Saudi Aramco’s $75 billion dividend survived one of the biggest disruptions to oil markets in decades as the coronavirus pandemic and a price war sent crude prices tumbling.

Aramco will make the payout — the largest of any listed company and almost all which goes to Saudi Arabia’s government — for 2020 despite a slump in earnings and revenue. The dividend is a key source of cash for the kingdom, whose economy was hit after the virus hammered energy markets and shut down local businesses.

The world’s biggest oil company has taken on more debt in the past 12 months to keep up the dividend in the face of dwindling cash flow, though its gearing remains below that of firms such as Royal Dutch Shell Plc.

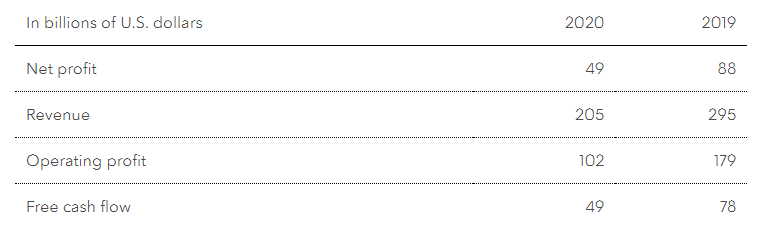

Net income for 2020 was 184 billion riyals ($49 billion), slightly better than analysts’ expectations and down 44% from the previous year. Free cash flow fell almost 40% to $49 billion, substantially below the level of the dividend.

Gearing, a measure of net debt to equity, climbed from minus 5% in March to 22% in September, above the firm’s target of no more than 15%. It rose marginally in the fourth quarter, according to Chief Financial Officer Khalid al-Dabbagh, though the company will release full numbers for the period on Monday.

Aramco said the dividend won’t rise above $75 billion this year. It expects capital expenditure to be $35 billion, down from previous guidance of as much as $45 billion. That signals it remains cautious about oil markets despite the rollout of coronavirus vaccines fueling a 25% increase in prices since the end of December to about $65 a barrel.

The new forecast is still higher than Aramco’s $27 billion of investment spending in 2020.

Asia Buoyant

The company, based in Dhahran in eastern Saudi Arabia, said that energy consumption was improving in some regions — including its main market of Asia — as the global economy recovers.

“We’re very optimistic about 2021 in terms of growth in demand, especially in the second half,” Chief Executive Officer Amin Nasser told reporters on Sunday. “Prices have so far responded to the recovery we are seeing. We need to be prudent, but you have to compare everything to 2020.”

Global oil use will increase to 99 million barrels a day by the end of the year, he said. That compares with today’s consumption of around 95 million barrels daily and would almost be back to pre-virus levels.

Demand in China and India is especially buoyant, Nasser said. While the recovery is slower in the U.S. and Europe, it should accelerate as more people are inoculated, he said.

Aramco’s average crude production fell to 9.2 million barrels a day during 2020, the lowest level since 2011. That was due to output cuts that the OPEC+ cartel — of which Saudi Arabia and Russia are de facto leaders — started in May to bolster prices. Riyadh carried out a brief price war with Moscow prior to that, pumping at record levels and causing prices to crash.

The OPEC+ cuts are due to end in April next year and Aramco is “progressing very well” with a plan to increase daily production capacity to 13 million barrels from 12 million, Nasser said.

Aramco’s shares rose 0.6% to 35.40 riyals on Sunday, extending their gain this year to 1.1%. The company listed on the Riyadh stock exchange in late 2019 and executives pledged to pay a $75 billion dividend annually for the next five years. Though the Saudi government only floated 2% of the firm, its market value of $1.9 trillion is second only to that of Apple Inc.

Drone Attacks

Investor concern is rising over an increase in drone and missile attacks on Aramco’s facilities, most of them claimed by Yemen’s Houthi rebels but which Saudi officials say involve Iran.

On Friday morning, Aramco’s 120,000-barrel-a-day refinery in the capital of Riyadh was targeted with missiles. That followed similar assaults on the company’s Ras Tanura export terminal and a fuel depot in Jeddah earlier in the month.

None of the attacks this year has caused much damage, but they underscore worsening tensions between the kingdom and the Houthis, who are fighting on opposite sides in Yemen’s civil war. The U.S. and Saudi Arabia — who back Yemen’s United Nations-recognized government — are trying to get the Iran-backed Houthis to agree to a ceasefire.

“We continue to strengthen and safeguard our operations,” Nasser said. “Our readiness and resilience is shown every time we are attacked. We are capable under any scenario to put a facility back on stream, ensure the safety and the security of our people, and ensure that supply to our customers is met.”