New research has cast light on the top companies commanding the majority of the UK’s North Sea production and spending.

Dundas Consultants collated data on the 254 exploration and production companies with licences in the UK sector, but found just 20 of them operate production hubs which handled 98% of production.

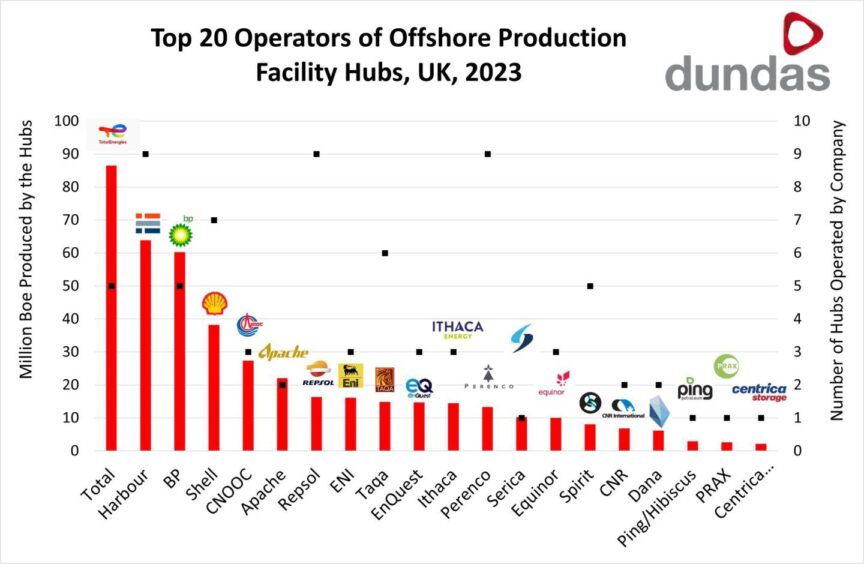

The research looks at which companies are running the largest number of hubs in the UK sector, with Harbour Energy, Repsol and Perenco topping the table at nine apiece.

Some of these hubs are no longer operational as decommissioning comes to the fore – but the data highlights where potential spending lies.

The data does not include companies’ ownership stakes of other hubs, only direct operatorship of hubs and the production from those combined assets through 2023.

TotalEnergies’ five hubs delivered the highest levels of production overall at nearly 90 million barrels of oil equivalent over 2023.

That was followed by Harbour Energy’s nine assets covering around 65 million barrels, and by BP’s five delivering 60 million.

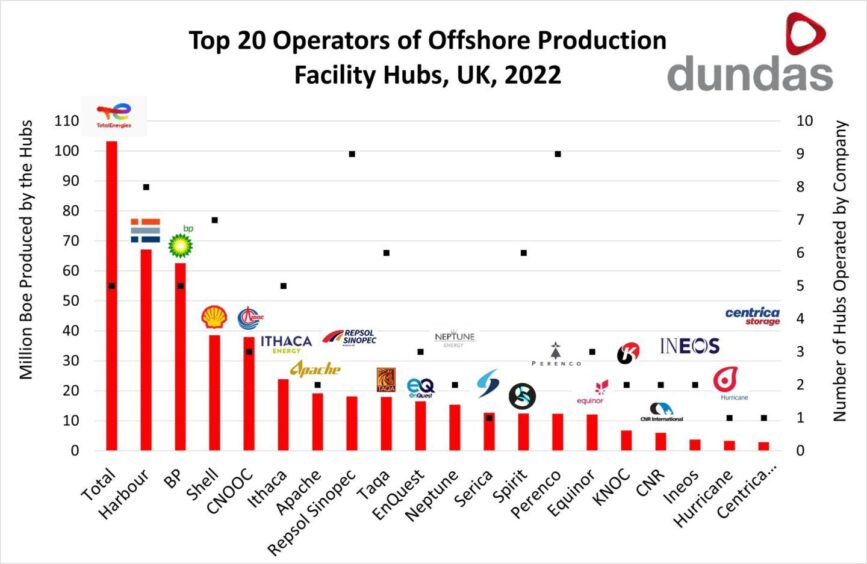

Some of the significant changes to last year’s table come from M&A deals, with the exit of Sinopec, the takeover of Hurricane Energy to become PRAX Group and Italian oil major ENI’s acquisition of Neptune Energy.

Serica Energy, with just one hub at its Bruce asset, performed well at around 10 million barrels over 2023 – beating out Equinor, Spirit Energy, CNR, Dana Petroleum, Ping/ Hibiscus, Prax and Centrica.

Apache, with just two hubs, came in sixth place on the table at more than 20 million barrels.

Perenco had low production relative to its nine operated hubs, coming in 12th on the table at less than 15million barrels.

It’s a similar picture for Repsol, another firm with high levels of ageing North Sea assets and decommissioning, with nine hubs producing less than 20 million barrels.

Overall production from the hubs totalled 446 million barrels of oil equivalent in 2023, down from 501 million boe the prior year.

Dundas director Richard Woodhouse said: “The UK offshore oil and gas sector currently has an annual operations and maintenance budget of around £9 billion per annum.

“Whilst there are 254 companies with a stake in UK offshore oil and gas licenses, just 20 key operators run the hubs handling the vast majority of production and this significant operating expenditure. Comparing with last year, the data shows significant M&A activity in this group.”

Recommended for you