© Shutterstock

© Shutterstock The long-awaited 33rd offshore oil and gas licensing round officially launches today.

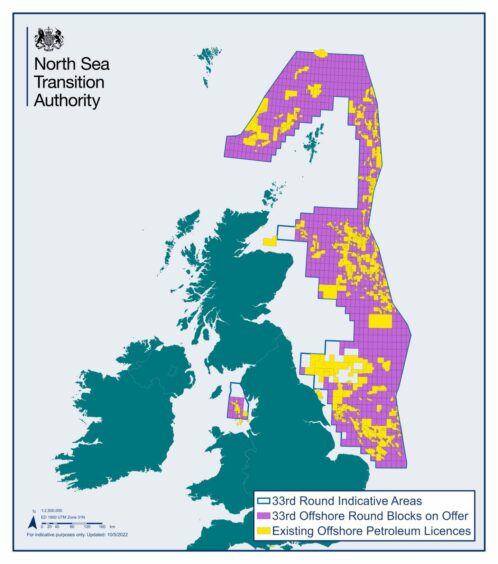

Industry regulator the North Sea Transition Authority (NSTA) has kicked off the process, part of a long term UK Government strategy to solidify energy security.

A total of 898 blocks and part-blocks of acreage have been made available, with estimates that over 100 licences could be dished out.

The licensing round will run until January 12, with results expected in late spring of 2023.

READ: Almost 900 blocks up for grabs as UK’s 33rd oil and gas licensing round gets underway

A large amount of work has already been done by the NSTA to get to this stage, and there is a great deal more to do before licences are allocated.

From there, many more hurdles, both regulatory and operational, have to be cleared before any oil and gas reserves uncovered begin producing.

In the short term, the process will be as followed:

- The NSTA studies available acreage in the UK Continental Shelf and, after consultation with other North Sea bodies, makes areas available for licence applications.

- Potential investors prepare and table their bids to fit the requirements laid out by the NSTA. These relate to technical and financial capability, corporate governance and fitness.

- The NSTA reviews the applications and, with the agreement of the Secretary of State, awards licences as appropriate.

- It is expected that in the case of this, the 33rd, Licensing Round the NSTA will award licences in Q2 2023.

Permit ≠ production

Any permits awarded will have conditions attached, requiring the licensee to make agreed progress at agreed times.

These conditions can include submitting development plans, shooting seismic and other benchmarks.

Before proceeding with certain stages of development, licensees must apply for, and receive, a series of further consents from the NSTA, and other organisations.

Being awarded a licence does not guarantee that further consents will be awarded, the NSTA said.

Nor does it guarantee that hydrocarbons will be produced, and a large number of permits will not yield oil and gas.

Of those licences that do eventually lead to production, it takes an average of five years from licence award to production.

New licences no quick fix

That delay has led many, particularly environmental groups, to criticises Liz Truss’ decision to authorise a new licensing round.

It is argued that owing to the time it takes for new fields to start up, they will have no impact on people’s bills, which have skyrocketed in recent months, and will simply fuel climate change.

To encourage production as quickly as possible, in order to reduce energy costs, the NSTA has identified four priority cluster areas in the Southern North Sea.

They all have known hydrocarbons, are close to infrastructure and have the potential to be developed quickly.

But groups, including Greenpeace, have claimed that because oil and gas is sold to the highest bidder, expanding North Sea supplies will do nothing to help UK households or boost energy security.

Concerns have also been flagged about the potential ease of the industry’s new climate compatibility checkpoint in recent weeks.

It is designed to ensure all new fields are in step with net zero, but it has been described by one academic as nothing more than a “wave-through test”.

In its revised strategy, which came into force last year, the NSTA, then the Oil and Gas Authority, included a requirement for industry to operate in a way consistent with net zero ambitions.

It also highlighted the need to lower production emissions and make serious progress on the solutions that can contribute to the UK achieving net zero.