Gulf Keystone Petroleum has benefited from increased payments from Kurdistan this year and adding the drilling of another well to its plans.

In 2021, the region paid $221.7 million to Gulf Keystone. This year to date, the company has received $354.4mn. This covers oil sales and revenue arrears.

As a result, the company has increased dividend payments and paid off a $100mn bond. As a result, it is now debt free.

“We have paid a record $190 million of dividends in 2022 and are pleased today to announce an incremental interim dividend of $25 million, increasing total dividends declared this year to $215 million,” said company CEO Jon Harris.

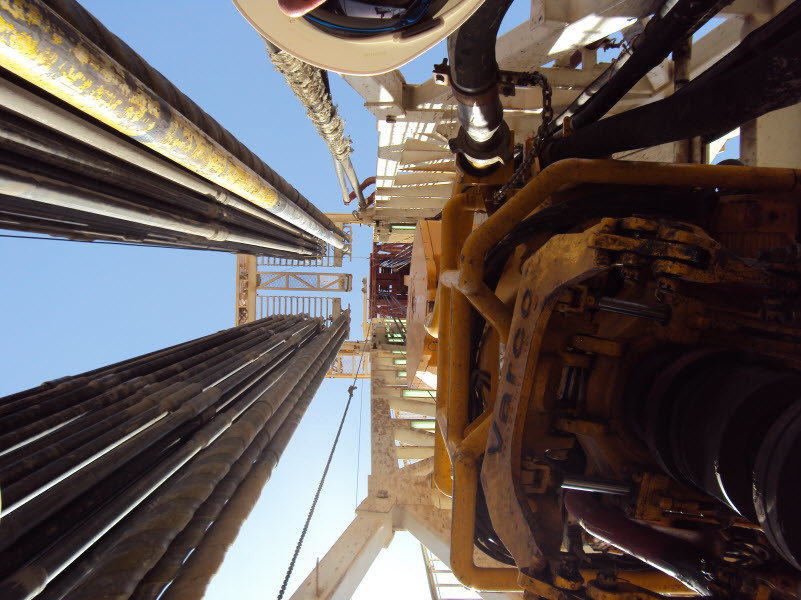

“We have delivered strong profitability and cash flow generation in the first half of the year. As we progress towards approval of the Field Development Plan, we have continued to develop the Shaikan Field and recently resumed drilling with the spud of SH-16.”

It began drilling the SH-16 in late August.

Gulf Keystone has increased its capital expenditure plans to $110-120mn this year, up from $85-95mn. The increase came in the addition of the SH-16 well.

“Looking ahead to the rest of the year, we are focused on progressing towards FDP approval and achieving our production and opex guidance as we continue to optimise production from the field while maintaining a rigorous focus on costs,” Harris said.

Gulf Keystone has produced 45,000 barrels per day this year gross, up 3.6% from 2021’s 43,440 bpd. In January, the company reported some problems at Shaikan wells.

The company intends to produce a gross average of 44,000-47,000 bpd this year.

Adjusted EBITDA rose 122% in the first half, to $208.6mn. Post-tax profit reached $162.8mn, up from $64.8mn.