Shell (LON:SHEL) could have been motivated to move forward with its plans for the Victory gas field by the “clear tax incentive” for such projects included in the UK’s windfall tax, experts say.

The Energy Profits Levy (EPL) provides tax incentives for any new oil and gas projects until the levy sunsets in March 2028, saving a total 91p for every £1 spent when combined with other tax measures.

The windfall tax measures are set to remain in place until March 2028, covering most of the expect eight-year field life of Shell’s Victory plans which were approved last week.

Shell did not disclose the level of its planned investment in the Victory field nor whether it plans to make use of the EPL investment allowance for the project.

However, Energy Voice understands the company will continue to pay taxes in line with the UK’s ringfenced fiscal regime for oil and gas

‘Clear tax incentive’ from EPL

Aberdeen University professor of petroleum economics Alex Kemp told Energy Voice there is a “clear tax incentive” for North Sea firms to plan the development of projects to take place within the lifetime of the EPL.

“As far as tax incentives are concerned with respect to new field developments there is a major incentive to incur investment expenditure in the period up to March 2028 because of the very large tax reliefs available within that time period,” he said.

“After March 2028 the investment allowances will be substantially less following the abolition of the [EPL].

“Also, the tax rate applicable to profits will be greatly reduced for periods from April 2028.”

Future ‘price shock mechanism’

While not able to comment on Shell’s decision making regarding Victory, Professor Kemp said the ability to obtain the benefits of the EPL allowances depends on the investor having income from other projects at the time of the investment.

“There is one other tax factor namely what could replace the Energy Profits Levy after it is abolished,” he said.

“This is unknown at the moment but could be based on gross revenues above specified base prices for oil and gas.”

A UK Treasury review laid the groundwork for a future post-EPL oil and gas “price shock mechanism” following the Autumn Statement last year.

While little has been finalised, North Sea operators may welcome potential tax policy changes surrounding decarbonisation investment and decommissioning funding.

One of the more significant changes outlined is confirmation the government will “legislate in a future finance bill to introduce tax relief for payments made by oil and gas companies into decommissioning funds”.

The review also hinted that any possible future tax on North Sea operators might be based on gross revenues, rather than profit.

Victory gas field plans

All of the gas recovered from Victory will enter the UK national grid at the St Fergus terminal near Peterhead, which also forms part of Shell’s plans for its Acorn Project joint venture.

The Acorn project aims to repurpose oil and gas infrastructure to enable carbon capture and storage (CCS) in depleted fields.

The Acorn partners, which include Storegga and Harbour Energy, are also investigating the potential for the production of blue hydrogen at St Fergus using North Sea gas.

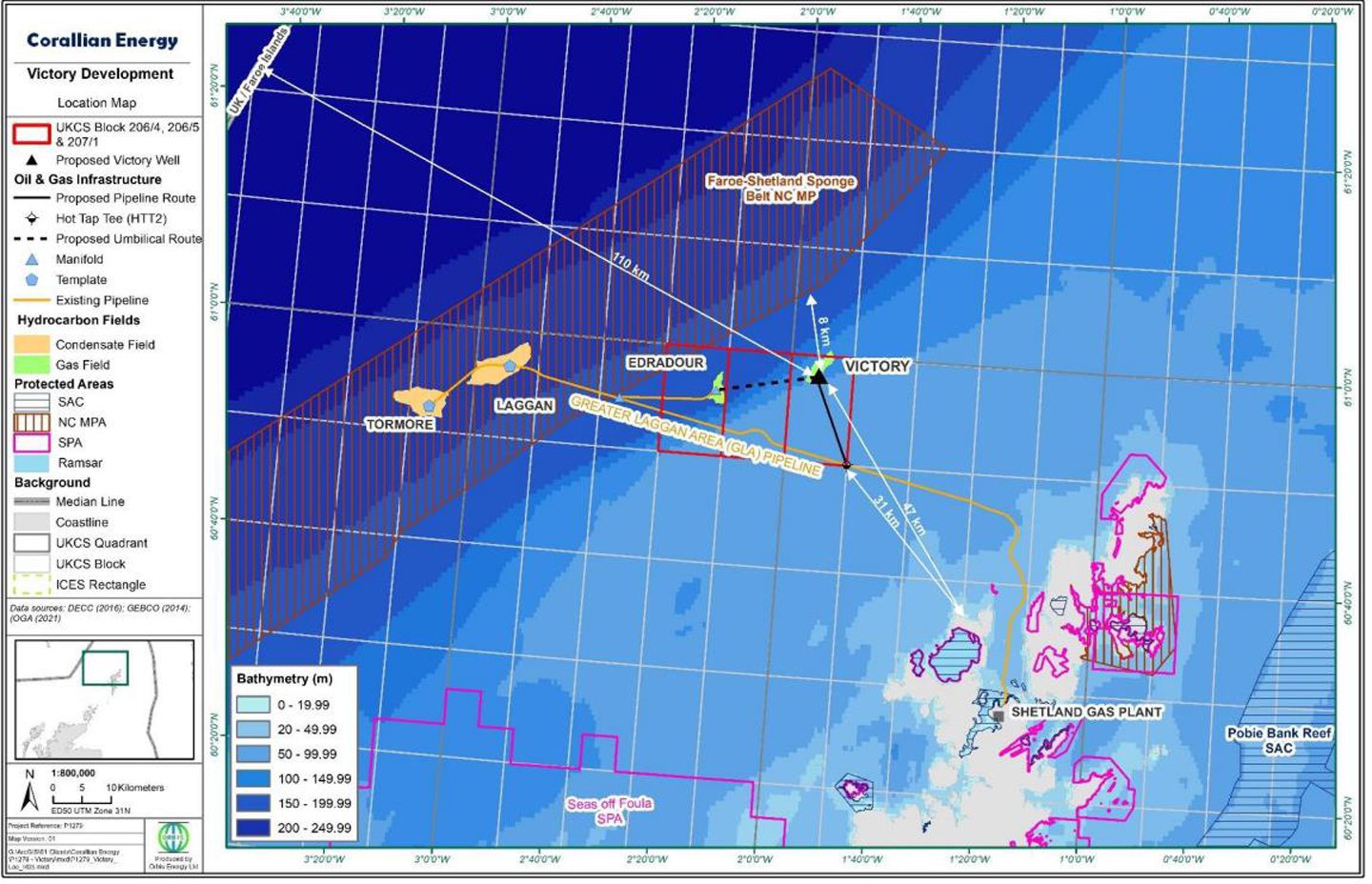

The London-listed supermajor took 100% ownership of Victory, which sits 29 miles north-west of Shetland, after buying out Corallian Energy in 2022.

Discovered in 1977 by Texaco, Corallian picked up Victory in the 32nd licensing round before Shell acquired the firm.

Shell intends to carry out development drilling and subsea installation activities from Q2 2024, with first gas targeted from 2025.

Recommended for you

© Supplied by Corallian Energy

© Supplied by Corallian Energy