Xcite Energy has has appointed liquidators in a bid to seek a fast sale, it was today confirmed.

Ian Morton of FTI Consulting and Chad Griffin of FTI Consulting have been appointed joint liquidators.

The pair said: “The Group’s attempts to restructure its debt were ultimately unsuccessful resulting in XEL being placed into liquidation. Our role as Liquidators is to maximise the return from XEL’s assets, which include the shares of XER, which holds the Bentley licence. We invite any credible party with an interest in XEL’s assets to contact us immediately at xcite@fticonsulting.com.”

The Eastern Caribbean Supreme Court in the High Court of Justice British Virgin Islands placed Xcite Energy Limited into liquidation.

Prior to the joint liquidators’ appointment, the directors of XEL undertook a marketing process with respect to XEL’s assets. The joint liquidators, in their capacity as the nominated liquidators supported and validated this marketing process. The joint liquidators are now reviewing the bids received during this process.

However, no sale has been arranged at this stage. The joint liquidators urged any interested parties to come forward as they are working to a “compressed timeframe”.

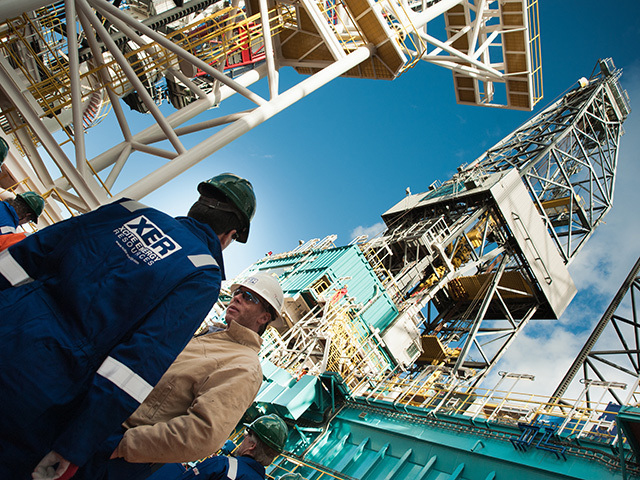

A statement added: “For the avoidance of doubt, its wholly owned subsidiary Xcite Energy Resources plc (XER) is not subject to an insolvency process. XEL and XER together are referred to as the Group.”

Xcite Energy spent most of the last year securing bond extensions.

Nordic acted as trustee for the holders of the $135million secured bonds issued by Xcite.

It later sought out a partner for its flagship Bentley development.

Xcite, which was headquartered in Guildford, Surrey, but had its operations base in Queen’s Gardens, Aberdeen was developing the £780million Bentley field in the North Sea.

Xcite estimated Bentley – discovered in 1977 – could produce nearly 300million barrels of oil using enhanced recovery techniques – over 35 years.