Shares in Xcite Energy plunged almost 70% last night after the firm warned a planned restructuring would see shareholders’ stakes nearly wiped out.

The North Sea firm said it now expects there will be “minimal residual equity stake” for existing shareholders once a deal over the firm’s $135million (£101million) debt pile was struck.

The company had previously said it was likely the restructuring would result in an equity stake in Xcite going to bondholders in order to reach an agreement.

Excite, which has been in talks with its bond holders since December, added that “terms of the restructuring have still to be agreed”.

In July the firm announced it had won a stay of execution after its talks with lenders blew through an earlier bond maturity date, which was extended to the end of this month.

In a statement to the London Stock Exchange, which was in response to a previous move in its share price, it said it “will update shareholders as soon as any further information relating to the restructuring of the bonds can be made available”.

On Friday, the company’s stock had risen from 6.85p to 8.25p, on speculation fueling speculation that it had closed a deal regarding the restructuring.

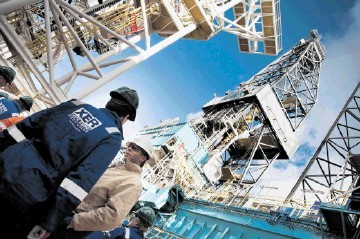

Xcite, which is headquartered in Guildford, Surrey, but has its operations base in Queen’s Gardens, Aberdeen is developing the £780million Bentley field in the North Sea.

Xcite estimates Bentley – discovered in 1977 – could produce nearly 300million barrels of oil using enhanced recovery techniques – over 35 years.

Its shares closed down 69.7% to just 2.5p.

Recommended for you