Abu Dhabi government institutional investors are paying $2.1 billion for a stake in a natural gas pipelines unit run by Abu Dhabi National Oil Co.

Abu Dhabi Pension Fund and holding company ADQ will take an indirect stake in the pipelines unit Adnoc set up earlier this year, the oil and gas company said in a statement. Adnoc is doing the transaction at the same price as a deal in June, when it agreed to sell a stake in the gas pipelines business to international investors and valued the business at $20.7 billion.

The deal enables local government funds to earn returns on infrastructure assets alongside global money managers.

Adnoc has raised about $16 billion so far this year from its assets and from the sale of shares in its service station unit as part of a financial and organizational restructuring the company started four years ago. Abu Dhabi, capital of the United Arab Emirates, is using its hydrocarbon wealth to attract investors to the country and generate cash from new sources. The U.A.E. is the third-largest oil producer in OPEC.

Adnoc has completed the deals at a time when energy producers are struggling with oil prices which have fallen about 35% this year. The pandemic crushed global energy demand, driven by lockdowns to curb the spread of the virus and a plunge in air traffic. While demand is recovering, it hasn’t returned to previous levels.

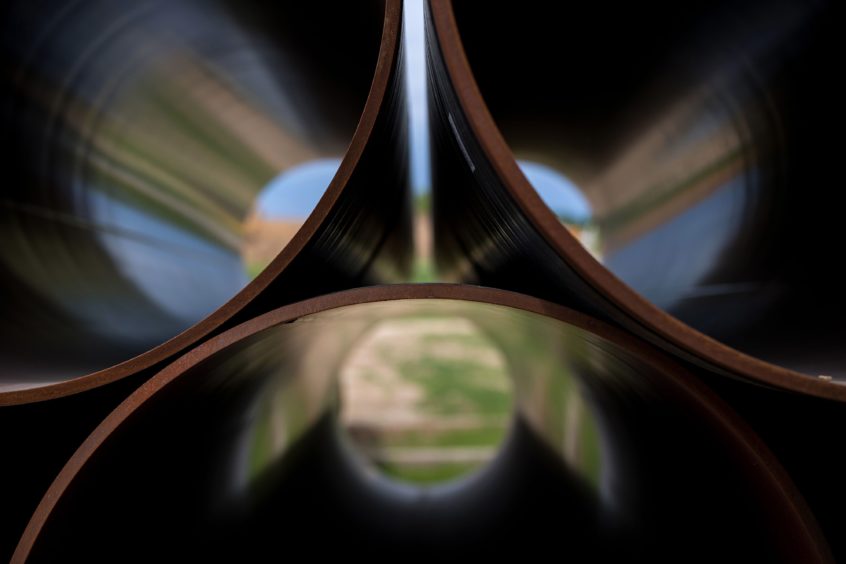

The Abu Dhabi government funds will buy 20% of a special purpose vehicle Adnoc has set up to hold its stake in the gas pipelines unit. That structure allows Adnoc to keep control of the assets used to move gas to and from its production and processing facilities. Bloomberg reported in August that Adnoc planned to bring local investors into the project.

In the June transaction, Adnoc sold a 49% stake in the pipelines, worth $10.1 billion, to a group of six investors including Global Infrastructure Partners, Brookfield Asset Management Inc. and Singapore’s sovereign wealth fund, GIC Pte. The 38 pipelines spanned almost 1,000 kilometers (621 miles).