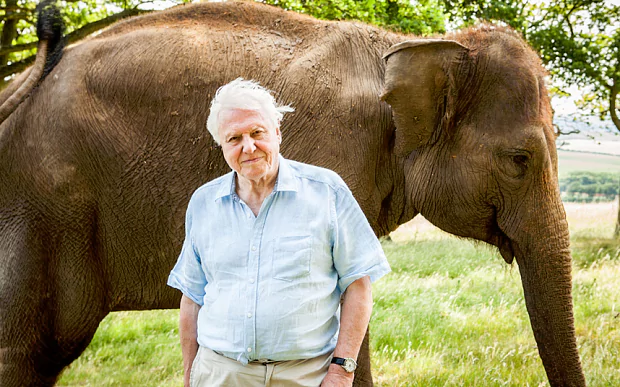

Energy Voice’s Guest Editor Philip Rodney sat down with Oil and Gas UK’s Upstream policy director Mike Tholen to discuss 2016’s influence on the North Sea. Find out why Tholen thinks the industry can be best described as an ‘elephant in a David Attenborough programme’ below.

“Harrowing but hopeful” – that’s the personal perspective on 2016 of Mike Tholen, Upstream policy director of Oil & Gas UK.

Harrowing, because of the impact the downturn on companies that have failed and the traumatic loss of jobs. Hopeful, on account of how businesses have reshaped themselves and are ready to move forward. Even when oil prices were at their historical highest level, businesses were under pressure because they were working all out and some hadn’t properly addressed their inefficiencies, according to Tholen. “It was like Star Trek when Kirk says ‘Scottie she won’t take any more!’ ”

“Trauma” is a word that Mike Tholen uses a lot to describe what has happened, but he points out that lots of good companies have survived and are better equipped to do the right sort of business in the short term.

As a veteran of the industry, he has watched all the price cycles since 1986. His view, perhaps surprisingly, is that 2008/9 was in many ways worse. No sooner had the price hit rock bottom, it bounced back up. So what needed to get done, was never addressed. Contrast that with the current situation.

By Autumn 2015, the industry was getting used to lower prices and had adapted its model. Tholen likens the situation to a post Christmas diet where you lose a few pounds in a couple of weeks and then put it all and more back on. The lengthy period of low prices means that the industry has not just gone on a faddy diet, but changed its lifestyle. The sector needs to “get fit, stay fit, be fit”.

In the core business of running the North Sea, companies are doing it more efficiently than ever before. They are in a healthy space, despite being lean. But what they have to do more of, is retain and attract talent for the climb back, according to Tholen.

Looking forward to 2017, Tholen is more optimistic than at the beginning of this year. The signs are there.

He said: “It’s like an elephant in the grass in the David Attenborough programmes. You can’t see it, but you can hear it. It’s a lot closer than you think.”

“Oil and gas is an extractive business, so it has to move on. Time will bring about stronger balance sheets and companies will have to keep investing, using next year’s income, if they are to move forward. Companies need to keep investing.”

Even though Tholen insisted the industry needs the courage to grow after retrenchment, he cautioned that courage doesn’t necessarily have to come packaged in the mega-projects that take years to develop, but in mid-sized investment. Brownfield development or infilling should be the sweet spot for the industry, according to the industry expert.

Tholen underlines this with the truism, “If you want to go looking for oil, best place to start is below your feet.”

So as UKCS hopefully enters recovery, what of the wider geo-political situation and the prospect of President Elect Trump’s energy policy Fab Four of Tillerson, Perry, Pruitt and Zinke? Tholen’s view is that if the Trump can make the US 1% more productive that should be a catalyst to stronger global demand for oil.

On shale, he talks about how good the Americans are at industrialising processes. The price “killed them at $70 and they can now cope at $50.” If anything, shale now has a lower glass ceiling, said Tholen. That will have some impact on the North Sea’s competitiveness rather than creating an oversupply that pulls the oil price down.

Despite the difficulties, the industry is fitter than ever, according the OGUK veteran. It has reconfigured, slimmed down and is in the best possible shape to remain competitive as world markets evolve. And who knows, perhaps next Christmas, Mike Tholen’s look back may be “Hopeful and happy”.

Philip Rodney is the chairman of Scottish law firm Burness Paull.