class underwater supply chain, which for decades has been in demand overseas,” he said.

“Creating project surety is critical in order for the underwater supply chain to support the timely development of multiple projects and deliver 2050 net-zero ambitions.”

Underwater sector expects stronger international growth compared to UK

According to Global Underwater Hub, the survey found the UK is home to a world-class supply chain, which it said is a “huge benefit” for domestic projects.

However, the supply chain considers UK opportunities amongst a global portfolio.

Approximately 93% of companies are also actively exploring international markets whilst retaining a focus on the UK.

These international market opportunities across are expected to increase in the short and medium term, with stronger growth anticipated from international markets compared to the UK.

Oil and gas and offshore wind “significantly represent the largest markets”.

Meanwhile, the survey found more than 80% of companies who took part in the survey are already active or considering diversification across the underwater market sectors.

GUH said the supply chain is confident that it currently has the required capability to be active across its core and diversified markets.

Nearly two-thirds (64%) are confident in their current capabilities, while looking ahead 83% are confident in their future levels.

Global supply chain hampered by lack of project visibility

While the report found confidence in supply chain capacity, respondents also said they are hampered by parallel demand from concurrent investment in the underwater sectors and an undersupply of a skilled workforce.

Only 55% of companies surveyed believe they have the required current capacity, although there is greater positivity when looking at the longer term.

The global underwater supply chain is confident required capacity to deliver planned projects can be achieved, however the majority of respondents expect ‘significant’ investment and headcount increases will be required over the longer term.

The survey found project visibility is the largest barrier to investor confidence, with the vast majority of respondents fearing most projects will not keep to proposed timelines, which greatly impacts supply chain planning.

Global Underwater Hub

Supported by the UK and Scottish governments, Global Underwater Hub represents businesses operating in the UK’s £8 billion underwater industry.

The body facilitates cross-collaboration and growth across the underwater industry, which comprises offshore energy, aquaculture, defence, telecoms, and seabed minerals.

GUH currently employs 22 staff across its offices in Aberdeenshire, Newcastle and Bristol.

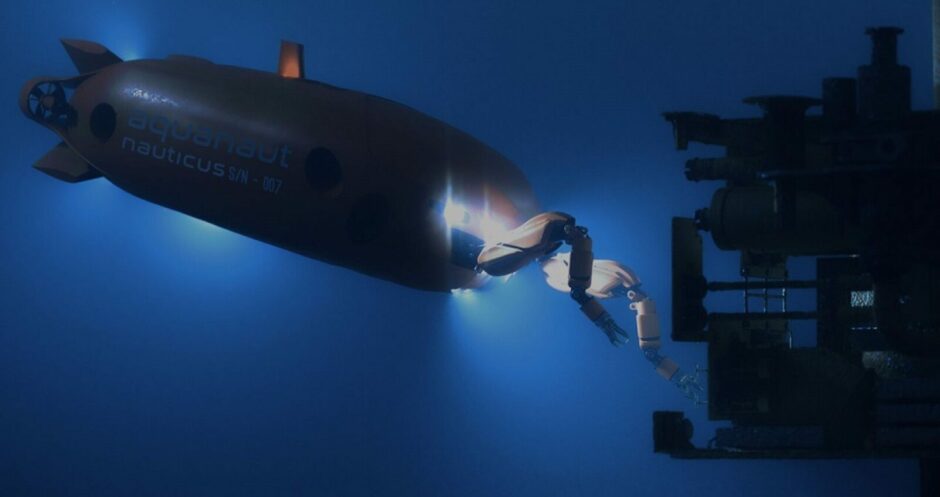

In September, King Charles visited the GUH precinct in Westhill where he met with students from Mintlaw Academy and piloted an underwater robot used to inspect subsea cables and pipelines.

© Supplied by DC Thomson/ Wullie M

© Supplied by DC Thomson/ Wullie M © DC Thomson

© DC Thomson © Supplied by Nauticus Robotics

© Supplied by Nauticus Robotics