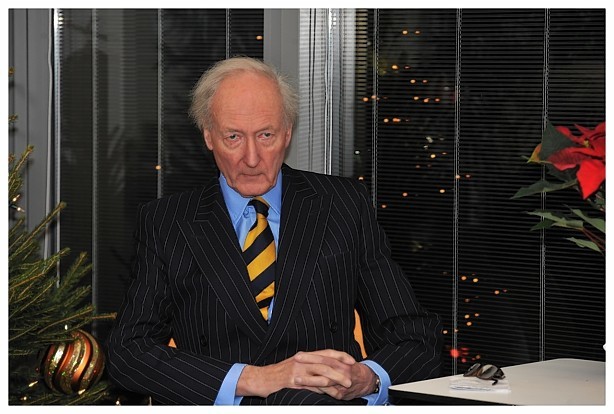

Oil pioneer Algy Cluff said yesterday his firm had taken another step on its way to becoming a major North Sea player after wrapping up a deal for stakes in “drill ready” licences.

Mr Cluff said the current low cost drilling environment had created the perfect opportunity for companies to beef up their oil and gas portfolios without breaking the bank.

His business, Cluff Natural Resources (CNR), will buy Verus Petroleum’s 5% share in the Fynn and Penny assets in the Outer Moray Firth for just £1, subject to regulatory approval.

Under the agreement, details of which were announced in March, CNR also has option to increase its stake in both prospects to 25% at a further cost of £1 during the next nine months.

In addition, it has an option to acquire 25% of Skerryvore in the central North Sea for another pound.

If the initial deal receives approval and CNR takes up the options to raise its overall share in the three licences to 25%, it will have paid £3 for the rights to about 100million barrels of oil.

Operator Parkmead has estimated the trio of assets hold up to 400million barrels of oil.

Mr Cluff, who was involved in the discovery of the North Sea Buchan field nearly 40 years ago, said the latest development had the potential to be truly transformational for CNR.

He added: “The acquisition of these high quality assets, which come with a highly regarded operator in Parkmead, attractive geology, near-term drilling opportunities and nearby infrastructure, provide the ideal cornerstone for building a significant new UK oil and gas company focused on the North Sea.

“We believe the lower cost drilling environment in the North Sea, which we expect to prevail for the foreseeable future, provides us with an excellent opportunity to build and advance a substantial portfolio of exploration and appraisal assets.”

CNR has been building up cash reserves to help it take advantage of the oil and gas industry downturn.

Last month it “conditionally raised” £700,000 through a share placing to fund its activities through to the end of the year and allow it to bid for others assets in the UK’s 29th licensing round later this year.

CNR switched its focus conventional oil and gas after putting its plans to create the UK’s first underground coal gasification plant on the back-burner.

It took the step after the Scottish Government placed a moratorium on unconventional gas extraction technology, which derailed CNR’s attempts to set up a plant in the Firth of Forth.

But CNR holds out hope of a government-commissioned report dismissing environmental concerns and has kept its nine UK licences for UCG.

Recommended for you