North Sea operator Deltic Energy (AIM:DELT) has outlined plans to target international markets after warning the UK is “not the ideal place” to invest in new oil and gas.

The statement comes after the company took an £18 million impairment after withdrawing from its Pensacola prospect due to political uncertainty ahead of the UK general election earlier this year.

Deltic blamed Labour’s plans to extend and raise the windfall tax on North Sea oil and gas firms after it struggled to complete a farm-out deal for Pensacola.

As a result of the fiscal changes, Deltic’s incoming chief executive Andrew Nunn, who took on the top job last week, said the company is pivoting its focus away from the North Sea towards “geographies where more supportive policies towards oil and gas development exist”.

“Our immediate focus is the ongoing Selene exploration well, where initial drilling indications are encouraging,” Nunn said.

Over the last decade, Deltic said it has invested in its UK portfolio and “achieved material exploration success”, despite the “well-publicised political and fiscal headwinds that have hampered the UK’s oil and gas industry”.

Deltic said that while this situation persists, the company will focus on extraction of value from its existing “core UK assets” such as the Selene prospect.

Meanwhile, Deltic plans to eliminate or defer expenditure on “non-core UK assets” to focus on “identify and access opportunities in overseas arenas”.

While the operator plans to initially focus on projects with early cash flows and faster cycle times from entry to “value crystallisation”, Deltic said it will continue to pursue “high-impact exploration” opportunities.

Meanwhile, the company also announced Peter Cowley will step down from its board with immediate effect, with no plans to recruit a replacement in the short term.

Deltic said Cowley “leaves with the board’s best wishes”.

Selene, Blackadder and Syros prospects

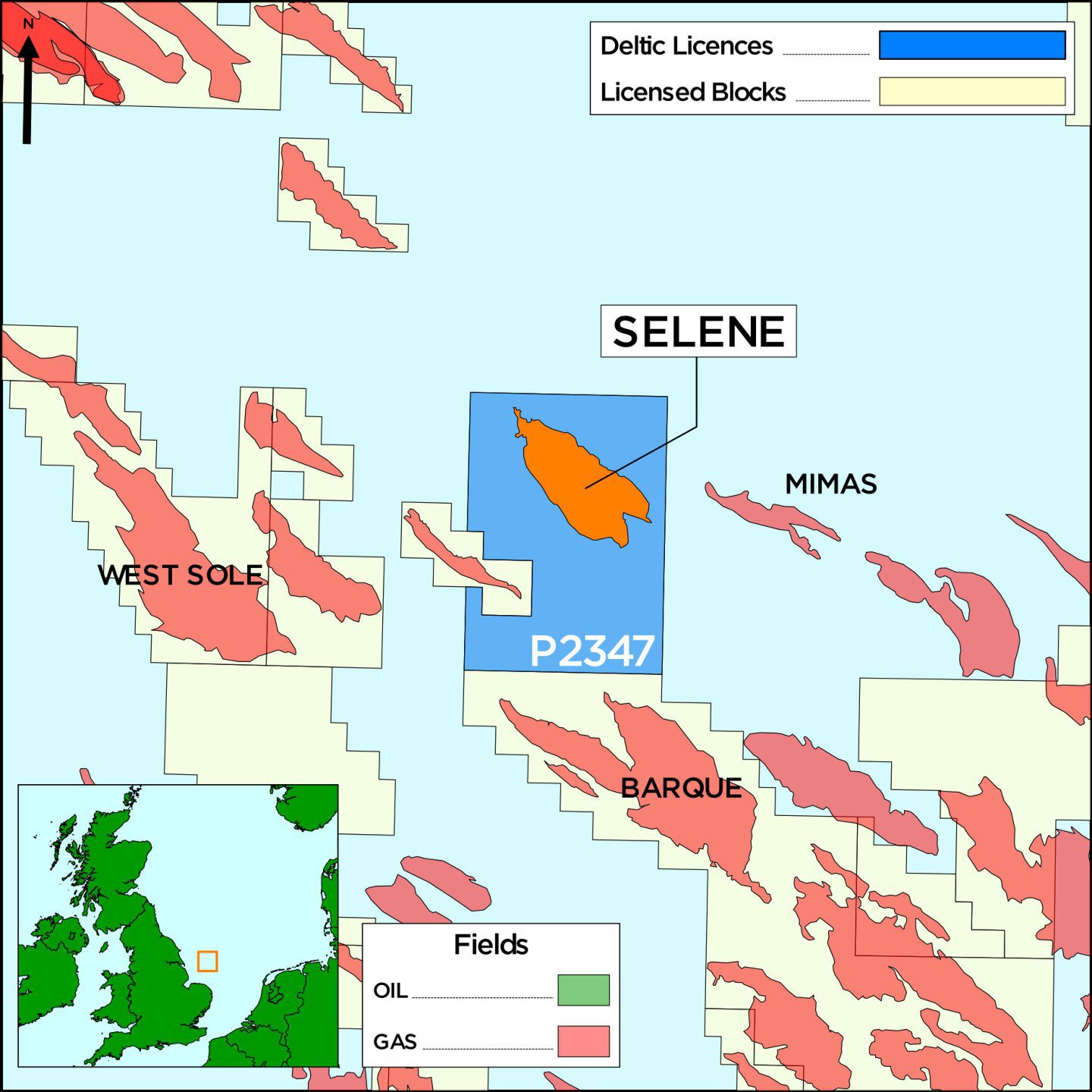

Deltic said drilling at the Shell-operated Selene well reached its total target depth of 3,540 metres on 17 October.

Deltic, which has a 25% working interest in the Selene licence in the Southern North Sea, said the company intends to proceed directly to field development planning after the “clearly encouraging” initial results from drilling.

Elsewhere, Deltic said it has received farm-in interest to its Blackadder licence “from a number of companies”, due to its proximity to Selene.

Deltic said it will defer the commencement of planned work programmes on Blackadder “until at least mid-2025” to allow time for farm-in discussions to mature.

Meanwhile, Deltic said the ongoing political and fiscal uncertainty surrounding the UK North Sea has prevented several interested parties from participating in the farm-out process for its Syros licence.

As a result, the company has requested a 12 month extension from the North Sea Transition Authority (NSTA) regulator to “allow a period of stability” following the October budget.

However, Deltic said the NSTA is “not minded to support” the request, and it is likely the licence will now expire on 30 November.

Finally, Deltic given the “continuing deterioration” of the fiscal and operating environment in the UK, it has entered into negotiations with the NSTA regarding the Phase A work programme requirements for its Dewar licence, awarded in February this year.

Deltic said it does not intend to incur any of the planned costs associated with the Phase A programme in 2025.

© Image: Deltic Energy

© Image: Deltic Energy