Lifting costs for Beryl are just $10 per barrel and operator Apache sees a host of opportunities to grow and sustain production long-term from the UK North Sea field.

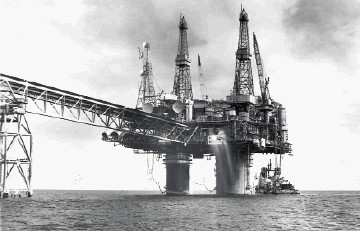

June 6 marks 40 years since first production from a UKCS asset originally developed by Mobil, later ExxonMobil and subsequently sold to US independent Apache in September 2011 as the majority part of a wider assets deal worth $1.75billion at the time.

At a stroke, Apache more than doubled its UK production at the time and boosted the then known reserves base by over 40%, the other source of production being the Forties field purchased in early 2003.

“We have two primary areas that we operate . . . Beryl and Forties,” Cory Loegering, VP and MD of Apache North Sea, told Energy.

“Forties still has a lot of potential and good enhanced recovery upside; it’s a field where we can maintain (current) production by continuing to drill wells.

“In contrast, Beryl has not yet been explored or developed as much as Forties and the reason is that, at Forties, we’re on a three-year cycle of reshooting seismic right now. We’ve got a 4D programme that we use to identify accumulations that we’d missed, accumulations that have recharged and some that are no longer there but were present on previous surveys.

“At Beryl, it had been the 1990s since seismic was last shot. So we acquired some new seismic in 2013 and have literally been reviewing that seismic and identifying new opportunities. The geology is much different to Forties. For example, we’re seeing a lot of stacked pays in the Beryl area.

“At the same time we see Beryl as a real growth area for us.”

So how different is the information coming from the latest shoot compared to the heritage data?

It turns out that it’s much better than expected because there was such a timespan between the previous survey and the Apache campaign, which has also benefited from the evolution of seismic technology, its interpretation; its lower cost too.

In short, the Apache North Sea team has a much better view of the subsurface than ever before.

“If you look at one of our recent wells . . . one we call BCR, which is to the north; it is probably one of the longest step-outs from the platform that we’ve drilled from Beryl,” said Loegering.

“It has also extended the field to the north and it’s a function of this new seismic that’s allowing us to do this.”

At the point of sale, Beryl was producing around 19,000 barrels of oil and 58million cu.ft of gas per day gross.

Now, it is up around 22,300bpd and 15fmmcfd and output is forecast to lift significantly over the next few years.

Loegering told Energy that there is a decent upside at Beryl but that the picture remains incomplete until seismic interpretation is complete.

The stated net unrisked remaining reserves potential for the field is in the range 350 – 600 net million barrels equivalent.

The Beryl area is a bit like Forties in that, within Beryl proper, Apache is able to sustain reserves and production. The real growth will come from the wider satellite areas . . . finds like Callater and Corona.

Last October, Apache issued a chunk of very good news about Beryl and Forties. It said that the two Beryl exploration wells – K (now Callater) and Corona – drilled to that point, plus an exploration well drilled on the Seagull prospect 50 miles to the south of Forties could hold “likely net recoverable reserves of 50-70million barrels oil equivalent”. The estimates for Callater and Corona were not separately identified.

Loegering said he was excited about the prospects portfolio and that there appeared to be multiple accumulations of the scale of Callater and Corona, both of which were hinted to be around 60million barrels.

“Those are two completely different plays,” he pointed out. “Callater is generally a wet gas accumulation with good condensate whereas Corona is an injectite type play and what we see is a low gravity 14-16deg API heavy oil. It’s going to present some challenges in getting it to market. Recovery will require some chemicals and heat. It’s certainly different from Beryl, which is a classic, very light crude.” A consequence is that this presents issues with regard to production facilities on the A & B platforms in terms of processing and commingling for export.

Loegering said there had been huge growth in the number of drill targets identified in the Beryl area.

“Back in 2012, we had 35-40 targets; today we’re looking at around 125. Some of these targets are very mature . . . ready to drill. Some are immature and need work; others are simply leads that we have to work up.”

Apache’s North Sea exploration update presentation of December 8 indicates that Titan is the next drill target.

Many of the targets are within the Beryl proper area and reachable from the field’s in-house drilling capability; attic style finds . . . 1-5million barrels range.

Loegering: “But as we step out, for example in the Corona area, we see a lot of these opportunities. So far we’ve tested just one. The next is Titan, probably next year. This would help prove up our concept for that area even further and add to geographic spread.

“Right now it’s great that we have excess capacity on the Beryl facilities. But, as we drill these larger opportunities like the Coronas we’re going to fill up that capacity pretty quickly.”

By capacity, Loegering is more than anything referring to export system ullage rather than processing capability.

This is because this is a hub. The Beryl Area has 12 fields using the same production infrastructure including the Ness, Buckland and Skene fields. Gas is also received from Edvard Grieg in the Norwegian Sector.

Gas is transported via the Scottish Area Gas Evacuation (SAGE) Pipeline to St Fergus terminal while oil travels to market via shuttle tankers.

But significant alteration to the processing systems will be nonetheless required, simply to handle the more challenging cocktail of hydrocarbon grades that will increasingly be processed. “What we’re doing right now, both with Callater and Corona, is bring those back into Beryl,” said Loegering. “We want to flow those wells, get a bit of history on them to make sure that, if there is some fluids incompatibility, we deal with that.

“We’re expecting several thousand barrels per day from these wells . . . liquids and very beneficial gas. Once we get a feel for well performance and reserves size, then we’re going to layer on additional wells.

“Say Corona is able to turn in 10,000 or so barrels per day then Beryl’s not going to be able to take too many of those.”

As noted earlier, Beryl is currently producing some 22,300 bpd of oil and 135million cu.ft of gas per day. The field has processing capacity of up to 120,000 barrels of oil and 350-400million cu.ft of gas per day.

But with limitations on local storage coupled with the ullage issue, this has a bearing on quite what levels of production that Apache might wish to take Beryl to.

“With some of the prospects that we have on the books at present and some of the prospects that we want to drill next year, there’s a good chance that we’re going to be filling up the capacity of our flowline/pipeline infrastructure to the platforms,” said Loegering.

In effect, it means that actual Beryl and new satellites production will at least for a time be limited by both in-field and export-related ullage issues.

That said, whereas at Forties the objective is to sustain production roughly where it is for years to come, at Beryl there really is the opportunity to grow production substantially.

“I think we could double it above current levels,” said Loegering.

As for lifting costs, it may come as a surprise to many Energy readers just how low they are for Beryl. They’re even lower than the Forties’ $16 per barrel.

“Currently, we’re less than $10 per barrel,” said Loegering. “Our average lifting cost for the region, including Forties where fixed costs are higher, is probably around $13 per barrel.”

Beryl’s $10 per barrel performance really shows what’s possible from a 40-year-old North Sea asset. And to drive that point home further, that puts it on a par with the average across Lundin Norway’s relatively young portfolio.

This really is an “elephant” class field with better than “cash cow” potential for maybe 16 years or so.

Happy Birthday Beryl!