Hundreds of North Sea oil and gas discoveries could be abandoned as companies battle with uncertain headwinds.

Currently there are “over 300” offshore finds that are not yet “under serious examination for development”, says Professor Alex Kemp of Aberdeen University.

Most of the unexplored discoveries are “relatively small”, meaning it is unlikely firms will take the risk of investing in them for limited reward, according to the leading petroeconomist.

Uncertainties around commodity prices and the energy profits levy make it even more improbable that companies will explore potential reserves.

In terms of resources still in place in the North Sea, there is “still a large volume”, says Professor Kemp, potentially between “10 and 20 billion barrels of oil equivalent (boe)”.

How much of that “would be economic is a different question” he added, pointing to the potential impact of taxes and prices.

Professor Kemp said: “Our modelling has always shown that the majority of that would come from discoveries already made, rather than from brand new ones. The problem is that a lot of these discoveries already made are not yet fully explored, and aren’t under serious examination for development.

“There are reserves that fall into the probable and possible categories that are seriously being considered, but there’s a lot more discoveries, over 300 for sure, not seriously being examined.”

He added: “We have looked at the windfall profits tax and we think that it will adversely affect investment decisions, both for exploration and for development, particularly of relatively small fields. Unfortunately, a lot of them are already there, but not yet developed.”

Uncertainty rife

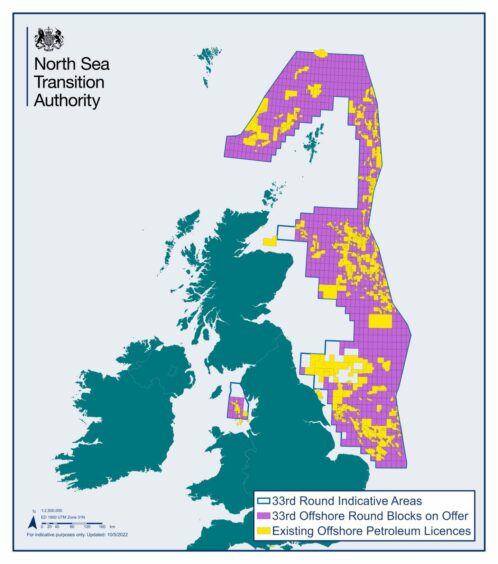

Such doubt, particularly around tax, could also impact any fields uncovered as part of the 33rd North Sea exploration licensing round.

The UK Government doubled down on its energy profits levy in November, increasing it by 10%, extending its runtime, and removing a clause linking it to the oil price.

When combined with other taxes on the sector, the changes mean oil and gas companies will pay 75% on their profits until at least 2028, even if another downturn hits.

An investment allowance has been included to incentivise spending, but Professor Kemp says “not every company is in that situation”, while some new entrants don’t pay enough tax for it to make a difference.

Fears being realised

Fears that companies would negatively respond to the fiscal changes have already materialised.

TotalEnergies (LON: TTE) is cutting its North Sea spend, while Harbour Energy (LON: HBR) shunned the North Sea Transition Authority’s (NSTA) latest licensing round, as well as announcing job cuts.

Professor Kemp believes the impacts of the tax will continue to seep through, particularly given there’s good deal of trepidation that it may be extended beyond 2028.

He said: “Further exploration may well find relatively small fields – the prospect of finding very large fields is quite low. Then there is the need to keep emissions low, pass the NSTA checkpoints, pass field development approvals, where you need to try to get power on the platform from electricity.

“With the windfall tax as well, our modelling is suggesting that smaller fields may not be possible economically, and that the levy is having a negative effect. This would work its way through to decisions on whether to apply for licenses.

“When it comes to the field development plans, investors will use long-term projection of prices that will be much lower that what we’ve seen over the last year or so.

“Putting all that together, the investment outlook is very mixed. The risks are quite high because of the big oil and gas price uncertainty, the fact costs are rising in general, and because of the windfall tax. There is much uncertainty.”

Recommended for you

© Supplied by NSTA

© Supplied by NSTA