Enquest today confirmed it whittled its operating costs down to $23 per barrel for the first half of the year.

The operator, which is still in talks with Delek about a possible farm-out, also cut $150million from its Kraken development costs. To date, the firm has decreased the project expenditure by $570million, giving it a new gross full cycle project capex cost of $2.6billion.

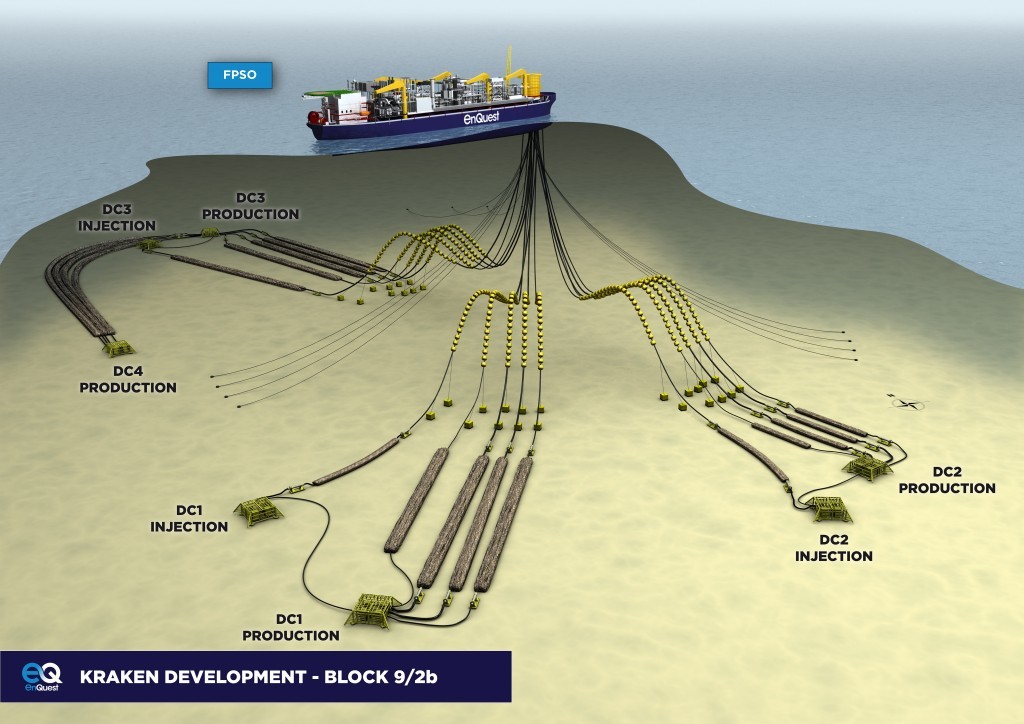

Sailaway of the Kraken FPSO is expected to take place by the end of the year. First oil is still on track for the first half of next year, according to Enquest.

The company is still negotiating a 20% farmout of Kraken’s working interest with Delek Group.

“EnQuest will provide further details in the event either of transaction documents being signed or of it becoming apparent that a binding agreement cannot be reached,” a statement read.

The North Sea operator is also conducting talks with creditors as it sits on $1.68billion net debt.

“EnQuest is holding constructive discussions with its main debt and credit providers, or their representatives, concerning proposals for accommodations including to amend the structure, covenants, interest payment obligations, maturities and other aspects of its debt. The RCF lenders continue to be supportive and have provided waivers when required,” a statement added.

Against the backdrop of “constructive discussions”, the company posted a 43% increase in production for the first half of the year, recording 42,520 boepd.

Chief executive Amjad Bseisu said: “Strong production of 42,520 Boepd has been delivered, representing broad based growth of 43% over H1 2015. Unit opex of $23/bbl is down 41% on the $39/bbl in H1 2015, and down 50% on the $46/bbl in H1 2014. 2016 cash capex, is reduced by a further c.$30 million, now set to be in the range between $670 million and $720 million.

“EnQuest is progressing both of its development projects ahead of budget; the Kraken FPSO is on track for sail away in H2 2016, with its full cycle gross capex costs now reduced by a further c.$150 million to c.$2.6 billion. The Scolty/Crathes development is ahead of schedule. This year’s drilling programme has been executed very efficiently, delivering more wells within the original budget.

“In H1 2016, EnQuest delivered EBITDA of $242.9 million and more than doubled cash generated from operations to $182.6 million, driven by the scale of the production growth, cost cutting and oil price hedging, more than countering the impact of lower oil prices.

“With very substantial structural reductions in our cost base already delivered, the long term potential of EnQuest’s business model remains compelling. EnQuest’s overriding priority continues to be delivering a business which is robust in this challenging environment.”

Recommended for you