Israel’s Delek Group is looking to bolster its UK oil and gas assets after starting discussions aimed at giving it a large stake in one of the North Sea’s biggest prospects.

Delek, which also as an interest in the Greater Stella Area development and other North Sea fields through its near-20% shareholding in Ithaca Energy, is targeting the Kraken discovery.

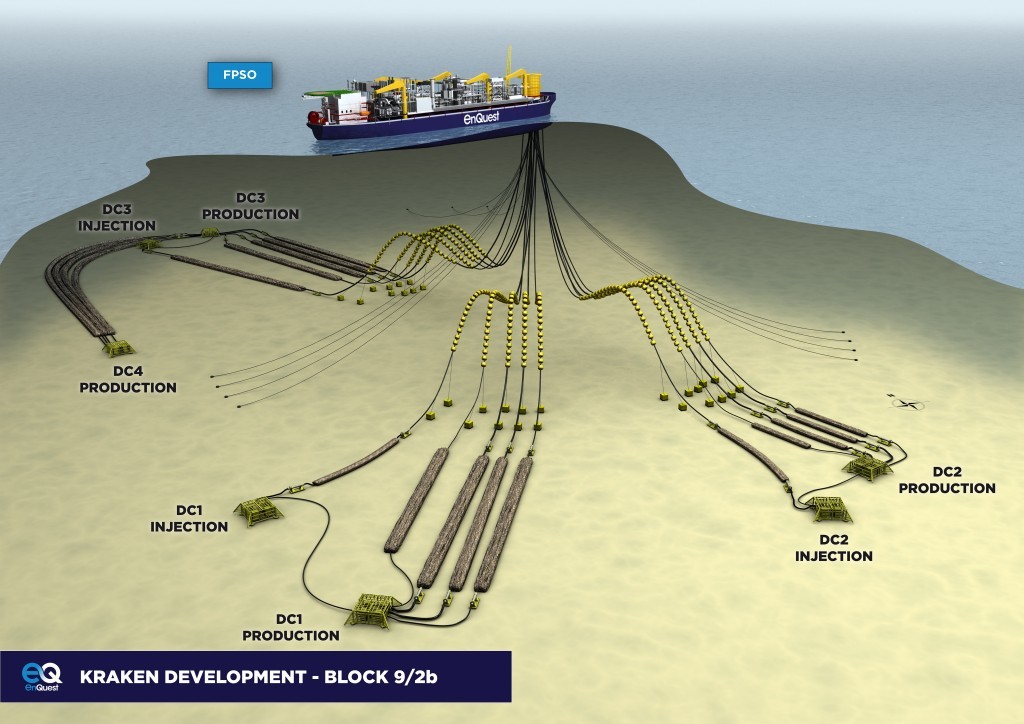

Terms already agreed in a non-binding memorandum of understanding would see Delek acquire 20% of Kraken from operator EnQuest, which has been looking to reduce debt and potentially sell off assets.

EnQuest currently owns 70.5% of Kraken, having picked up 10.5% from a subsidiary of First Oil Expro (FOE) for a nominal sum earlier this year – shortly before Aberdeen-based FOE was put into administration.

Delek, which has its headquarters in the popular eastern Mediterranean tourism resort of Netanya, expects to spend about £122million on Kraken’s development costs in the run-up to its anticipated start-up during the first half of 2017.

It has agreed to also “make available” to EnQuest about £15million, plus interest of 3% annually, which would be recoverable if the Israeli firm could not recoup its investment – both capital and operational expenditure – within five years.

EnQuest, which is the largest UK independent producer in the UK North Sea, stressed there was no guarantee that a final agreement on the proposed farm-out would be reached.

In a statement announcing the talks with Delek, it added: “The transaction is subject to EnQuest’s lending banks’ consent.

“EnQuest continues to closely monitor and manage its funding and liquidity position in light of the current market environment and is engaging as appropriate with its credit facility providers, including banks and bondholders.”

EnQuest has previously said it is pursuing other opportunities for debt reduction, including potential asset sales and farm-outs.

Tel Aviv-listed Delek was established by the Israeli government in 1951 to operate a chain of petrol stations.

Its natural gas exploration and production activities in the eastern Mediterranean’s Levant basin are transforming that part of the world into one of the global energy industry’s most promising regions.

Having invested in Aberdeen-based Ithaca late last year, it said its swoop for a share in Kraken was part of its strategy to “identify international investment opportunities in the energy field”.